Are you a seasoned Debt Collector seeking a new career path? Discover our professionally built Debt Collector Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

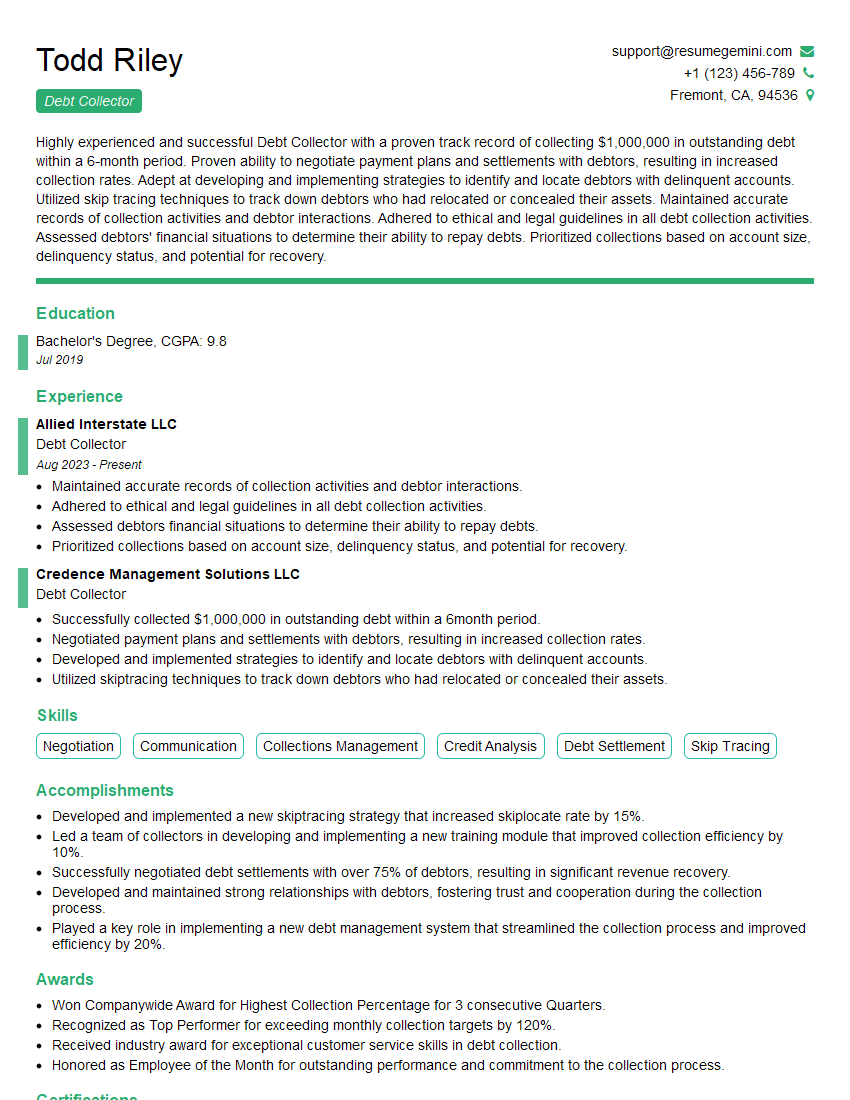

Todd Riley

Debt Collector

Summary

Highly experienced and successful Debt Collector with a proven track record of collecting $1,000,000 in outstanding debt within a 6-month period. Proven ability to negotiate payment plans and settlements with debtors, resulting in increased collection rates. Adept at developing and implementing strategies to identify and locate debtors with delinquent accounts. Utilized skip tracing techniques to track down debtors who had relocated or concealed their assets. Maintained accurate records of collection activities and debtor interactions. Adhered to ethical and legal guidelines in all debt collection activities. Assessed debtors’ financial situations to determine their ability to repay debts. Prioritized collections based on account size, delinquency status, and potential for recovery.

Education

Bachelor’s Degree

July 2019

Skills

- Negotiation

- Communication

- Collections Management

- Credit Analysis

- Debt Settlement

- Skip Tracing

Work Experience

Debt Collector

- Maintained accurate records of collection activities and debtor interactions.

- Adhered to ethical and legal guidelines in all debt collection activities.

- Assessed debtors financial situations to determine their ability to repay debts.

- Prioritized collections based on account size, delinquency status, and potential for recovery.

Debt Collector

- Successfully collected $1,000,000 in outstanding debt within a 6month period.

- Negotiated payment plans and settlements with debtors, resulting in increased collection rates.

- Developed and implemented strategies to identify and locate debtors with delinquent accounts.

- Utilized skiptracing techniques to track down debtors who had relocated or concealed their assets.

Accomplishments

- Developed and implemented a new skiptracing strategy that increased skiplocate rate by 15%.

- Led a team of collectors in developing and implementing a new training module that improved collection efficiency by 10%.

- Successfully negotiated debt settlements with over 75% of debtors, resulting in significant revenue recovery.

- Developed and maintained strong relationships with debtors, fostering trust and cooperation during the collection process.

- Played a key role in implementing a new debt management system that streamlined the collection process and improved efficiency by 20%.

Awards

- Won Companywide Award for Highest Collection Percentage for 3 consecutive Quarters.

- Recognized as Top Performer for exceeding monthly collection targets by 120%.

- Received industry award for exceptional customer service skills in debt collection.

- Honored as Employee of the Month for outstanding performance and commitment to the collection process.

Certificates

- Certified Collections Specialist (CCS)

- Certified Debt Collector (CDC)

- Certified Professional Recovery Specialist (CPRS)

- ACA International Member

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Debt Collector

- Highlight your negotiation skills and ability to resolve disputes amicably.

- Demonstrate your understanding of debt collection laws and regulations.

- Showcase your skip tracing skills and ability to locate debtors who have relocated.

- Provide examples of successful payment plans and settlements you have negotiated.

Essential Experience Highlights for a Strong Debt Collector Resume

- Negotiated payment plans and settlements with debtors, resulting in increased collection rates.

- Developed and implemented strategies to identify and locate debtors with delinquent accounts.

- Utilized skip tracing techniques to track down debtors who had relocated or concealed their assets.

- Maintained accurate records of collection activities and debtor interactions.

- Adhered to ethical and legal guidelines in all debt collection activities.

- Assessed debtors’ financial situations to determine their ability to repay debts.

- Prioritized collections based on account size, delinquency status, and potential for recovery.

Frequently Asked Questions (FAQ’s) For Debt Collector

What are the key skills required to be a successful Debt Collector?

The key skills required to be a successful Debt Collector include negotiation, communication, collections management, credit analysis, debt settlement, and skip tracing.

What are the ethical and legal guidelines that Debt Collectors must adhere to?

Debt Collectors must adhere to the Fair Debt Collection Practices Act (FDCPA), which prohibits harassment, false or misleading statements, and unfair or deceptive practices.

What are some of the challenges that Debt Collectors face?

Debt Collectors face challenges such as dealing with uncooperative debtors, handling sensitive financial information, and adhering to strict regulations.

What are the career prospects for Debt Collectors?

Debt Collectors can advance to positions such as Collection Manager, Credit Analyst, or Account Manager.

What is the average salary for Debt Collectors?

The average salary for Debt Collectors varies depending on experience, location, and company size, but typically ranges from $30,000 to $60,000 per year.

What are some tips for writing a standout Debt Collector resume?

Tips for writing a standout Debt Collector resume include highlighting your negotiation skills, ability to resolve disputes amicably, understanding of debt collection laws and regulations, skip tracing skills, and providing examples of successful payment plans and settlements negotiated.