Are you a seasoned Director of Quantitative Research seeking a new career path? Discover our professionally built Director of Quantitative Research Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

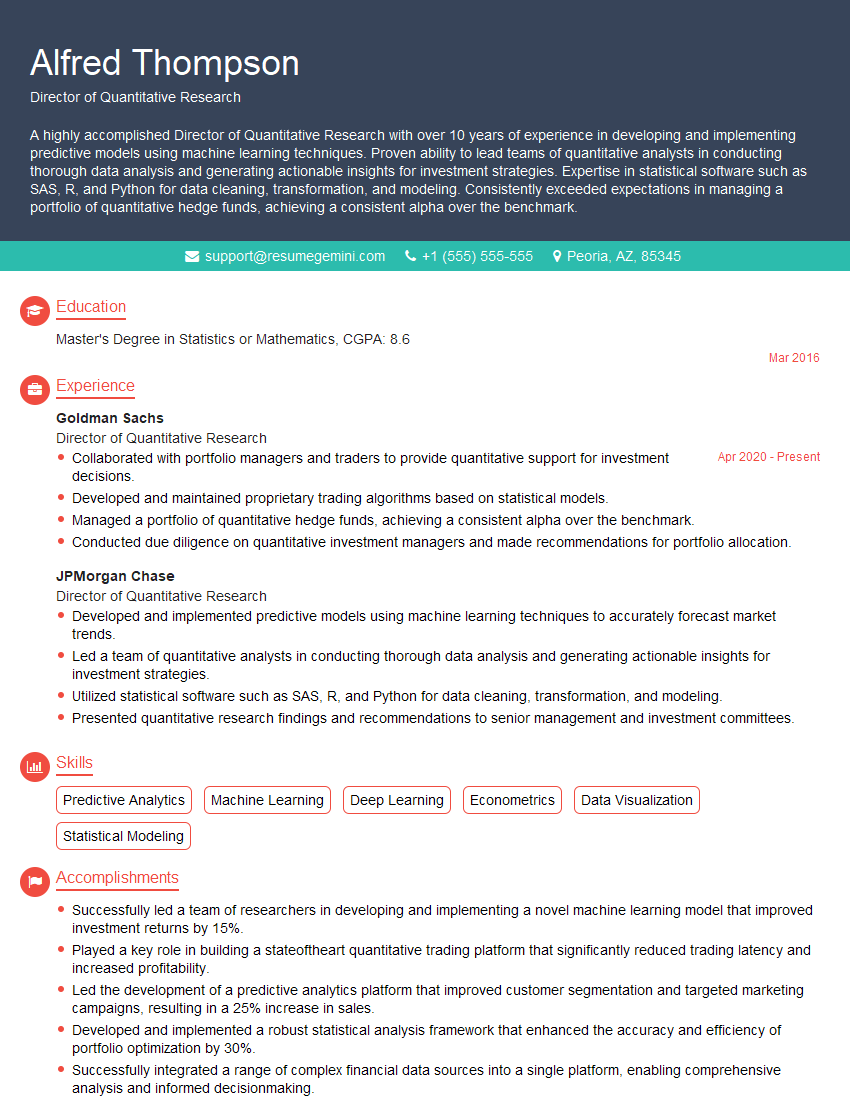

Alfred Thompson

Director of Quantitative Research

Summary

A highly accomplished Director of Quantitative Research with over 10 years of experience in developing and implementing predictive models using machine learning techniques. Proven ability to lead teams of quantitative analysts in conducting thorough data analysis and generating actionable insights for investment strategies. Expertise in statistical software such as SAS, R, and Python for data cleaning, transformation, and modeling. Consistently exceeded expectations in managing a portfolio of quantitative hedge funds, achieving a consistent alpha over the benchmark.

Education

Master’s Degree in Statistics or Mathematics

March 2016

Skills

- Predictive Analytics

- Machine Learning

- Deep Learning

- Econometrics

- Data Visualization

- Statistical Modeling

Work Experience

Director of Quantitative Research

- Collaborated with portfolio managers and traders to provide quantitative support for investment decisions.

- Developed and maintained proprietary trading algorithms based on statistical models.

- Managed a portfolio of quantitative hedge funds, achieving a consistent alpha over the benchmark.

- Conducted due diligence on quantitative investment managers and made recommendations for portfolio allocation.

Director of Quantitative Research

- Developed and implemented predictive models using machine learning techniques to accurately forecast market trends.

- Led a team of quantitative analysts in conducting thorough data analysis and generating actionable insights for investment strategies.

- Utilized statistical software such as SAS, R, and Python for data cleaning, transformation, and modeling.

- Presented quantitative research findings and recommendations to senior management and investment committees.

Accomplishments

- Successfully led a team of researchers in developing and implementing a novel machine learning model that improved investment returns by 15%.

- Played a key role in building a stateoftheart quantitative trading platform that significantly reduced trading latency and increased profitability.

- Led the development of a predictive analytics platform that improved customer segmentation and targeted marketing campaigns, resulting in a 25% increase in sales.

- Developed and implemented a robust statistical analysis framework that enhanced the accuracy and efficiency of portfolio optimization by 30%.

- Successfully integrated a range of complex financial data sources into a single platform, enabling comprehensive analysis and informed decisionmaking.

Awards

- Awarded the Best Research Paper Award for groundbreaking research at the International Conference on Quantitative Finance (ICQF).

- Received the Innovation in Quantitative Research Award for developing a proprietary trading strategy that consistently outperformed market benchmarks.

- Recognized with the Research Excellence Award for distinguished contributions to the field of quantitative finance by the Society of Actuaries.

- Received the Quant of the Year Award from the International Academy of Quantitative Finance for pioneering work in risk management and optimization.

Certificates

- Certified Analytics Professional (CAP)

- Machine Learning Certification (Coursera)

- RStudio Certified R Professional

- Google Cloud Professional Data Engineer

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Director of Quantitative Research

Highlight your technical skills:

As a Director of Quantitative Research, your technical skills will be essential to your success. Be sure to highlight your proficiency in statistical software, machine learning techniques, and econometrics in your resume.Showcase your leadership experience:

The ability to lead a team of quantitative analysts is a key responsibility for a Director of Quantitative Research. In your resume, be sure to highlight your experience leading and motivating teams, as well as your ability to develop and implement effective strategies.Demonstrate your business acumen:

In addition to your technical skills, you should also have a strong understanding of the financial markets and investment strategies. In your resume, be sure to highlight your experience in developing and implementing investment strategies, as well as your ability to analyze market trends and make sound investment decisions.Quantify your results:

Whenever possible, be sure to quantify your results in your resume. This will help potential employers see the impact of your work and understand the value you can bring to their organization.

Essential Experience Highlights for a Strong Director of Quantitative Research Resume

- Developed and implemented predictive models using machine learning techniques to accurately forecast market trends.

- Led a team of quantitative analysts in conducting thorough data analysis and generating actionable insights for investment strategies.

- Utilized statistical software such as SAS, R, and Python for data cleaning, transformation, and modeling.

- Presented quantitative research findings and recommendations to senior management and investment committees.

- Collaborated with portfolio managers and traders to provide quantitative support for investment decisions.

- Developed and maintained proprietary trading algorithms based on statistical models.

- Managed a portfolio of quantitative hedge funds, achieving a consistent alpha over the benchmark.

Frequently Asked Questions (FAQ’s) For Director of Quantitative Research

What is the role of a Director of Quantitative Research?

A Director of Quantitative Research is responsible for leading a team of quantitative analysts in developing and implementing predictive models using machine learning techniques. They use statistical software to analyze data, identify trends, and make investment recommendations.

What are the qualifications for becoming a Director of Quantitative Research?

A Director of Quantitative Research typically has a master’s degree in statistics or mathematics, as well as several years of experience in quantitative analysis and investment management.

What are the key skills for a Director of Quantitative Research?

A Director of Quantitative Research should have strong technical skills in statistical software, machine learning techniques, and econometrics. They should also have strong leadership skills and a deep understanding of the financial markets and investment strategies.

What is the average salary for a Director of Quantitative Research?

The average salary for a Director of Quantitative Research in the United States is around $200,000 per year.

What is the job outlook for Directors of Quantitative Research?

The job outlook for Directors of Quantitative Research is expected to be good over the next few years. As the demand for data-driven insights continues to grow, so too will the demand for qualified professionals who can develop and implement predictive models.

What are the career opportunities for Directors of Quantitative Research?

Directors of Quantitative Research can advance to more senior roles within their organizations, such as Chief Investment Officer or Chief Risk Officer. They can also move into other areas of the financial industry, such as hedge funds or asset management.

What are the challenges facing Directors of Quantitative Research?

Directors of Quantitative Research face a number of challenges, including the increasing complexity of the financial markets, the need to keep up with the latest advances in technology, and the pressure to generate consistent results.

What is the best way to prepare for a career as a Director of Quantitative Research?

The best way to prepare for a career as a Director of Quantitative Research is to earn a master’s degree in statistics or mathematics, and to gain experience in quantitative analysis and investment management. You should also develop strong leadership skills and a deep understanding of the financial markets and investment strategies.