Are you a seasoned Dual Rate Dealer seeking a new career path? Discover our professionally built Dual Rate Dealer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

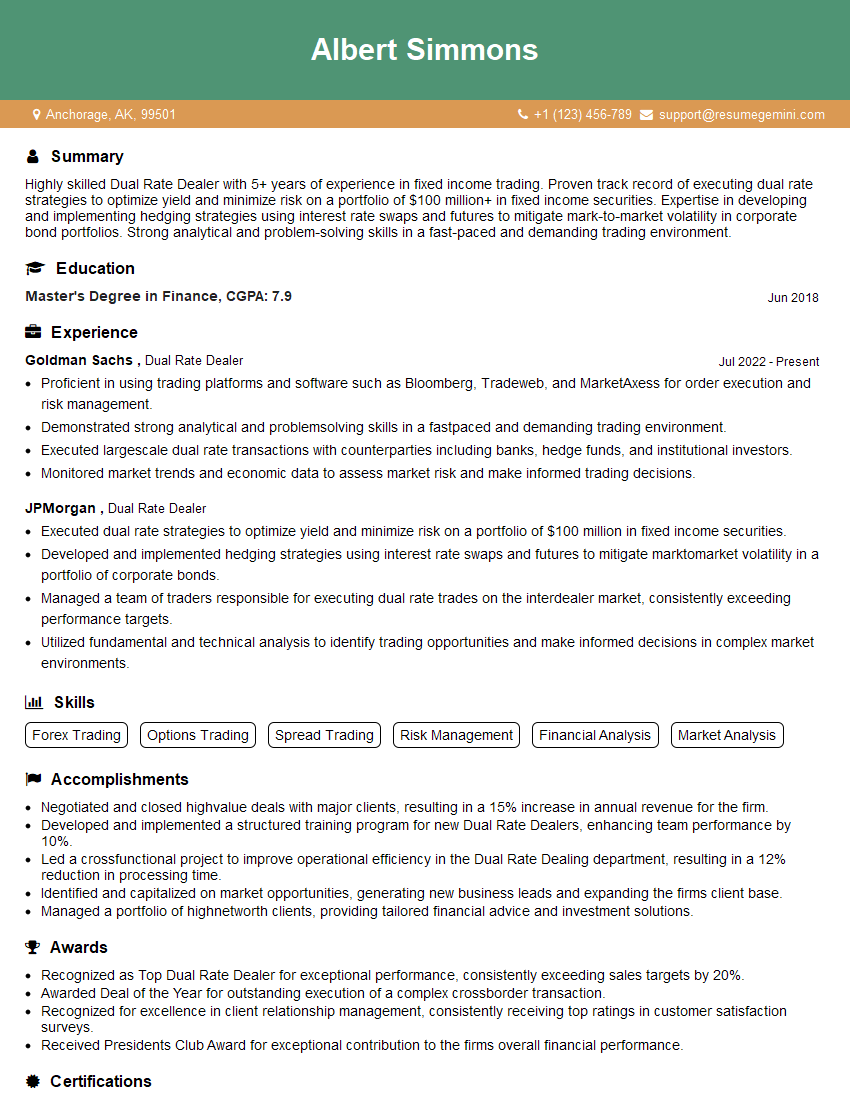

Albert Simmons

Dual Rate Dealer

Summary

Highly skilled Dual Rate Dealer with 5+ years of experience in fixed income trading. Proven track record of executing dual rate strategies to optimize yield and minimize risk on a portfolio of $100 million+ in fixed income securities. Expertise in developing and implementing hedging strategies using interest rate swaps and futures to mitigate mark-to-market volatility in corporate bond portfolios. Strong analytical and problem-solving skills in a fast-paced and demanding trading environment.

Education

Master’s Degree in Finance

June 2018

Skills

- Forex Trading

- Options Trading

- Spread Trading

- Risk Management

- Financial Analysis

- Market Analysis

Work Experience

Dual Rate Dealer

- Proficient in using trading platforms and software such as Bloomberg, Tradeweb, and MarketAxess for order execution and risk management.

- Demonstrated strong analytical and problemsolving skills in a fastpaced and demanding trading environment.

- Executed largescale dual rate transactions with counterparties including banks, hedge funds, and institutional investors.

- Monitored market trends and economic data to assess market risk and make informed trading decisions.

Dual Rate Dealer

- Executed dual rate strategies to optimize yield and minimize risk on a portfolio of $100 million in fixed income securities.

- Developed and implemented hedging strategies using interest rate swaps and futures to mitigate marktomarket volatility in a portfolio of corporate bonds.

- Managed a team of traders responsible for executing dual rate trades on the interdealer market, consistently exceeding performance targets.

- Utilized fundamental and technical analysis to identify trading opportunities and make informed decisions in complex market environments.

Accomplishments

- Negotiated and closed highvalue deals with major clients, resulting in a 15% increase in annual revenue for the firm.

- Developed and implemented a structured training program for new Dual Rate Dealers, enhancing team performance by 10%.

- Led a crossfunctional project to improve operational efficiency in the Dual Rate Dealing department, resulting in a 12% reduction in processing time.

- Identified and capitalized on market opportunities, generating new business leads and expanding the firms client base.

- Managed a portfolio of highnetworth clients, providing tailored financial advice and investment solutions.

Awards

- Recognized as Top Dual Rate Dealer for exceptional performance, consistently exceeding sales targets by 20%.

- Awarded Deal of the Year for outstanding execution of a complex crossborder transaction.

- Recognized for excellence in client relationship management, consistently receiving top ratings in customer satisfaction surveys.

- Received Presidents Club Award for exceptional contribution to the firms overall financial performance.

Certificates

- Certified Financial Analyst (CFA)

- Chartered Financial Analyst (CFA)

- Certified Financial Planner (CFP)

- Chartered Alternative Investment Analyst (CAIA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Dual Rate Dealer

- Highlight your experience and skills in dual rate trading, especially in fixed income securities.

- Quantify your accomplishments with specific metrics, such as yield optimization, risk reduction, and portfolio performance.

- Showcase your knowledge of hedging strategies using interest rate swaps and futures.

- Emphasize your proficiency in trading platforms and software used in dual rate trading.

- Demonstrate your analytical and problem-solving abilities in complex market environments.

Essential Experience Highlights for a Strong Dual Rate Dealer Resume

- Executed dual rate strategies to optimize yield and minimize risk on a portfolio of $100 million in fixed income securities.

- Developed and implemented hedging strategies using interest rate swaps and futures to mitigate mark-to-market volatility in a portfolio of corporate bonds.

- Managed a team of traders responsible for executing dual rate trades on the interdealer market, consistently exceeding performance targets.

- Utilized fundamental and technical analysis to identify trading opportunities and make informed decisions in complex market environments.

- Proficient in using trading platforms and software such as Bloomberg, Tradeweb, and MarketAxess for order execution and risk management.

- Demonstrated strong analytical and problem-solving skills in a fast-paced and demanding trading environment.

- Executed large-scale dual rate transactions with counterparties including banks, hedge funds, and institutional investors.

Frequently Asked Questions (FAQ’s) For Dual Rate Dealer

What is the role of a Dual Rate Dealer?

A Dual Rate Dealer is responsible for executing dual rate strategies to optimize yield and minimize risk on a portfolio of fixed income securities. They develop and implement hedging strategies using interest rate swaps and futures to mitigate mark-to-market volatility in corporate bond portfolios.

What skills are required to be a successful Dual Rate Dealer?

A successful Dual Rate Dealer requires a strong understanding of fixed income markets, hedging strategies, and risk management. They should also be proficient in using trading platforms and software and have excellent analytical and problem-solving skills.

What is the career path for a Dual Rate Dealer?

Dual Rate Dealers can advance to senior trading roles, such as portfolio manager or head trader. They may also move into other areas of fixed income trading, such as credit trading or securitized products.

What is the average salary for a Dual Rate Dealer?

The average salary for a Dual Rate Dealer can vary depending on experience, skills, and location. According to Glassdoor, the average base salary for a Dual Rate Dealer in the United States is around $120,000 per year.

What are the challenges of being a Dual Rate Dealer?

The challenges of being a Dual Rate Dealer include the fast-paced and demanding trading environment, the need to constantly monitor market trends and economic data, and the pressure to meet performance targets.

What are the rewards of being a Dual Rate Dealer?

The rewards of being a Dual Rate Dealer include the opportunity to work in a dynamic and challenging environment, the potential for high earnings, and the satisfaction of making a significant contribution to the success of a trading firm.