Are you a seasoned Employment Benefits or Pensions Retirement Plan Specialist seeking a new career path? Discover our professionally built Employment Benefits or Pensions Retirement Plan Specialist Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

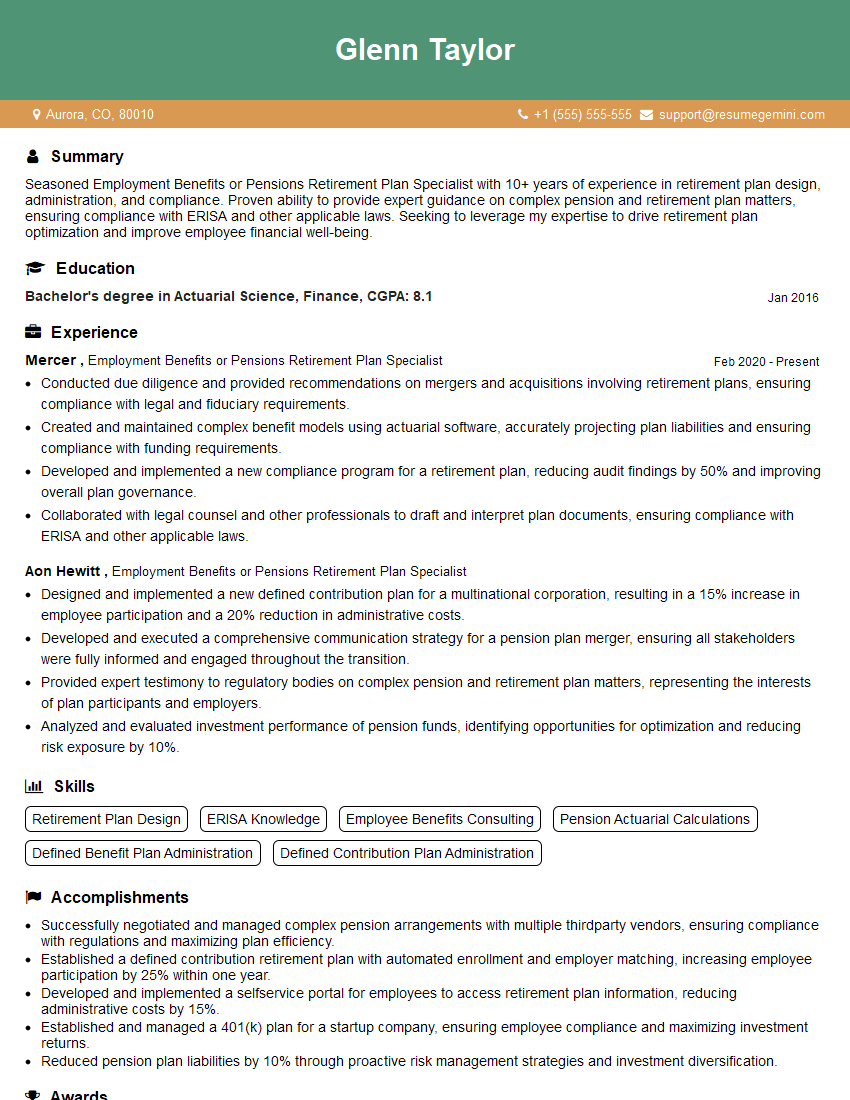

Glenn Taylor

Employment Benefits or Pensions Retirement Plan Specialist

Summary

Seasoned Employment Benefits or Pensions Retirement Plan Specialist with 10+ years of experience in retirement plan design, administration, and compliance. Proven ability to provide expert guidance on complex pension and retirement plan matters, ensuring compliance with ERISA and other applicable laws. Seeking to leverage my expertise to drive retirement plan optimization and improve employee financial well-being.

Education

Bachelor’s degree in Actuarial Science, Finance

January 2016

Skills

- Retirement Plan Design

- ERISA Knowledge

- Employee Benefits Consulting

- Pension Actuarial Calculations

- Defined Benefit Plan Administration

- Defined Contribution Plan Administration

Work Experience

Employment Benefits or Pensions Retirement Plan Specialist

- Conducted due diligence and provided recommendations on mergers and acquisitions involving retirement plans, ensuring compliance with legal and fiduciary requirements.

- Created and maintained complex benefit models using actuarial software, accurately projecting plan liabilities and ensuring compliance with funding requirements.

- Developed and implemented a new compliance program for a retirement plan, reducing audit findings by 50% and improving overall plan governance.

- Collaborated with legal counsel and other professionals to draft and interpret plan documents, ensuring compliance with ERISA and other applicable laws.

Employment Benefits or Pensions Retirement Plan Specialist

- Designed and implemented a new defined contribution plan for a multinational corporation, resulting in a 15% increase in employee participation and a 20% reduction in administrative costs.

- Developed and executed a comprehensive communication strategy for a pension plan merger, ensuring all stakeholders were fully informed and engaged throughout the transition.

- Provided expert testimony to regulatory bodies on complex pension and retirement plan matters, representing the interests of plan participants and employers.

- Analyzed and evaluated investment performance of pension funds, identifying opportunities for optimization and reducing risk exposure by 10%.

Accomplishments

- Successfully negotiated and managed complex pension arrangements with multiple thirdparty vendors, ensuring compliance with regulations and maximizing plan efficiency.

- Established a defined contribution retirement plan with automated enrollment and employer matching, increasing employee participation by 25% within one year.

- Developed and implemented a selfservice portal for employees to access retirement plan information, reducing administrative costs by 15%.

- Established and managed a 401(k) plan for a startup company, ensuring employee compliance and maximizing investment returns.

- Reduced pension plan liabilities by 10% through proactive risk management strategies and investment diversification.

Awards

- Awarded Retirement Benefits Excellence Award for developing and implementing a comprehensive retirement savings program.

- Received Employee Benefits Innovation Award for designing a groundbreaking employee stock ownership plan.

- Recognized as Top Benefits Advisor for providing exceptional guidance and support to clients on complex retirement planning issues.

- Awarded Retirement Plan Administrator of the Year for outstanding proficiency in administering and managing complex retirement plans.

Certificates

- Certified Employee Benefit Specialist (CEBS)

- Chartered Retirement Plans Specialist (CRPS)

- Enrolled Actuary (EA)

- Qualified 401(k) Administrator (QKA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Employment Benefits or Pensions Retirement Plan Specialist

- Quantify your accomplishments using specific metrics to demonstrate your impact.

- Highlight your knowledge of ERISA and other relevant regulations to showcase your compliance expertise.

- Showcase your communication and interpersonal skills by emphasizing your ability to effectively engage with stakeholders.

- Demonstrate your commitment to professional development by mentioning any certifications or continuing education courses you have completed.

Essential Experience Highlights for a Strong Employment Benefits or Pensions Retirement Plan Specialist Resume

- Design and implement retirement plans, including defined benefit and defined contribution plans

- Conduct actuarial calculations, analyze investment performance, and project plan liabilities

- Provide expert testimony to regulatory bodies and represent plan participants and employers

- Draft and interpret plan documents, ensuring compliance with ERISA and other applicable laws

- Develop and implement compliance programs to mitigate risk and improve plan governance

- Collaborate with legal counsel, investment professionals, and other stakeholders to ensure seamless plan operations

- Stay abreast of industry best practices and regulatory changes to provide innovative and compliant retirement solutions

Frequently Asked Questions (FAQ’s) For Employment Benefits or Pensions Retirement Plan Specialist

What are the primary responsibilities of an Employment Benefits or Pensions Retirement Plan Specialist?

Employment Benefits or Pensions Retirement Plan Specialists are responsible for designing, implementing, and overseeing retirement plans to ensure compliance and optimize employee benefits. They conduct actuarial calculations, provide expert guidance on complex pension and retirement plan matters, and collaborate with various stakeholders to ensure seamless plan operations.

What are the key skills required for this role?

Employment Benefits or Pensions Retirement Plan Specialists require a strong understanding of retirement plan design, ERISA, and other applicable laws. They should possess excellent analytical, communication, and interpersonal skills, as well as proficiency in actuarial software and investment analysis techniques.

What career opportunities are available for Employment Benefits or Pensions Retirement Plan Specialists?

Individuals with experience as Employment Benefits or Pensions Retirement Plan Specialists can pursue various career paths within the financial services industry. They can advance to leadership positions in retirement plan consulting, pension actuarial services, or employee benefits management.

What is the salary range for Employment Benefits or Pensions Retirement Plan Specialists?

The salary range for Employment Benefits or Pensions Retirement Plan Specialists varies depending on experience, qualifications, and location. According to Salary.com, the average salary for this role in the United States is around $120,000 per year.

What are the challenges faced by Employment Benefits or Pensions Retirement Plan Specialists?

Employment Benefits or Pensions Retirement Plan Specialists face challenges in navigating complex regulatory environments, staying abreast of industry best practices, and addressing the evolving needs of plan participants and employers. They must also stay informed about tax laws and investment strategies to provide comprehensive retirement planning solutions.

What are the benefits of working as an Employment Benefits or Pensions Retirement Plan Specialist?

Employment Benefits or Pensions Retirement Plan Specialists enjoy job security, competitive compensation, and opportunities for professional development. They play a crucial role in securing the financial future of employees and making a positive impact on organizations.

What is the future outlook for the Employment Benefits or Pensions Retirement Plan Specialist role?

The outlook for Employment Benefits or Pensions Retirement Plan Specialists is expected to be positive due to the increasing demand for retirement planning services as the population ages. The role requires specialized knowledge and expertise, making it a sought-after profession in the financial services industry.

What type of work environment can Employment Benefits or Pensions Retirement Plan Specialists expect?

Employment Benefits or Pensions Retirement Plan Specialists typically work in office settings, collaborating with colleagues in finance, human resources, and legal departments. They may also interact with clients and external stakeholders, such as investment managers and actuaries.