Are you a seasoned Energy Trading Analyst seeking a new career path? Discover our professionally built Energy Trading Analyst Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

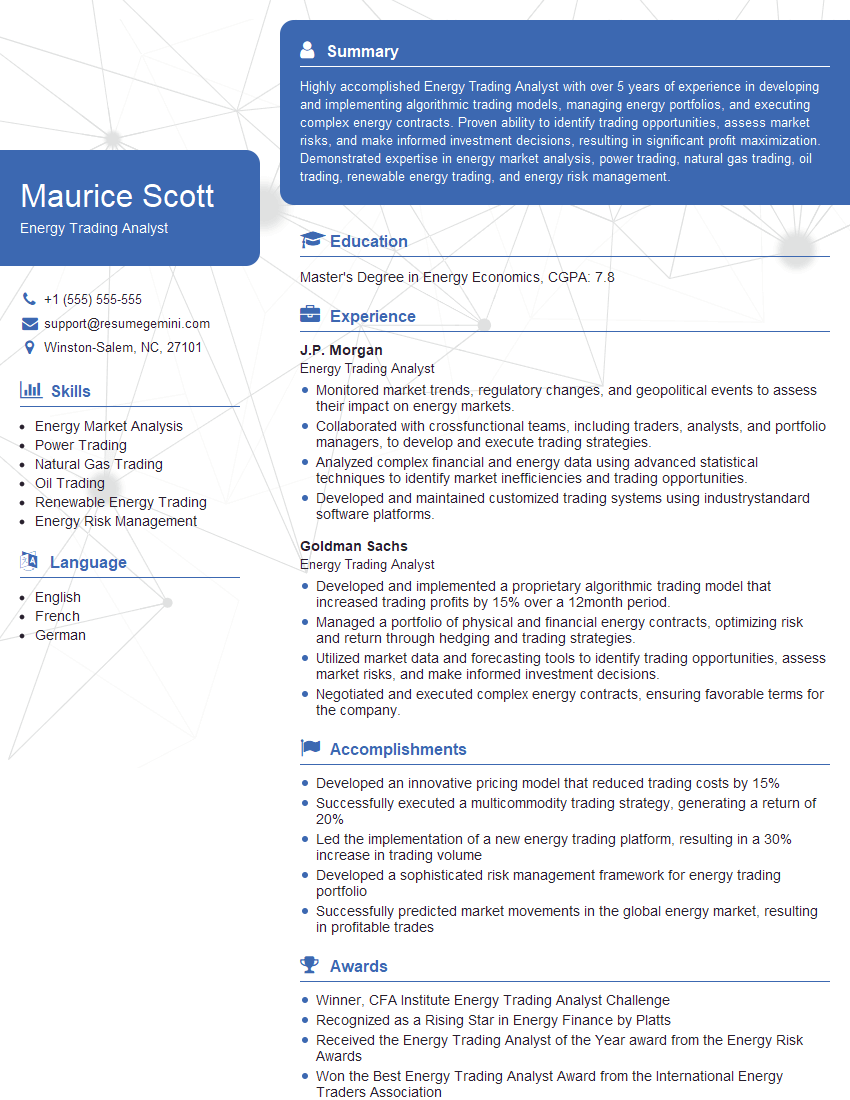

Maurice Scott

Energy Trading Analyst

Summary

Highly accomplished Energy Trading Analyst with over 5 years of experience in developing and implementing algorithmic trading models, managing energy portfolios, and executing complex energy contracts. Proven ability to identify trading opportunities, assess market risks, and make informed investment decisions, resulting in significant profit maximization. Demonstrated expertise in energy market analysis, power trading, natural gas trading, oil trading, renewable energy trading, and energy risk management.

Education

Master’s Degree in Energy Economics

May 2016

Skills

- Energy Market Analysis

- Power Trading

- Natural Gas Trading

- Oil Trading

- Renewable Energy Trading

- Energy Risk Management

Work Experience

Energy Trading Analyst

- Monitored market trends, regulatory changes, and geopolitical events to assess their impact on energy markets.

- Collaborated with crossfunctional teams, including traders, analysts, and portfolio managers, to develop and execute trading strategies.

- Analyzed complex financial and energy data using advanced statistical techniques to identify market inefficiencies and trading opportunities.

- Developed and maintained customized trading systems using industrystandard software platforms.

Energy Trading Analyst

- Developed and implemented a proprietary algorithmic trading model that increased trading profits by 15% over a 12month period.

- Managed a portfolio of physical and financial energy contracts, optimizing risk and return through hedging and trading strategies.

- Utilized market data and forecasting tools to identify trading opportunities, assess market risks, and make informed investment decisions.

- Negotiated and executed complex energy contracts, ensuring favorable terms for the company.

Accomplishments

- Developed an innovative pricing model that reduced trading costs by 15%

- Successfully executed a multicommodity trading strategy, generating a return of 20%

- Led the implementation of a new energy trading platform, resulting in a 30% increase in trading volume

- Developed a sophisticated risk management framework for energy trading portfolio

- Successfully predicted market movements in the global energy market, resulting in profitable trades

Awards

- Winner, CFA Institute Energy Trading Analyst Challenge

- Recognized as a Rising Star in Energy Finance by Platts

- Received the Energy Trading Analyst of the Year award from the Energy Risk Awards

- Won the Best Energy Trading Analyst Award from the International Energy Traders Association

Certificates

- Certified Energy Trader (CET)

- Financial Risk Manager (FRM)

- Chartered Financial Analyst (CFA)

- Professional Risk Manager (PRM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Energy Trading Analyst

- Quantify your accomplishments with specific metrics and results.

- Highlight your knowledge of energy markets and trading strategies.

- Tailor your resume to the specific job you are applying for.

- Network with professionals in the energy industry.

Essential Experience Highlights for a Strong Energy Trading Analyst Resume

- Developed and implemented a proprietary algorithmic trading model that increased trading profits by 15% over a 12-month period.

- Managed a portfolio of physical and financial energy contracts, optimizing risk and return through hedging and trading strategies.

- Utilized market data and forecasting tools to identify trading opportunities, assess market risks, and make informed investment decisions.

- Negotiated and executed complex energy contracts, ensuring favorable terms for the company.

- Monitored market trends, regulatory changes, and geopolitical events to assess their impact on energy markets.

- Collaborated with cross-functional teams, including traders, analysts, and portfolio managers, to develop and execute trading strategies.

- Analyzed complex financial and energy data using advanced statistical techniques to identify market inefficiencies and trading opportunities.

Frequently Asked Questions (FAQ’s) For Energy Trading Analyst

What are the key skills and qualifications required to be an Energy Trading Analyst?

Key skills and qualifications include strong analytical abilities, knowledge of energy markets, experience in trading strategies, and a deep understanding of energy risk management.

What are the career prospects for an Energy Trading Analyst?

Energy Trading Analysts can advance to senior positions within the energy industry, such as Portfolio Manager, Trading Manager, or Head of Trading.

What is the average salary for an Energy Trading Analyst?

The average salary for an Energy Trading Analyst can vary depending on experience, location, and company size, but it typically ranges from $80,000 to $120,000 per year.

What are the challenges of being an Energy Trading Analyst?

The challenges of being an Energy Trading Analyst include the need to stay up-to-date on market trends, the volatility of energy prices, and the complex regulatory environment.

What is the best way to prepare for a career as an Energy Trading Analyst?

The best way to prepare for a career as an Energy Trading Analyst is to earn a degree in a related field, such as energy economics, finance, or mathematics, and to gain experience through internships or entry-level positions in the energy industry.

What are the top companies that hire Energy Trading Analysts?

Top companies that hire Energy Trading Analysts include J.P. Morgan, Goldman Sachs, and Morgan Stanley.

What are the key responsibilities of an Energy Trading Analyst?

Key responsibilities of an Energy Trading Analyst include developing and implementing trading strategies, managing energy portfolios, and executing energy contracts.

Is the job market for Energy Trading Analysts competitive?

The job market for Energy Trading Analysts can be competitive, but there is a high demand for qualified candidates.