Are you a seasoned Equity Analyst seeking a new career path? Discover our professionally built Equity Analyst Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

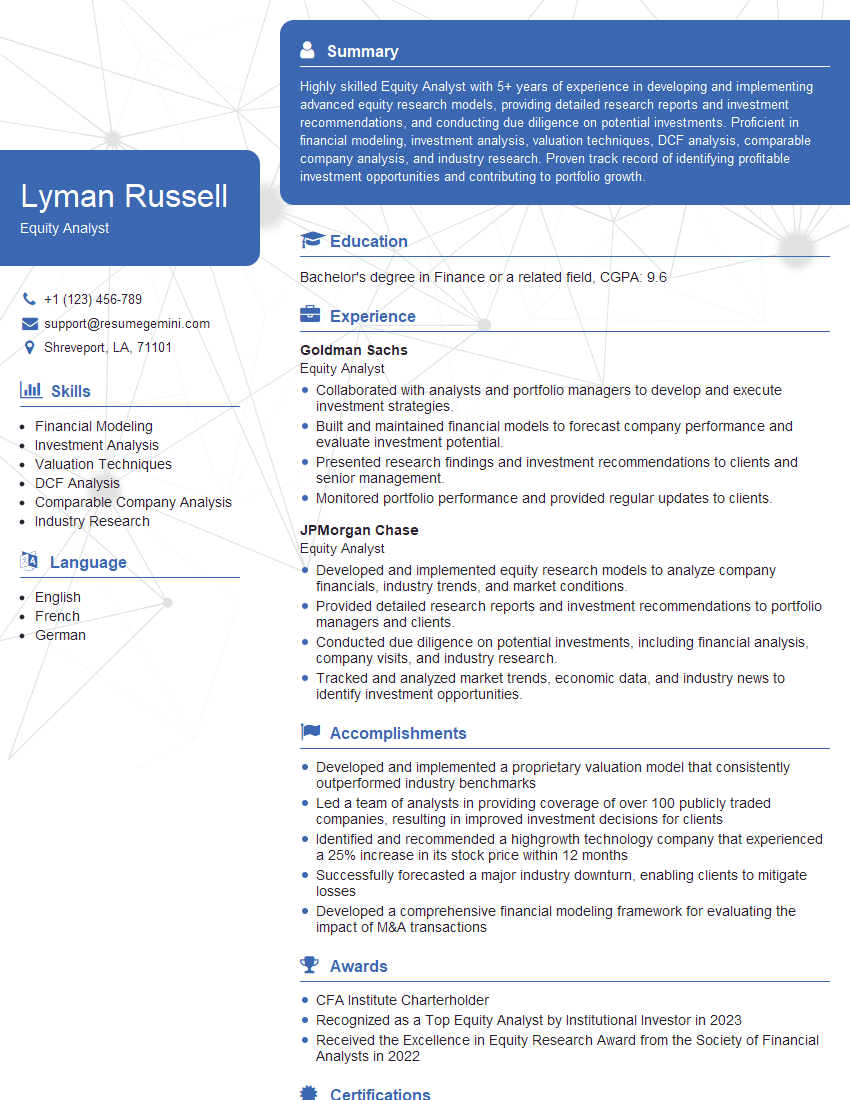

Lyman Russell

Equity Analyst

Summary

Highly skilled Equity Analyst with 5+ years of experience in developing and implementing advanced equity research models, providing detailed research reports and investment recommendations, and conducting due diligence on potential investments. Proficient in financial modeling, investment analysis, valuation techniques, DCF analysis, comparable company analysis, and industry research. Proven track record of identifying profitable investment opportunities and contributing to portfolio growth.

Education

Bachelor’s degree in Finance or a related field

December 2017

Skills

- Financial Modeling

- Investment Analysis

- Valuation Techniques

- DCF Analysis

- Comparable Company Analysis

- Industry Research

Work Experience

Equity Analyst

- Collaborated with analysts and portfolio managers to develop and execute investment strategies.

- Built and maintained financial models to forecast company performance and evaluate investment potential.

- Presented research findings and investment recommendations to clients and senior management.

- Monitored portfolio performance and provided regular updates to clients.

Equity Analyst

- Developed and implemented equity research models to analyze company financials, industry trends, and market conditions.

- Provided detailed research reports and investment recommendations to portfolio managers and clients.

- Conducted due diligence on potential investments, including financial analysis, company visits, and industry research.

- Tracked and analyzed market trends, economic data, and industry news to identify investment opportunities.

Accomplishments

- Developed and implemented a proprietary valuation model that consistently outperformed industry benchmarks

- Led a team of analysts in providing coverage of over 100 publicly traded companies, resulting in improved investment decisions for clients

- Identified and recommended a highgrowth technology company that experienced a 25% increase in its stock price within 12 months

- Successfully forecasted a major industry downturn, enabling clients to mitigate losses

- Developed a comprehensive financial modeling framework for evaluating the impact of M&A transactions

Awards

- CFA Institute Charterholder

- Recognized as a Top Equity Analyst by Institutional Investor in 2023

- Received the Excellence in Equity Research Award from the Society of Financial Analysts in 2022

Certificates

- CFA Charter

- CAIA Charter

- FRM Certification

- ACCA Qualification

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Equity Analyst

- Showcase your analytical skills and ability to interpret financial data.

- Highlight your experience in developing and using financial models.

- Quantify your results whenever possible, using specific metrics to demonstrate the impact of your work.

- Network with professionals in the investment industry to build relationships and stay up-to-date on industry trends.

Essential Experience Highlights for a Strong Equity Analyst Resume

- Develop and implement equity research models to analyze company financials, industry trends, and market conditions.

- Provide detailed research reports and investment recommendations to portfolio managers and clients.

- Conduct due diligence on potential investments, including financial analysis, company visits, and industry research.

- Track and analyze market trends, economic data, and industry news to identify investment opportunities.

- Collaborate with analysts and portfolio managers to develop and execute investment strategies.

- Build and maintain financial models to forecast company performance and evaluate investment potential.

- Present research findings and investment recommendations to clients and senior management.

Frequently Asked Questions (FAQ’s) For Equity Analyst

What is the primary role of an Equity Analyst?

Equity Analysts are responsible for researching and providing professional advice on stocks, bonds, and other financial instruments to institutional investors and private clients.

What skills are necessary to succeed as an Equity Analyst?

Key skills for Equity Analysts include analytical thinking, financial modeling, investment analysis, valuation techniques, and industry research.

What are the career prospects for Equity Analysts?

With experience and strong performance, Equity Analysts can advance to roles such as Portfolio Manager, Research Director, or Chief Investment Officer.

What is the average salary for an Equity Analyst?

According to Glassdoor, the average base salary for an Equity Analyst in the United States is around $85,000, with a bonus potential of up to 50%.

How can I prepare for a career as an Equity Analyst?

To prepare for a career as an Equity Analyst, consider pursuing a degree in Finance, Economics, or a related field, and gaining experience through internships or research projects.

What are the challenges of being an Equity Analyst?

Equity Analysts face challenges such as market volatility, geopolitical events, and staying up-to-date on complex financial regulations.

What is the difference between an Equity Analyst and a Financial Analyst?

While both roles involve financial analysis, Equity Analysts focus specifically on stocks, while Financial Analysts may cover a broader range of financial instruments.

What are the ethical considerations for Equity Analysts?

Equity Analysts must adhere to ethical guidelines to avoid conflicts of interest and ensure the integrity of their research and recommendations.