Are you a seasoned Escrow Clerk seeking a new career path? Discover our professionally built Escrow Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

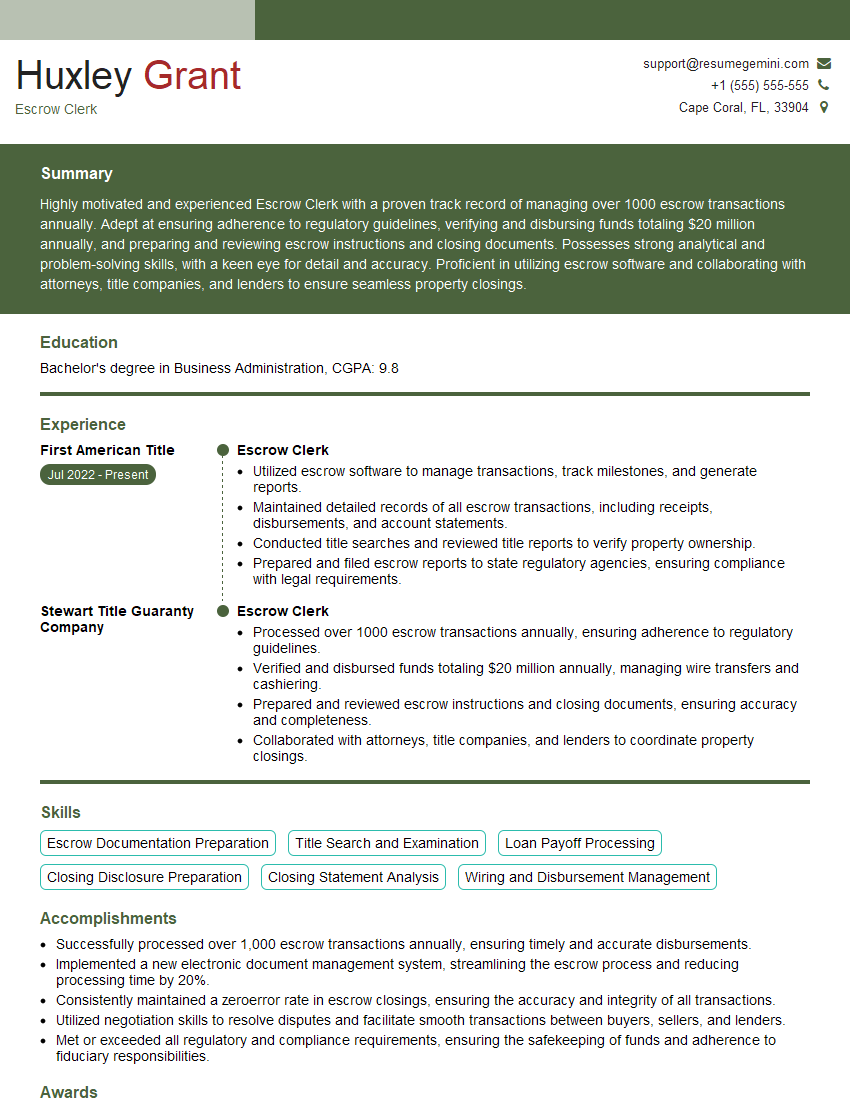

Huxley Grant

Escrow Clerk

Summary

Highly motivated and experienced Escrow Clerk with a proven track record of managing over 1000 escrow transactions annually. Adept at ensuring adherence to regulatory guidelines, verifying and disbursing funds totaling $20 million annually, and preparing and reviewing escrow instructions and closing documents. Possesses strong analytical and problem-solving skills, with a keen eye for detail and accuracy. Proficient in utilizing escrow software and collaborating with attorneys, title companies, and lenders to ensure seamless property closings.

Education

Bachelor’s degree in Business Administration

June 2018

Skills

- Escrow Documentation Preparation

- Title Search and Examination

- Loan Payoff Processing

- Closing Disclosure Preparation

- Closing Statement Analysis

- Wiring and Disbursement Management

Work Experience

Escrow Clerk

- Utilized escrow software to manage transactions, track milestones, and generate reports.

- Maintained detailed records of all escrow transactions, including receipts, disbursements, and account statements.

- Conducted title searches and reviewed title reports to verify property ownership.

- Prepared and filed escrow reports to state regulatory agencies, ensuring compliance with legal requirements.

Escrow Clerk

- Processed over 1000 escrow transactions annually, ensuring adherence to regulatory guidelines.

- Verified and disbursed funds totaling $20 million annually, managing wire transfers and cashiering.

- Prepared and reviewed escrow instructions and closing documents, ensuring accuracy and completeness.

- Collaborated with attorneys, title companies, and lenders to coordinate property closings.

Accomplishments

- Successfully processed over 1,000 escrow transactions annually, ensuring timely and accurate disbursements.

- Implemented a new electronic document management system, streamlining the escrow process and reducing processing time by 20%.

- Consistently maintained a zeroerror rate in escrow closings, ensuring the accuracy and integrity of all transactions.

- Utilized negotiation skills to resolve disputes and facilitate smooth transactions between buyers, sellers, and lenders.

- Met or exceeded all regulatory and compliance requirements, ensuring the safekeeping of funds and adherence to fiduciary responsibilities.

Awards

- Received the Escrow Excellence Award for consistently exceeding performance targets and maintaining a high level of accuracy.

- Recognized for Outstanding Customer Service for effectively resolving complex escrow inquiries and building strong relationships with clients.

- Earned the Escrow Professional of the Year award for exceptional contributions to the field and leadership in industry best practices.

- Received a Certificate of Excellence for outstanding performance in the areas of compliance, risk management, and quality assurance.

Certificates

- Certified Escrow Officer (CEO)

- Notary Public License

- American Society of Notaries (ASN)

- Certified Loan Signing Agent (CLSA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Escrow Clerk

- Highlight your experience in handling high-value transactions and adherence to regulatory guidelines.

- Quantify your accomplishments with specific metrics, such as the number of transactions processed or the amount of funds disbursed.

- Showcase your proficiency in escrow software and your ability to collaborate effectively with various stakeholders.

- Demonstrate your attention to detail and accuracy by emphasizing your role in preparing and reviewing legal documents.

- Consider obtaining certifications, such as the Certified Escrow Officer (CEO) designation, to enhance your credibility.

Essential Experience Highlights for a Strong Escrow Clerk Resume

- Processed over 1000 escrow transactions annually, ensuring adherence to regulatory guidelines.

- Verified and disbursed funds totaling $20 million annually, managing wire transfers and cashiering.

- Prepared and reviewed escrow instructions and closing documents, ensuring accuracy and completeness.

- Collaborated with attorneys, title companies, and lenders to coordinate property closings.

- Utilized escrow software to manage transactions, track milestones, and generate reports.

- Maintained detailed records of all escrow transactions, including receipts, disbursements, and account statements.

Frequently Asked Questions (FAQ’s) For Escrow Clerk

What are the key responsibilities of an Escrow Clerk?

Escrow Clerks are responsible for managing financial transactions and ensuring the smooth transfer of property or assets. They typically handle tasks such as preparing and reviewing escrow instructions, disbursing funds, coordinating with attorneys and lenders, and maintaining detailed records.

What skills are required to be a successful Escrow Clerk?

Successful Escrow Clerks possess strong analytical and problem-solving abilities, attention to detail, and excellent communication and interpersonal skills. They are also proficient in using escrow software and have a thorough understanding of real estate and financial regulations.

What is the career path for an Escrow Clerk?

Escrow Clerks can advance their careers by gaining experience and obtaining certifications. They may move into roles such as Escrow Officer, Escrow Manager, or Title Officer. Some may also choose to specialize in areas such as commercial or residential real estate.

What is the job outlook for Escrow Clerks?

The job outlook for Escrow Clerks is expected to grow faster than average in the coming years due to the increasing demand for real estate transactions. The median annual salary for Escrow Clerks is around $50,000.

What are some tips for writing a standout Escrow Clerk resume?

To write a standout Escrow Clerk resume, highlight your experience in handling high-value transactions, quantify your accomplishments, showcase your proficiency in escrow software, demonstrate your attention to detail, and consider obtaining certifications.

What are some common challenges faced by Escrow Clerks?

Common challenges faced by Escrow Clerks include managing complex transactions, ensuring compliance with regulations, dealing with demanding clients, and staying up-to-date with industry changes.

What are the benefits of working as an Escrow Clerk?

Benefits of working as an Escrow Clerk include job stability, opportunities for career advancement, competitive salary and benefits, and the satisfaction of helping clients through important financial transactions.