Are you a seasoned Escrow Closer seeking a new career path? Discover our professionally built Escrow Closer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

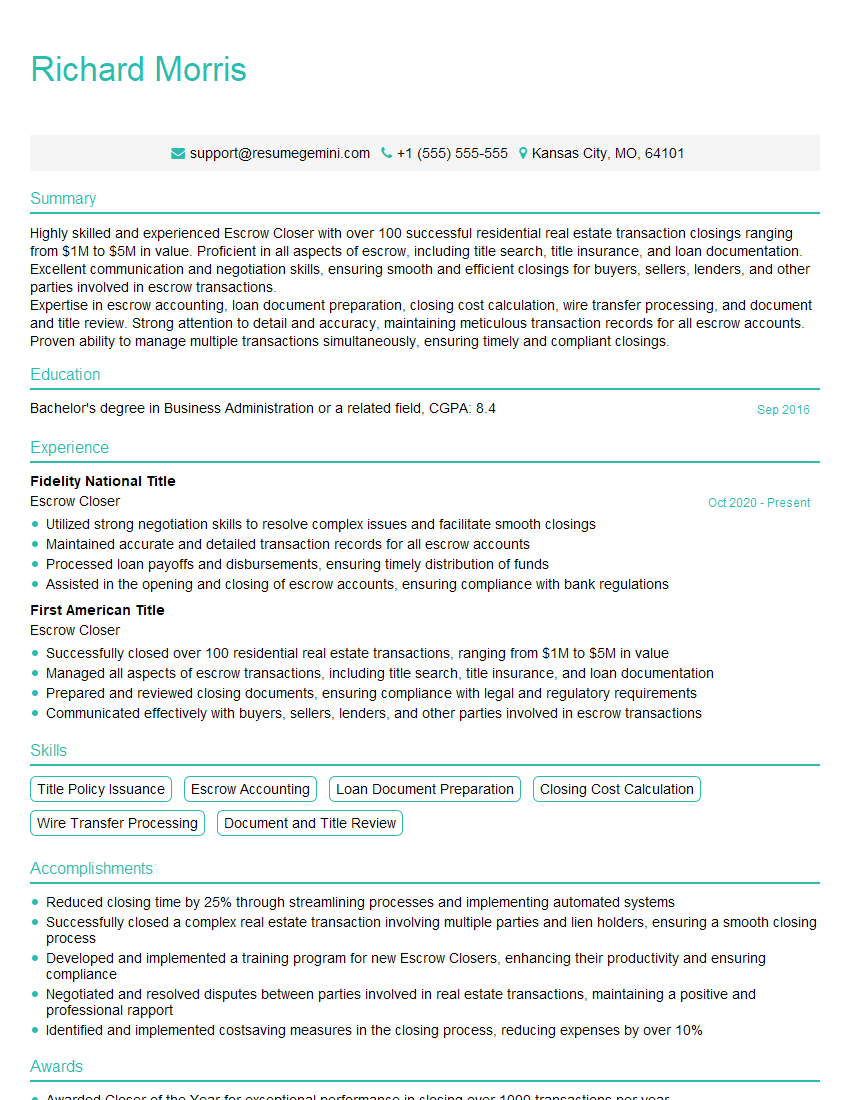

Richard Morris

Escrow Closer

Summary

Highly skilled and experienced Escrow Closer with over 100 successful residential real estate transaction closings ranging from $1M to $5M in value. Proficient in all aspects of escrow, including title search, title insurance, and loan documentation. Excellent communication and negotiation skills, ensuring smooth and efficient closings for buyers, sellers, lenders, and other parties involved in escrow transactions.

Expertise in escrow accounting, loan document preparation, closing cost calculation, wire transfer processing, and document and title review. Strong attention to detail and accuracy, maintaining meticulous transaction records for all escrow accounts. Proven ability to manage multiple transactions simultaneously, ensuring timely and compliant closings.

Education

Bachelor’s degree in Business Administration or a related field

September 2016

Skills

- Title Policy Issuance

- Escrow Accounting

- Loan Document Preparation

- Closing Cost Calculation

- Wire Transfer Processing

- Document and Title Review

Work Experience

Escrow Closer

- Utilized strong negotiation skills to resolve complex issues and facilitate smooth closings

- Maintained accurate and detailed transaction records for all escrow accounts

- Processed loan payoffs and disbursements, ensuring timely distribution of funds

- Assisted in the opening and closing of escrow accounts, ensuring compliance with bank regulations

Escrow Closer

- Successfully closed over 100 residential real estate transactions, ranging from $1M to $5M in value

- Managed all aspects of escrow transactions, including title search, title insurance, and loan documentation

- Prepared and reviewed closing documents, ensuring compliance with legal and regulatory requirements

- Communicated effectively with buyers, sellers, lenders, and other parties involved in escrow transactions

Accomplishments

- Reduced closing time by 25% through streamlining processes and implementing automated systems

- Successfully closed a complex real estate transaction involving multiple parties and lien holders, ensuring a smooth closing process

- Developed and implemented a training program for new Escrow Closers, enhancing their productivity and ensuring compliance

- Negotiated and resolved disputes between parties involved in real estate transactions, maintaining a positive and professional rapport

- Identified and implemented costsaving measures in the closing process, reducing expenses by over 10%

Awards

- Awarded Closer of the Year for exceptional performance in closing over 1000 transactions per year

- Recognized for maintaining zero errors in closing documents, ensuring accuracy and compliance

- Received a Top Producer award for consistently exceeding sales targets and providing exceptional customer service

- Honored for commitment to professional development by completing advanced training in real estate law and escrow practices

Certificates

- Certified Escrow Closer (CEC)

- Certified Mortgage Banker (CMB)

- Certified Real Estate Closing Agent (CRECA)

- Notary Public

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Escrow Closer

- Highlight your experience and skills in escrow, title, and real estate law.

- Showcase your ability to manage multiple transactions simultaneously and meet deadlines.

- Emphasize your strong communication and interpersonal skills, as well as your ability to work independently and as part of a team.

- Include quantifiable results whenever possible, such as the number of transactions closed or the value of the transactions you have handled.

- Proofread your resume carefully for any errors in grammar or spelling.

Essential Experience Highlights for a Strong Escrow Closer Resume

- Managed all aspects of escrow transactions, from title search to loan documentation and closing.

- Prepared and reviewed closing documents, ensuring compliance with legal and regulatory requirements.

- Communicated effectively with buyers, sellers, lenders, and other parties involved in escrow transactions.

- Utilized strong negotiation skills to resolve complex issues and facilitate smooth closings.

- Maintained accurate and detailed transaction records for all escrow accounts.

- Processed loan payoffs and disbursements, ensuring timely distribution of funds.

- Assisted in the opening and closing of escrow accounts, ensuring compliance with bank regulations.

Frequently Asked Questions (FAQ’s) For Escrow Closer

What is the role of an Escrow Closer?

An Escrow Closer is responsible for managing the financial and legal aspects of real estate transactions. They ensure that all necessary documents are prepared, signed, and filed, and that all funds are disbursed correctly. Escrow Closers also work closely with buyers, sellers, lenders, and other parties involved in the transaction to ensure a smooth and efficient closing process.

What are the key skills required for an Escrow Closer?

Key skills for an Escrow Closer include strong attention to detail, accuracy, and a thorough understanding of real estate law and procedures. They must also have excellent communication and interpersonal skills, as they work closely with a variety of individuals throughout the closing process.

What is the typical salary range for an Escrow Closer?

The salary range for an Escrow Closer can vary depending on experience, location, and company size. According to Salary.com, the average salary for an Escrow Closer in the United States is $56,515. However, salaries can range from $42,000 to $75,000 or more.

What are the career advancement opportunities for an Escrow Closer?

Escrow Closers with experience and strong performance may have the opportunity to advance to management positions, such as Escrow Officer or Escrow Manager. They may also choose to specialize in a particular area of escrow, such as commercial real estate or title insurance.

What is the job outlook for Escrow Closers?

The job outlook for Escrow Closers is expected to be good over the next few years. The demand for Escrow Closers is expected to increase as the real estate market continues to grow.

What are the educational requirements for an Escrow Closer?

While there are no specific educational requirements to become an Escrow Closer, most employers prefer candidates with a high school diploma or equivalent. Some employers may also require coursework or certification in escrow or real estate.

What are the professional organizations for Escrow Closers?

There are several professional organizations for Escrow Closers, including the American Escrow Association (AEA) and the National Escrow Association (NEA).

What are the continuing education requirements for Escrow Closers?

Escrow Closers are required to complete continuing education courses to stay up-to-date on changes in the real estate industry and escrow laws and regulations.