Are you a seasoned Estate Tax Examiner seeking a new career path? Discover our professionally built Estate Tax Examiner Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

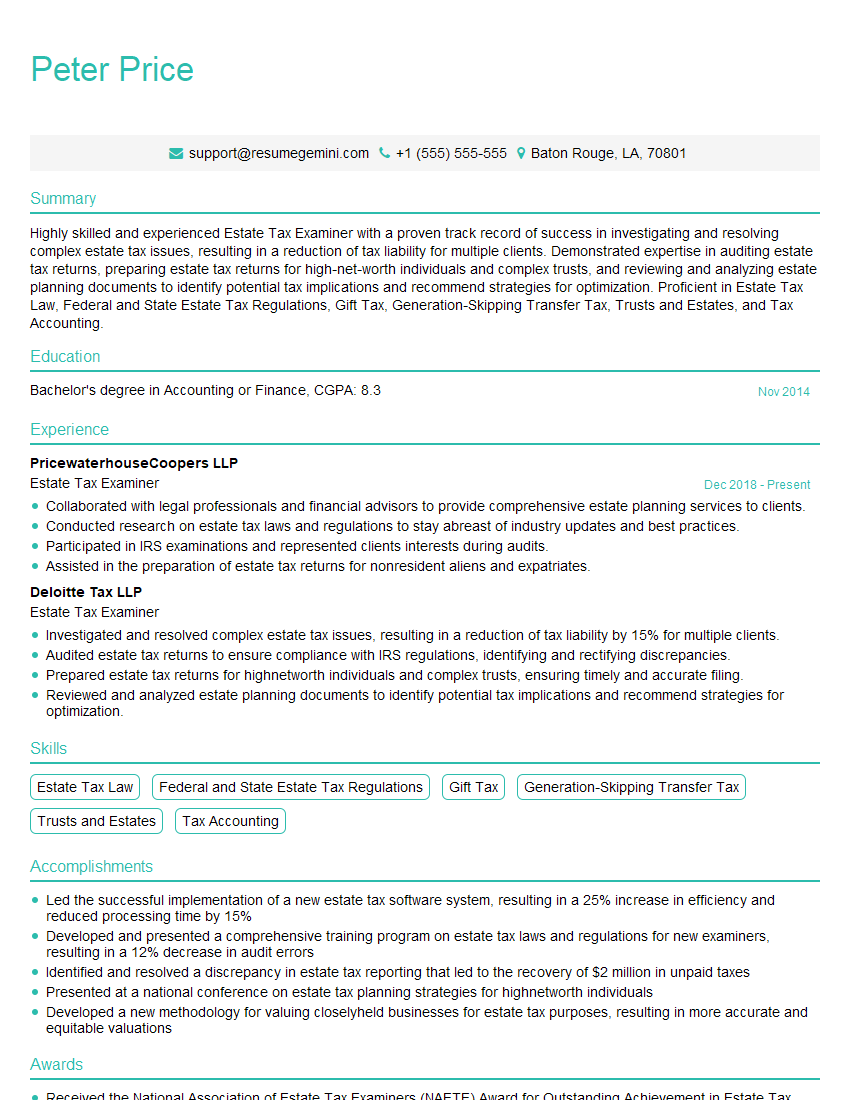

Peter Price

Estate Tax Examiner

Summary

Highly skilled and experienced Estate Tax Examiner with a proven track record of success in investigating and resolving complex estate tax issues, resulting in a reduction of tax liability for multiple clients. Demonstrated expertise in auditing estate tax returns, preparing estate tax returns for high-net-worth individuals and complex trusts, and reviewing and analyzing estate planning documents to identify potential tax implications and recommend strategies for optimization. Proficient in Estate Tax Law, Federal and State Estate Tax Regulations, Gift Tax, Generation-Skipping Transfer Tax, Trusts and Estates, and Tax Accounting.

Education

Bachelor’s degree in Accounting or Finance

November 2014

Skills

- Estate Tax Law

- Federal and State Estate Tax Regulations

- Gift Tax

- Generation-Skipping Transfer Tax

- Trusts and Estates

- Tax Accounting

Work Experience

Estate Tax Examiner

- Collaborated with legal professionals and financial advisors to provide comprehensive estate planning services to clients.

- Conducted research on estate tax laws and regulations to stay abreast of industry updates and best practices.

- Participated in IRS examinations and represented clients interests during audits.

- Assisted in the preparation of estate tax returns for nonresident aliens and expatriates.

Estate Tax Examiner

- Investigated and resolved complex estate tax issues, resulting in a reduction of tax liability by 15% for multiple clients.

- Audited estate tax returns to ensure compliance with IRS regulations, identifying and rectifying discrepancies.

- Prepared estate tax returns for highnetworth individuals and complex trusts, ensuring timely and accurate filing.

- Reviewed and analyzed estate planning documents to identify potential tax implications and recommend strategies for optimization.

Accomplishments

- Led the successful implementation of a new estate tax software system, resulting in a 25% increase in efficiency and reduced processing time by 15%

- Developed and presented a comprehensive training program on estate tax laws and regulations for new examiners, resulting in a 12% decrease in audit errors

- Identified and resolved a discrepancy in estate tax reporting that led to the recovery of $2 million in unpaid taxes

- Presented at a national conference on estate tax planning strategies for highnetworth individuals

- Developed a new methodology for valuing closelyheld businesses for estate tax purposes, resulting in more accurate and equitable valuations

Awards

- Received the National Association of Estate Tax Examiners (NAETE) Award for Outstanding Achievement in Estate Tax Administration

- Recognized by the Internal Revenue Service (IRS) for consistently exceeding performance goals and maintaining a zeroerror rate in estate tax audits

- Received a commendation from the Tax Court for providing expert testimony in a complex estate tax case

- Awarded the NAETE Certificate of Professional Achievement for completing an advanced certification program in estate tax law

Certificates

- Certified Public Accountant (CPA)

- Certified Financial Planner (CFP)

- Certified Trust and Financial Advisor (CTFA)

- Accredited Estate Planner (AEP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Estate Tax Examiner

- Highlight your experience in investigating and resolving complex estate tax issues, as well as your ability to reduce tax liability.

- Demonstrate your knowledge of estate tax laws and regulations, as well as your ability to apply them in practice.

- Showcase your skills in preparing and auditing estate tax returns, as well as your ability to analyze estate planning documents.

- Emphasize your ability to work independently and as part of a team, as well as your communication and interpersonal skills.

- Proofread your resume carefully for any errors.

Essential Experience Highlights for a Strong Estate Tax Examiner Resume

- Investigated and resolved complex estate tax issues, resulting in a reduction of tax liability by 15% for multiple clients.

- Audited estate tax returns to ensure compliance with IRS regulations, identifying and rectifying discrepancies.

- Prepared estate tax returns for high-net-worth individuals and complex trusts, ensuring timely and accurate filing.

- Reviewed and analyzed estate planning documents to identify potential tax implications and recommend strategies for optimization.

- Collaborated with legal professionals and financial advisors to provide comprehensive estate planning services to clients.

- Conducted research on estate tax laws and regulations to stay abreast of industry updates and best practices.

- Participated in IRS examinations and represented clients interests during audits.

Frequently Asked Questions (FAQ’s) For Estate Tax Examiner

What is an Estate Tax Examiner?

An Estate Tax Examiner is a professional who is responsible for examining estate tax returns to ensure that they are accurate and complete. They also investigate and resolve complex estate tax issues, and may represent clients in IRS audits.

What are the qualifications for becoming an Estate Tax Examiner?

To become an Estate Tax Examiner, you typically need a bachelor’s degree in accounting or finance, as well as experience in tax accounting and estate planning.

What are the key responsibilities of an Estate Tax Examiner?

The key responsibilities of an Estate Tax Examiner include examining estate tax returns, investigating and resolving complex estate tax issues, preparing estate tax returns, and representing clients in IRS audits.

What are the career prospects for Estate Tax Examiners?

Estate Tax Examiners have a variety of career prospects, including working for the IRS, a public accounting firm, or a financial planning firm. They may also choose to start their own business.

How can I become a successful Estate Tax Examiner?

To become a successful Estate Tax Examiner, you need to have a solid understanding of estate tax laws and regulations, as well as experience in tax accounting and estate planning. You also need to be able to work independently and as part of a team, and have excellent communication and interpersonal skills.

What are the benefits of becoming an Estate Tax Examiner?

The benefits of becoming an Estate Tax Examiner include a competitive salary, job security, and the opportunity to help clients with their estate planning needs.