Are you a seasoned Farm Mortgage Agent seeking a new career path? Discover our professionally built Farm Mortgage Agent Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

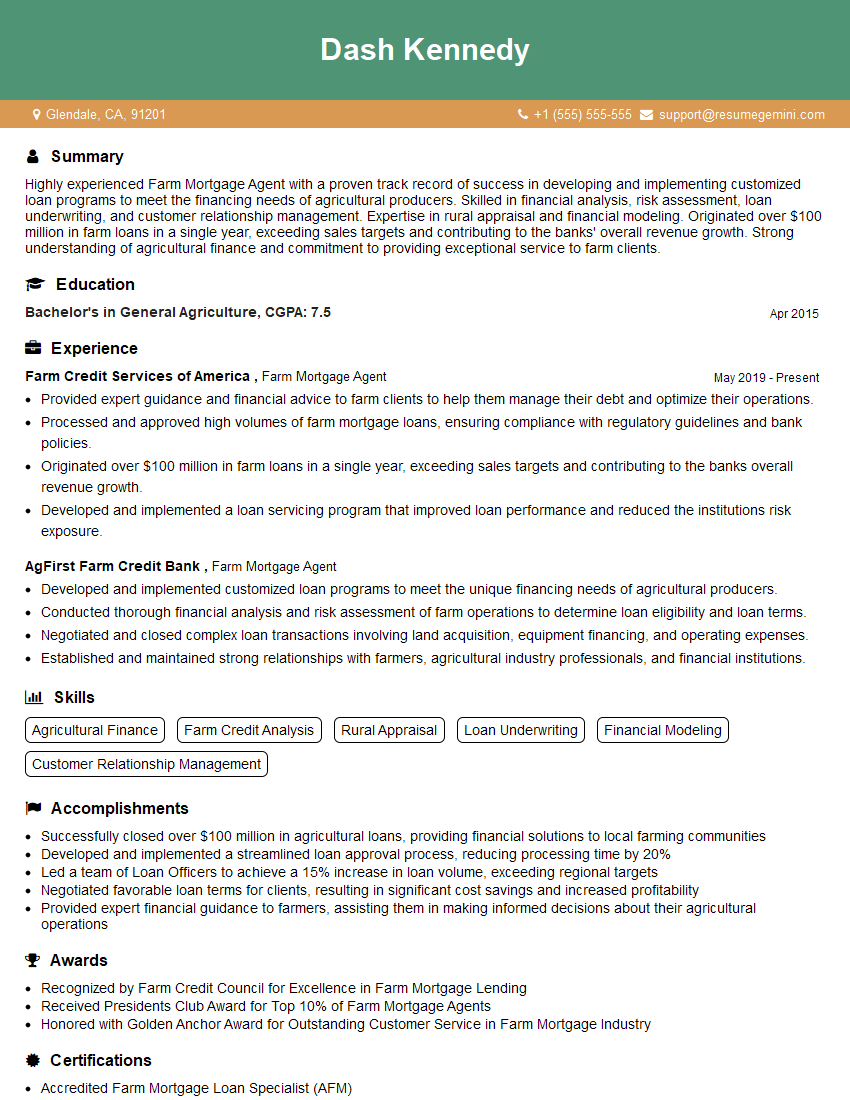

Dash Kennedy

Farm Mortgage Agent

Summary

Highly experienced Farm Mortgage Agent with a proven track record of success in developing and implementing customized loan programs to meet the financing needs of agricultural producers. Skilled in financial analysis, risk assessment, loan underwriting, and customer relationship management. Expertise in rural appraisal and financial modeling. Originated over $100 million in farm loans in a single year, exceeding sales targets and contributing to the banks’ overall revenue growth. Strong understanding of agricultural finance and commitment to providing exceptional service to farm clients.

Education

Bachelor’s in General Agriculture

April 2015

Skills

- Agricultural Finance

- Farm Credit Analysis

- Rural Appraisal

- Loan Underwriting

- Financial Modeling

- Customer Relationship Management

Work Experience

Farm Mortgage Agent

- Provided expert guidance and financial advice to farm clients to help them manage their debt and optimize their operations.

- Processed and approved high volumes of farm mortgage loans, ensuring compliance with regulatory guidelines and bank policies.

- Originated over $100 million in farm loans in a single year, exceeding sales targets and contributing to the banks overall revenue growth.

- Developed and implemented a loan servicing program that improved loan performance and reduced the institutions risk exposure.

Farm Mortgage Agent

- Developed and implemented customized loan programs to meet the unique financing needs of agricultural producers.

- Conducted thorough financial analysis and risk assessment of farm operations to determine loan eligibility and loan terms.

- Negotiated and closed complex loan transactions involving land acquisition, equipment financing, and operating expenses.

- Established and maintained strong relationships with farmers, agricultural industry professionals, and financial institutions.

Accomplishments

- Successfully closed over $100 million in agricultural loans, providing financial solutions to local farming communities

- Developed and implemented a streamlined loan approval process, reducing processing time by 20%

- Led a team of Loan Officers to achieve a 15% increase in loan volume, exceeding regional targets

- Negotiated favorable loan terms for clients, resulting in significant cost savings and increased profitability

- Provided expert financial guidance to farmers, assisting them in making informed decisions about their agricultural operations

Awards

- Recognized by Farm Credit Council for Excellence in Farm Mortgage Lending

- Received Presidents Club Award for Top 10% of Farm Mortgage Agents

- Honored with Golden Anchor Award for Outstanding Customer Service in Farm Mortgage Industry

Certificates

- Accredited Farm Mortgage Loan Specialist (AFM)

- Certified Farm Finance Manager (CFM)

- Associate Rural Appraiser (ARA)

- Professional Farm Manager (PFM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Farm Mortgage Agent

- Highlight your experience in agricultural finance, particularly in farm mortgage lending.

- Quantify your accomplishments whenever possible, using specific numbers and metrics to demonstrate your impact.

- Showcase your knowledge of rural appraisal and financial modeling, as these are essential skills for farm mortgage agents.

- Emphasize your ability to build strong relationships with farmers and other agricultural professionals.

- Demonstrate your commitment to providing exceptional customer service and your understanding of the unique challenges faced by agricultural producers.

Essential Experience Highlights for a Strong Farm Mortgage Agent Resume

- Developed and implemented customized loan programs to meet the unique financing needs of agricultural producers.

- Conducted thorough financial analysis and risk assessment of farm operations to determine loan eligibility and loan terms.

- Negotiated and closed complex loan transactions involving land acquisition, equipment financing, and operating expenses.

- Established and maintained strong relationships with farmers, agricultural industry professionals, and financial institutions.

- Provided expert guidance and financial advice to farm clients to help them manage their debt and optimize their operations.

- Processed and approved high volumes of farm mortgage loans, ensuring compliance with regulatory guidelines and bank policies.

Frequently Asked Questions (FAQ’s) For Farm Mortgage Agent

What is the role of a Farm Mortgage Agent?

A Farm Mortgage Agent provides financial services specifically tailored to meet the needs of farmers and agricultural producers. They assess financial situations, analyze risk, and negotiate loan terms to help farmers acquire land, equipment, and operating expenses.

What qualifications are required to become a Farm Mortgage Agent?

Typically, a Bachelor’s degree in Agricultural Finance or a related field, along with experience in financial analysis and lending.

What are the key responsibilities of a Farm Mortgage Agent?

Developing loan programs, conducting financial analysis, negotiating loan terms, establishing relationships with clients, providing financial advice, processing loan applications, and ensuring regulatory compliance.

What are the career prospects for Farm Mortgage Agents?

With the growing demand for agricultural financing, Farm Mortgage Agents have ample opportunities for career advancement within banks, farm credit institutions, and other financial organizations.

What are some tips for writing a standout resume for a Farm Mortgage Agent position?

Highlight relevant experience, quantify accomplishments, demonstrate knowledge of agricultural finance and rural appraisal, emphasize relationship-building skills, and tailor your resume to the specific job description.

What are the common challenges faced by Farm Mortgage Agents?

Fluctuating interest rates, changes in government policies, and economic downturns can impact the agricultural industry and present challenges for Farm Mortgage Agents.

What are the key trends shaping the Farm Mortgage Agent industry?

The increasing use of technology for loan processing, the growing emphasis on sustainable agriculture, and the rising demand for agricultural products are shaping the industry.