Are you a seasoned Field Examiner seeking a new career path? Discover our professionally built Field Examiner Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

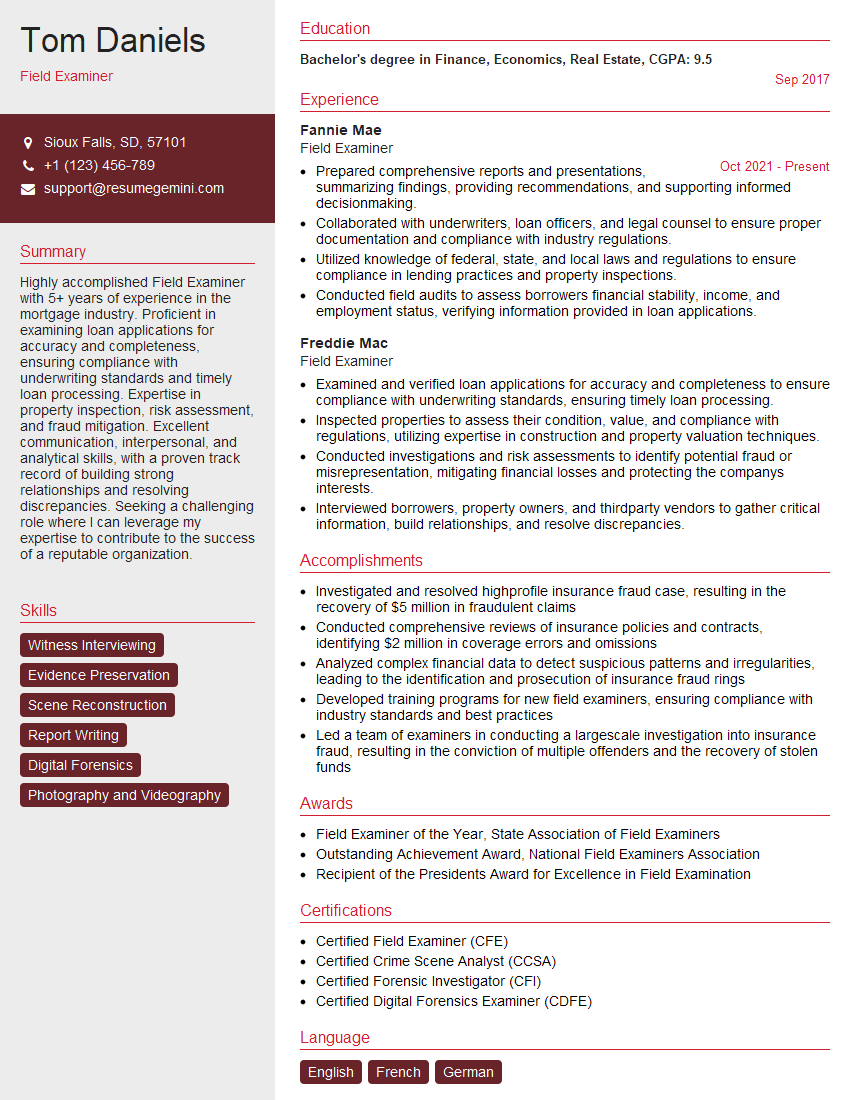

Tom Daniels

Field Examiner

Summary

Highly accomplished Field Examiner with 5+ years of experience in the mortgage industry. Proficient in examining loan applications for accuracy and completeness, ensuring compliance with underwriting standards and timely loan processing. Expertise in property inspection, risk assessment, and fraud mitigation. Excellent communication, interpersonal, and analytical skills, with a proven track record of building strong relationships and resolving discrepancies. Seeking a challenging role where I can leverage my expertise to contribute to the success of a reputable organization.

Education

Bachelor’s degree in Finance, Economics, Real Estate

September 2017

Skills

- Witness Interviewing

- Evidence Preservation

- Scene Reconstruction

- Report Writing

- Digital Forensics

- Photography and Videography

Work Experience

Field Examiner

- Prepared comprehensive reports and presentations, summarizing findings, providing recommendations, and supporting informed decisionmaking.

- Collaborated with underwriters, loan officers, and legal counsel to ensure proper documentation and compliance with industry regulations.

- Utilized knowledge of federal, state, and local laws and regulations to ensure compliance in lending practices and property inspections.

- Conducted field audits to assess borrowers financial stability, income, and employment status, verifying information provided in loan applications.

Field Examiner

- Examined and verified loan applications for accuracy and completeness to ensure compliance with underwriting standards, ensuring timely loan processing.

- Inspected properties to assess their condition, value, and compliance with regulations, utilizing expertise in construction and property valuation techniques.

- Conducted investigations and risk assessments to identify potential fraud or misrepresentation, mitigating financial losses and protecting the companys interests.

- Interviewed borrowers, property owners, and thirdparty vendors to gather critical information, build relationships, and resolve discrepancies.

Accomplishments

- Investigated and resolved highprofile insurance fraud case, resulting in the recovery of $5 million in fraudulent claims

- Conducted comprehensive reviews of insurance policies and contracts, identifying $2 million in coverage errors and omissions

- Analyzed complex financial data to detect suspicious patterns and irregularities, leading to the identification and prosecution of insurance fraud rings

- Developed training programs for new field examiners, ensuring compliance with industry standards and best practices

- Led a team of examiners in conducting a largescale investigation into insurance fraud, resulting in the conviction of multiple offenders and the recovery of stolen funds

Awards

- Field Examiner of the Year, State Association of Field Examiners

- Outstanding Achievement Award, National Field Examiners Association

- Recipient of the Presidents Award for Excellence in Field Examination

Certificates

- Certified Field Examiner (CFE)

- Certified Crime Scene Analyst (CCSA)

- Certified Forensic Investigator (CFI)

- Certified Digital Forensics Examiner (CDFE)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Field Examiner

Highlight your expertise:

Showcase your skills in loan examination, property inspection, and risk assessment, emphasizing your knowledge of underwriting standards and industry regulations.Quantify your accomplishments:

Use specific numbers and metrics to demonstrate the impact of your work, such as the number of loans processed, properties inspected, or cases resolved.Demonstrate your communication abilities:

Emphasize your strong communication and interpersonal skills, highlighting your ability to build rapport, resolve conflicts, and present findings effectively.Showcase your attention to detail:

Proofread your resume carefully to ensure that there are no errors, and use precise language to convey your experience and qualifications.Tailor your resume to each job:

Review the job description carefully and tailor your resume to match the specific requirements of the position you are applying for.

Essential Experience Highlights for a Strong Field Examiner Resume

- Examined and verified loan applications for accuracy and completeness to ensure compliance with underwriting standards, ensuring timely loan processing.

- Inspected properties to assess their condition, value, and compliance with regulations, utilizing expertise in construction and property valuation techniques.

- Conducted investigations and risk assessments to identify potential fraud or misrepresentation, mitigating financial losses and protecting the company’s interests.

- Interviewed borrowers, property owners, and third-party vendors to gather critical information, build relationships, and resolve discrepancies.

- Prepared comprehensive reports and presentations, summarizing findings, providing recommendations, and supporting informed decision-making.

- Collaborated with underwriters, loan officers, and legal counsel to ensure proper documentation and compliance with industry regulations.

- Utilized knowledge of federal, state, and local laws and regulations to ensure compliance in lending practices and property inspections.

- Conducted field audits to assess borrowers’ financial stability, income, and employment status, verifying information provided in loan applications.

Frequently Asked Questions (FAQ’s) For Field Examiner

What are the primary responsibilities of a Field Examiner?

Field Examiners are responsible for examining loan applications for accuracy and completeness, inspecting properties to assess their condition and value, conducting investigations and risk assessments to identify potential fraud or misrepresentation, interviewing borrowers and other parties to gather information, and preparing reports and presentations summarizing their findings and recommendations.

What qualifications are required to become a Field Examiner?

Most Field Examiners have a bachelor’s degree in finance, economics, real estate, or a related field, as well as experience in the mortgage industry. They should also have strong analytical, problem-solving, and communication skills.

What is the job outlook for Field Examiners?

The job outlook for Field Examiners is expected to be good in the coming years, as the demand for mortgage lending continues to grow. The median annual salary for Field Examiners is around $60,000, with the top 10% earning over $90,000.

What are the benefits of working as a Field Examiner?

Working as a Field Examiner offers several benefits, including the opportunity to work independently, develop strong analytical and problem-solving skills, and make a positive impact on the mortgage industry by ensuring that loans are processed fairly and accurately.

What are the challenges of working as a Field Examiner?

Some of the challenges of working as a Field Examiner include the need to work independently and manage your own time, the potential for travel, and the need to deal with complex financial and legal issues.

What are some tips for writing a standout Field Examiner resume?

To write a standout Field Examiner resume, focus on highlighting your skills and experience in loan examination, property inspection, and risk assessment, quantify your accomplishments, demonstrate your communication abilities, showcase your attention to detail, and tailor your resume to each job you apply for.

What are some of the common interview questions for Field Examiner positions?

Some of the common interview questions for Field Examiner positions include: Tell me about your experience in loan examination, property inspection, and risk assessment, what are your strengths and weaknesses as a Field Examiner, why are you interested in this position, and what are your salary expectations?