Are you a seasoned Financial Adviser seeking a new career path? Discover our professionally built Financial Adviser Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

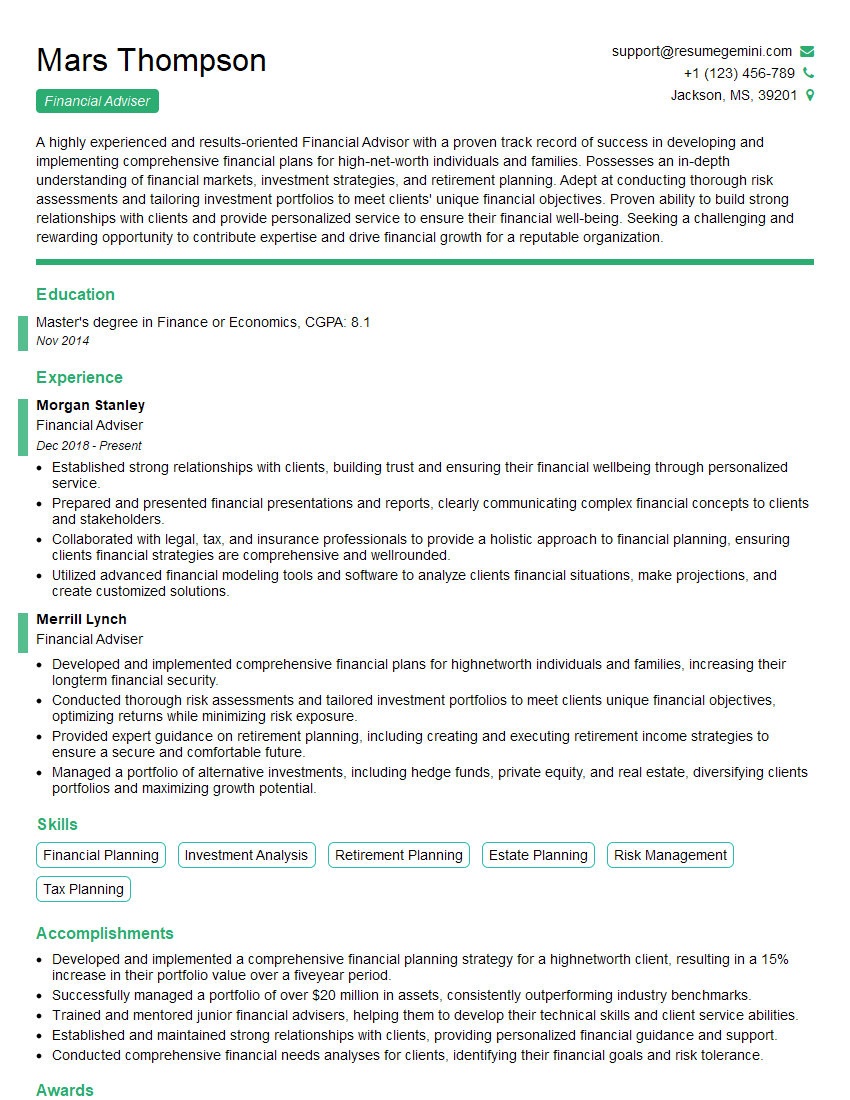

Mars Thompson

Financial Adviser

Summary

A highly experienced and results-oriented Financial Advisor with a proven track record of success in developing and implementing comprehensive financial plans for high-net-worth individuals and families. Possesses an in-depth understanding of financial markets, investment strategies, and retirement planning. Adept at conducting thorough risk assessments and tailoring investment portfolios to meet clients’ unique financial objectives. Proven ability to build strong relationships with clients and provide personalized service to ensure their financial well-being. Seeking a challenging and rewarding opportunity to contribute expertise and drive financial growth for a reputable organization.

Education

Master’s degree in Finance or Economics

November 2014

Skills

- Financial Planning

- Investment Analysis

- Retirement Planning

- Estate Planning

- Risk Management

- Tax Planning

Work Experience

Financial Adviser

- Established strong relationships with clients, building trust and ensuring their financial wellbeing through personalized service.

- Prepared and presented financial presentations and reports, clearly communicating complex financial concepts to clients and stakeholders.

- Collaborated with legal, tax, and insurance professionals to provide a holistic approach to financial planning, ensuring clients financial strategies are comprehensive and wellrounded.

- Utilized advanced financial modeling tools and software to analyze clients financial situations, make projections, and create customized solutions.

Financial Adviser

- Developed and implemented comprehensive financial plans for highnetworth individuals and families, increasing their longterm financial security.

- Conducted thorough risk assessments and tailored investment portfolios to meet clients unique financial objectives, optimizing returns while minimizing risk exposure.

- Provided expert guidance on retirement planning, including creating and executing retirement income strategies to ensure a secure and comfortable future.

- Managed a portfolio of alternative investments, including hedge funds, private equity, and real estate, diversifying clients portfolios and maximizing growth potential.

Accomplishments

- Developed and implemented a comprehensive financial planning strategy for a highnetworth client, resulting in a 15% increase in their portfolio value over a fiveyear period.

- Successfully managed a portfolio of over $20 million in assets, consistently outperforming industry benchmarks.

- Trained and mentored junior financial advisers, helping them to develop their technical skills and client service abilities.

- Established and maintained strong relationships with clients, providing personalized financial guidance and support.

- Conducted comprehensive financial needs analyses for clients, identifying their financial goals and risk tolerance.

Awards

- Awarded the Presidents Club Award for exceeding sales targets by 25%.

- Received the Financial Adviser of the Year Award from the local chapter of the National Association of Insurance and Financial Advisors (NAIFA).

- Recognized as a Five Star Wealth Manager by Forbes magazine.

- Certified Financial Planner (CFP) designation

Certificates

- CERTIFIED FINANCIAL PLANNER™ (CFP®)

- Chartered Financial Consultant (ChFC®)

- Personal Financial Specialist (PFS)

- Certified Investment Management Analyst (CIMA®)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Financial Adviser

- Highlight your financial planning expertise and track record of success in managing high-net-worth portfolios.

- Quantify your accomplishments with specific metrics, such as the percentage increase in client assets under management or the number of successful financial plans implemented.

- Showcase your ability to build strong client relationships and provide personalized service.

- Emphasize your knowledge of financial markets, investment strategies, and retirement planning.

- Demonstrate your commitment to professional development and continuing education in the financial industry.

Essential Experience Highlights for a Strong Financial Adviser Resume

- Develop and implement comprehensive financial plans for high-net-worth individuals and families, encompassing investment strategies, retirement planning, estate planning, risk management, and tax planning.

- Conduct thorough risk assessments and tailor investment portfolios to meet clients’ unique financial objectives, optimizing returns while minimizing risk exposure.

- Provide expert guidance on retirement planning, including creating and executing retirement income strategies to ensure a secure and comfortable future.

- Manage a portfolio of alternative investments, including hedge funds, private equity, and real estate, diversifying clients’ portfolios and maximizing growth potential.

- Establish strong relationships with clients, building trust and ensuring their financial wellbeing through personalized service.

- Prepare and present financial presentations and reports, clearly communicating complex financial concepts to clients and stakeholders.

- Collaborate with legal, tax, and insurance professionals to provide a holistic approach to financial planning, ensuring clients’ financial strategies are comprehensive and well-rounded.

Frequently Asked Questions (FAQ’s) For Financial Adviser

What is the primary role of a Financial Advisor?

A Financial Advisor provides personalized financial advice and guidance to individuals and families, helping them achieve their financial goals. They assess clients’ financial situations, develop comprehensive financial plans, and recommend investment strategies to meet specific needs and objectives.

What qualifications are required to become a Financial Advisor?

Typically, a bachelor’s or master’s degree in finance, economics, or a related field is required. Additionally, many Financial Advisors obtain industry certifications, such as the Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA) designation, to enhance their credibility and knowledge.

What are the key skills and qualities of a successful Financial Advisor?

Successful Financial Advisors possess strong analytical and problem-solving skills, as well as excellent communication and interpersonal abilities. They are ethical, trustworthy, and committed to acting in the best interests of their clients.

What are the typical responsibilities of a Financial Advisor?

Financial Advisors typically develop financial plans, conduct risk assessments, recommend investment strategies, manage client portfolios, and provide ongoing financial advice and support.

What is the earning potential for a Financial Advisor?

The earning potential for Financial Advisors varies depending on experience, qualifications, and the size and location of the firm. According to the U.S. Bureau of Labor Statistics, the median annual salary for Financial Advisors was $94,180 in May 2021.

What are the career advancement opportunities for Financial Advisors?

With experience and success, Financial Advisors can advance to senior-level positions, such as Wealth Manager or Portfolio Manager. They may also choose to specialize in a particular area of financial planning, such as retirement planning or estate planning.

What is the job outlook for Financial Advisors?

The job outlook for Financial Advisors is expected to grow faster than average over the next decade, due to the increasing demand for financial planning services from aging baby boomers and millennials.