Are you a seasoned Financial Agent seeking a new career path? Discover our professionally built Financial Agent Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

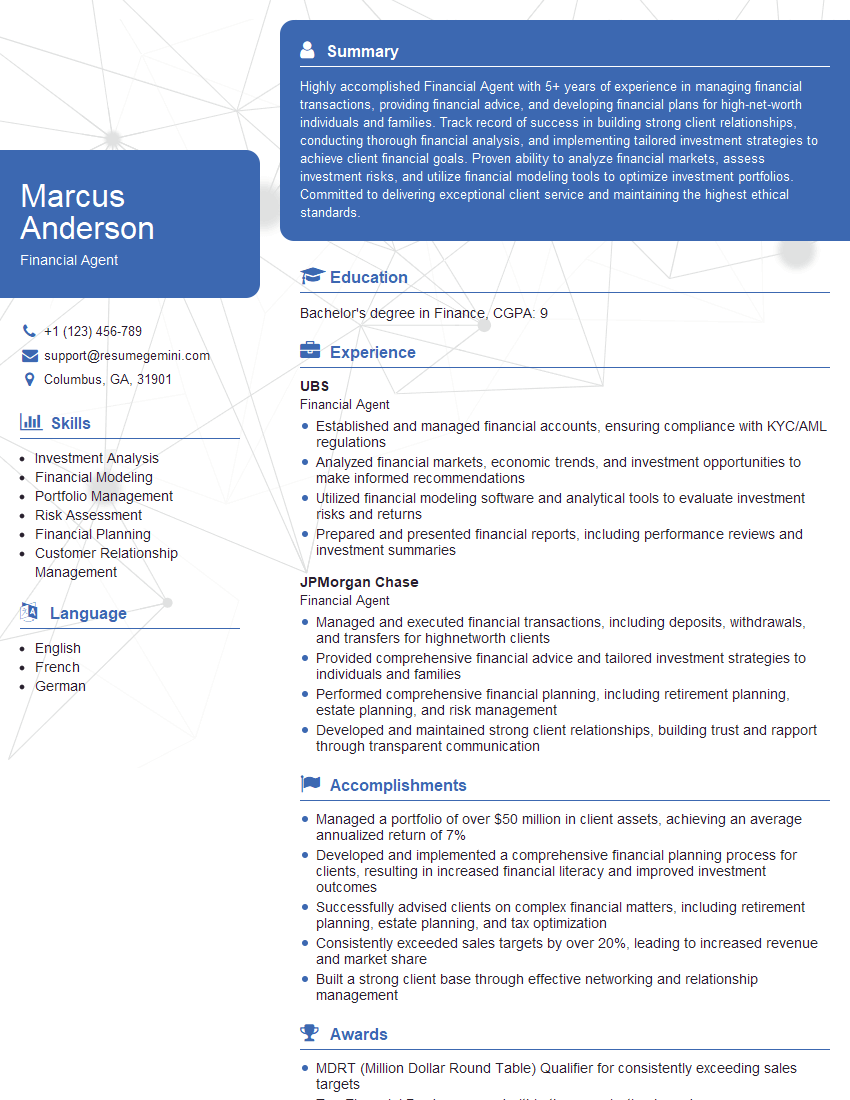

Marcus Anderson

Financial Agent

Summary

Highly accomplished Financial Agent with 5+ years of experience in managing financial transactions, providing financial advice, and developing financial plans for high-net-worth individuals and families. Track record of success in building strong client relationships, conducting thorough financial analysis, and implementing tailored investment strategies to achieve client financial goals. Proven ability to analyze financial markets, assess investment risks, and utilize financial modeling tools to optimize investment portfolios. Committed to delivering exceptional client service and maintaining the highest ethical standards.

Education

Bachelor’s degree in Finance

August 2017

Skills

- Investment Analysis

- Financial Modeling

- Portfolio Management

- Risk Assessment

- Financial Planning

- Customer Relationship Management

Work Experience

Financial Agent

- Established and managed financial accounts, ensuring compliance with KYC/AML regulations

- Analyzed financial markets, economic trends, and investment opportunities to make informed recommendations

- Utilized financial modeling software and analytical tools to evaluate investment risks and returns

- Prepared and presented financial reports, including performance reviews and investment summaries

Financial Agent

- Managed and executed financial transactions, including deposits, withdrawals, and transfers for highnetworth clients

- Provided comprehensive financial advice and tailored investment strategies to individuals and families

- Performed comprehensive financial planning, including retirement planning, estate planning, and risk management

- Developed and maintained strong client relationships, building trust and rapport through transparent communication

Accomplishments

- Managed a portfolio of over $50 million in client assets, achieving an average annualized return of 7%

- Developed and implemented a comprehensive financial planning process for clients, resulting in increased financial literacy and improved investment outcomes

- Successfully advised clients on complex financial matters, including retirement planning, estate planning, and tax optimization

- Consistently exceeded sales targets by over 20%, leading to increased revenue and market share

- Built a strong client base through effective networking and relationship management

Awards

- MDRT (Million Dollar Round Table) Qualifier for consistently exceeding sales targets

- Top Financial Producer award within the organization based on revenue generated

- Recognized for exceptional client service and high customer satisfaction ratings

- Certified Financial Planner (CFP) designation, demonstrating adherence to ethical standards and commitment to professional development

Certificates

- Certified Financial Planner (CFP)

- Chartered Financial Analyst (CFA)

- Financial Industry Regulatory Authority (FINRA) Series 7

- Certified Private Wealth Advisor (CPWA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Financial Agent

- Showcase your analytical skills and experience in financial modeling and investment analysis.

- Highlight your ability to build strong client relationships and provide personalized financial advice.

- Quantify your accomplishments and provide specific examples of how you have helped clients achieve their financial goals.

- Demonstrate your knowledge of financial regulations and compliance requirements.

- Proofread your resume carefully for any errors in grammar, spelling, or punctuation.

Essential Experience Highlights for a Strong Financial Agent Resume

- Managed financial transactions, including deposits, withdrawals, and transfers, for high-net-worth clients, ensuring accuracy and compliance with regulatory guidelines

- Provided comprehensive financial advice and tailored investment strategies to individuals and families, considering their unique financial goals, risk tolerance, and investment objectives

- Performed comprehensive financial planning, including retirement planning, estate planning, and risk management, to help clients achieve long-term financial security

- Developed and maintained strong client relationships, building trust and rapport through transparent communication and proactive service

- Established and managed financial accounts, ensuring compliance with KYC/AML regulations and maintaining accurate and up-to-date client information

- Analyzed financial markets, economic trends, and investment opportunities to make informed recommendations and identify potential growth opportunities

- Utilized financial modeling software and analytical tools to evaluate investment risks and returns, and optimize investment portfolios for clients

Frequently Asked Questions (FAQ’s) For Financial Agent

What is the role of a Financial Agent?

A Financial Agent provides comprehensive financial services to individuals and families, including financial advice, investment management, and financial planning. They help clients achieve their financial goals by developing tailored strategies and managing their financial affairs.

What are the key skills required for a Financial Agent?

Financial Agents should possess strong analytical skills, knowledge of financial markets and investment strategies, and exceptional communication and interpersonal skills. They should also be proficient in financial modeling and software tools.

What is the career path for a Financial Agent?

Financial Agents can progress to senior roles within financial institutions, such as Portfolio Manager, Wealth Manager, or Financial Advisor. They can also start their own financial advisory firms or specialize in areas such as retirement planning or estate planning.

What is the average salary for a Financial Agent?

The average salary for Financial Agents varies depending on experience, location, and the size of the firm. According to the U.S. Bureau of Labor Statistics, the median annual salary for Financial Advisors in May 2021 was $93,280.

Is a Financial Agent the same as a Financial Advisor?

Financial Agent and Financial Advisor are often used interchangeably, and both roles involve providing financial advice and managing client investments. However, Financial Advisors may have a broader scope of practice and offer additional services, such as tax planning and insurance advice.

How do I become a Financial Agent?

To become a Financial Agent, you typically need a bachelor’s degree in finance or a related field, and pass the Series 7 and 66 exams administered by the Financial Industry Regulatory Authority (FINRA).

What is the job outlook for Financial Agents?

The job outlook for Financial Agents is expected to be positive over the next ten years, driven by the increasing demand for financial advice and investment management services from individuals and families.