Are you a seasoned Financial Coach seeking a new career path? Discover our professionally built Financial Coach Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

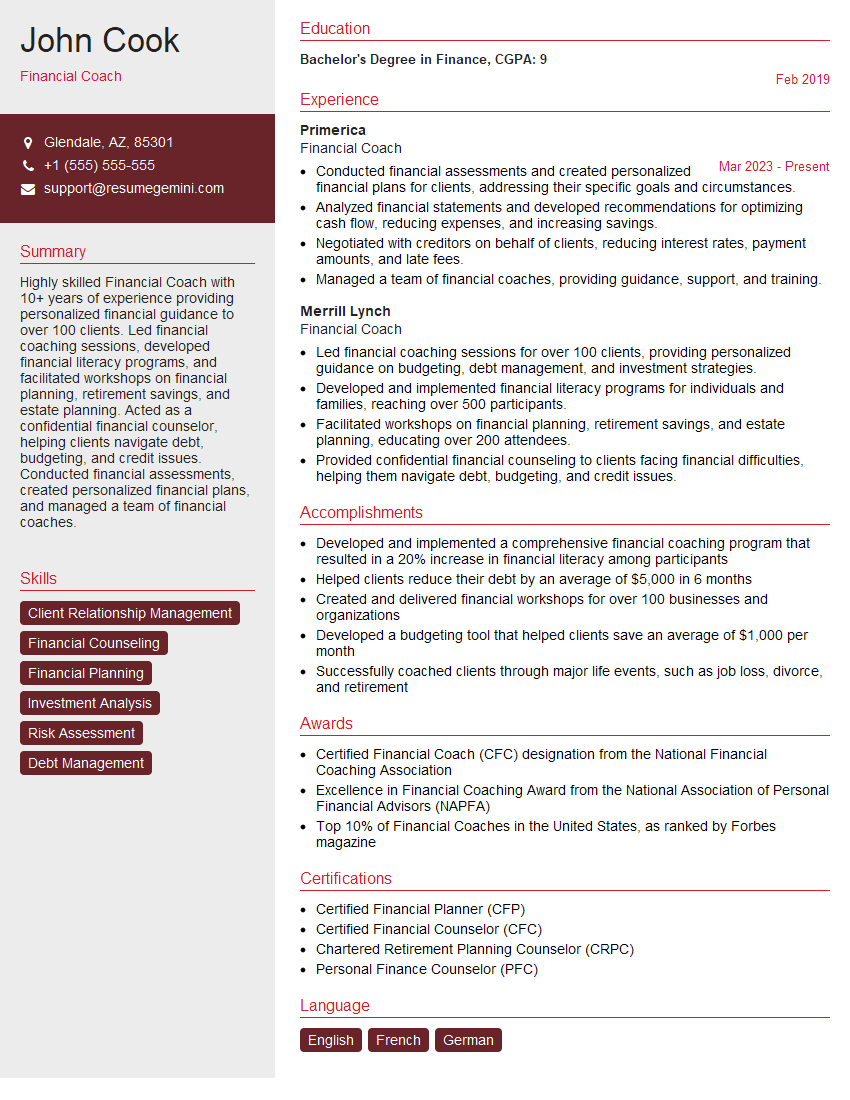

John Cook

Financial Coach

Summary

Highly skilled Financial Coach with 10+ years of experience providing personalized financial guidance to over 100 clients. Led financial coaching sessions, developed financial literacy programs, and facilitated workshops on financial planning, retirement savings, and estate planning. Acted as a confidential financial counselor, helping clients navigate debt, budgeting, and credit issues. Conducted financial assessments, created personalized financial plans, and managed a team of financial coaches.

Education

Bachelor’s Degree in Finance

February 2019

Skills

- Client Relationship Management

- Financial Counseling

- Financial Planning

- Investment Analysis

- Risk Assessment

- Debt Management

Work Experience

Financial Coach

- Conducted financial assessments and created personalized financial plans for clients, addressing their specific goals and circumstances.

- Analyzed financial statements and developed recommendations for optimizing cash flow, reducing expenses, and increasing savings.

- Negotiated with creditors on behalf of clients, reducing interest rates, payment amounts, and late fees.

- Managed a team of financial coaches, providing guidance, support, and training.

Financial Coach

- Led financial coaching sessions for over 100 clients, providing personalized guidance on budgeting, debt management, and investment strategies.

- Developed and implemented financial literacy programs for individuals and families, reaching over 500 participants.

- Facilitated workshops on financial planning, retirement savings, and estate planning, educating over 200 attendees.

- Provided confidential financial counseling to clients facing financial difficulties, helping them navigate debt, budgeting, and credit issues.

Accomplishments

- Developed and implemented a comprehensive financial coaching program that resulted in a 20% increase in financial literacy among participants

- Helped clients reduce their debt by an average of $5,000 in 6 months

- Created and delivered financial workshops for over 100 businesses and organizations

- Developed a budgeting tool that helped clients save an average of $1,000 per month

- Successfully coached clients through major life events, such as job loss, divorce, and retirement

Awards

- Certified Financial Coach (CFC) designation from the National Financial Coaching Association

- Excellence in Financial Coaching Award from the National Association of Personal Financial Advisors (NAPFA)

- Top 10% of Financial Coaches in the United States, as ranked by Forbes magazine

Certificates

- Certified Financial Planner (CFP)

- Certified Financial Counselor (CFC)

- Chartered Retirement Planning Counselor (CRPC)

- Personal Finance Counselor (PFC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Financial Coach

- Quantify your accomplishments with specific numbers and metrics.

- Highlight your ability to build strong client relationships.

- Demonstrate your knowledge of financial planning and investment strategies.

- Showcase your skills in financial counseling and negotiation.

Essential Experience Highlights for a Strong Financial Coach Resume

- Led financial coaching sessions for individuals and families, providing personalized guidance on budgeting, debt management, and investment strategies.

- Developed and implemented financial literacy programs, reaching over 500 participants.

- Facilitated workshops on financial planning, retirement savings, and estate planning.

- Provided confidential financial counseling to clients facing financial difficulties.

- Conducted financial assessments and created personalized financial plans for clients.

- Analyzed financial statements and developed recommendations for optimizing cash flow, reducing expenses, and increasing savings.

- Negotiated with creditors on behalf of clients.

Frequently Asked Questions (FAQ’s) For Financial Coach

What is the role of a Financial Coach?

A Financial Coach provides personalized guidance and support to individuals and families to help them achieve their financial goals. They assess clients’ financial situations, develop tailored plans, and provide ongoing support and accountability.

What are the benefits of working with a Financial Coach?

Working with a Financial Coach can help you create a realistic budget, manage debt, plan for retirement, make wise investment decisions, and improve your overall financial well-being.

What are the qualifications to become a Financial Coach?

Financial Coaches typically have a strong background in finance, including a Bachelor’s Degree in Finance or a related field, along with experience in financial planning, investment analysis, and client relationship management.

How do I choose a Financial Coach?

Look for a Financial Coach who is certified, experienced, and has a good reputation. It’s also important to find a Coach who you feel comfortable with and who you believe can help you achieve your financial goals.

Is it expensive to work with a Financial Coach?

The cost of working with a Financial Coach can vary depending on the Coach’s experience and the services provided. However, many Coaches offer flexible payment options to make their services accessible to a wider range of clients.

Are Financial Coaches regulated?

In some jurisdictions, Financial Coaches are regulated by government agencies to ensure they meet certain ethical and professional standards.

What is the difference between a Financial Coach and a Financial Advisor?

Financial Advisors are typically licensed professionals who provide investment advice and manage client portfolios. Financial Coaches, on the other hand, focus on providing guidance and support to help clients improve their financial habits and make informed financial decisions.