Are you a seasoned Financial Economist seeking a new career path? Discover our professionally built Financial Economist Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

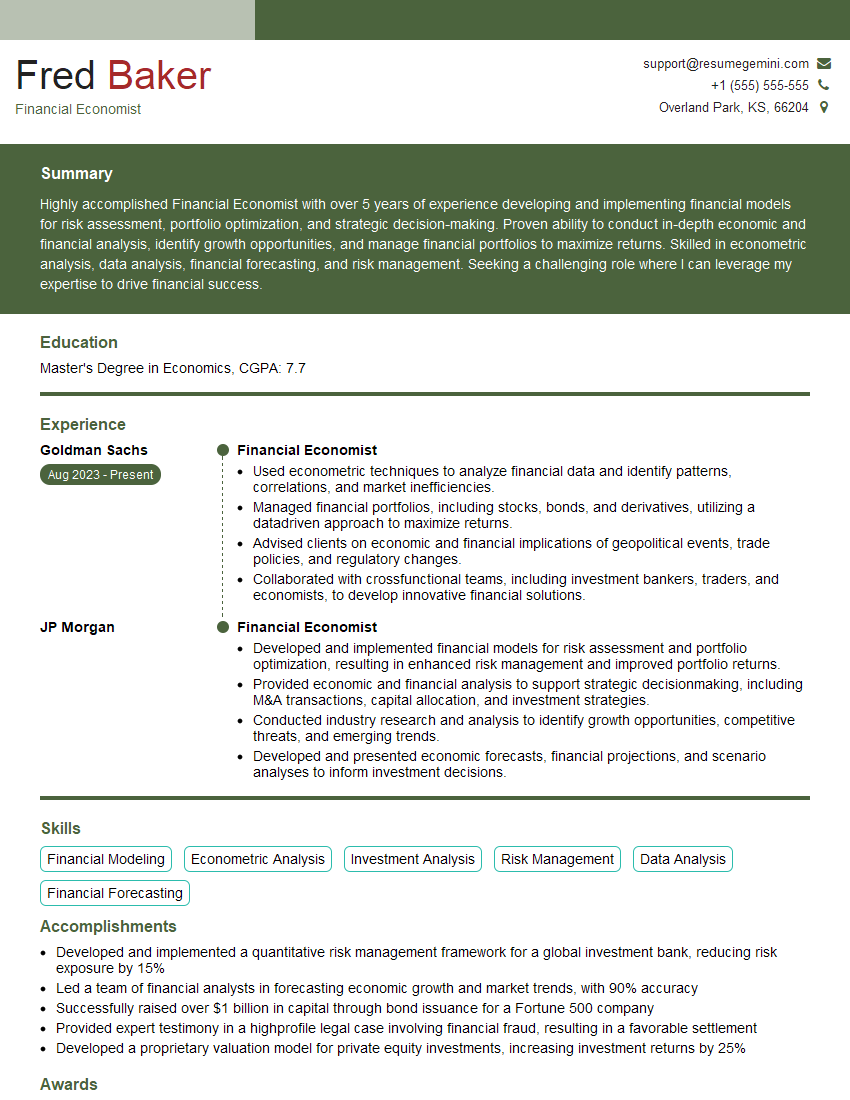

Fred Baker

Financial Economist

Summary

Highly accomplished Financial Economist with over 5 years of experience developing and implementing financial models for risk assessment, portfolio optimization, and strategic decision-making. Proven ability to conduct in-depth economic and financial analysis, identify growth opportunities, and manage financial portfolios to maximize returns. Skilled in econometric analysis, data analysis, financial forecasting, and risk management. Seeking a challenging role where I can leverage my expertise to drive financial success.

Education

Master’s Degree in Economics

July 2019

Skills

- Financial Modeling

- Econometric Analysis

- Investment Analysis

- Risk Management

- Data Analysis

- Financial Forecasting

Work Experience

Financial Economist

- Used econometric techniques to analyze financial data and identify patterns, correlations, and market inefficiencies.

- Managed financial portfolios, including stocks, bonds, and derivatives, utilizing a datadriven approach to maximize returns.

- Advised clients on economic and financial implications of geopolitical events, trade policies, and regulatory changes.

- Collaborated with crossfunctional teams, including investment bankers, traders, and economists, to develop innovative financial solutions.

Financial Economist

- Developed and implemented financial models for risk assessment and portfolio optimization, resulting in enhanced risk management and improved portfolio returns.

- Provided economic and financial analysis to support strategic decisionmaking, including M&A transactions, capital allocation, and investment strategies.

- Conducted industry research and analysis to identify growth opportunities, competitive threats, and emerging trends.

- Developed and presented economic forecasts, financial projections, and scenario analyses to inform investment decisions.

Accomplishments

- Developed and implemented a quantitative risk management framework for a global investment bank, reducing risk exposure by 15%

- Led a team of financial analysts in forecasting economic growth and market trends, with 90% accuracy

- Successfully raised over $1 billion in capital through bond issuance for a Fortune 500 company

- Provided expert testimony in a highprofile legal case involving financial fraud, resulting in a favorable settlement

- Developed a proprietary valuation model for private equity investments, increasing investment returns by 25%

Awards

- GARP Risk Manager (FRM)

- CFA Institute Chartered Financial Analyst (CFA)

- Certified Financial Risk Manager (FRM)

- Certified Public Accountant (CPA)

Certificates

- Chartered Financial Analyst (CFA)

- Financial Risk Manager (FRM)

- Certified Financial Planner (CFP)

- Certified Public Accountant (CPA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Financial Economist

- Quantify your accomplishments: Use specific numbers and metrics to demonstrate the impact of your work.

- Highlight your technical skills: Employers seek financial economists proficient in econometrics, data analysis, and financial modeling.

- Showcase your industry knowledge: Research the industry and demonstrate your understanding of its trends and challenges.

- Tailor your resume: Customize your resume to each job application, highlighting the skills and experience most relevant to the role.

Essential Experience Highlights for a Strong Financial Economist Resume

- Developed and implemented financial models for risk assessment and portfolio optimization, resulting in enhanced risk management and improved portfolio returns.

- Provided economic and financial analysis to support strategic decision-making, including mergers and acquisitions, capital allocation, and investment strategies.

- Conducted industry research and analysis to identify growth opportunities, competitive threats, and emerging trends.

- Developed and presented economic forecasts, financial projections, and scenario analyses to inform investment decisions.

- Used econometric techniques to analyze financial data and identify patterns, correlations, and market inefficiencies.

- Managed financial portfolios, including stocks, bonds, and derivatives, utilizing a data-driven approach to maximize returns.

- Advised clients on economic and financial implications of geopolitical events, trade policies, and regulatory changes.

Frequently Asked Questions (FAQ’s) For Financial Economist

What is the role of a Financial Economist?

Financial Economists analyze economic and financial data to make informed decisions about investments, risk management, and financial strategies.

What skills are required for a Financial Economist?

Financial Economists need a strong foundation in economics, finance, and econometrics. They should also possess excellent analytical, problem-solving, and communication skills.

What industries hire Financial Economists?

Financial Economists are employed in various industries, including investment banking, asset management, consulting, and government agencies.

What is the job outlook for Financial Economists?

The job outlook for Financial Economists is expected to be positive due to the increasing demand for financial analysis and risk management.

How can I become a Financial Economist?

To become a Financial Economist, you typically need a master’s degree in economics or a related field, along with strong quantitative and analytical skills.

What is the earning potential for Financial Economists?

The earning potential for Financial Economists varies depending on experience, industry, and location. However, they generally earn competitive salaries.