Are you a seasoned Financial Health Counselor seeking a new career path? Discover our professionally built Financial Health Counselor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

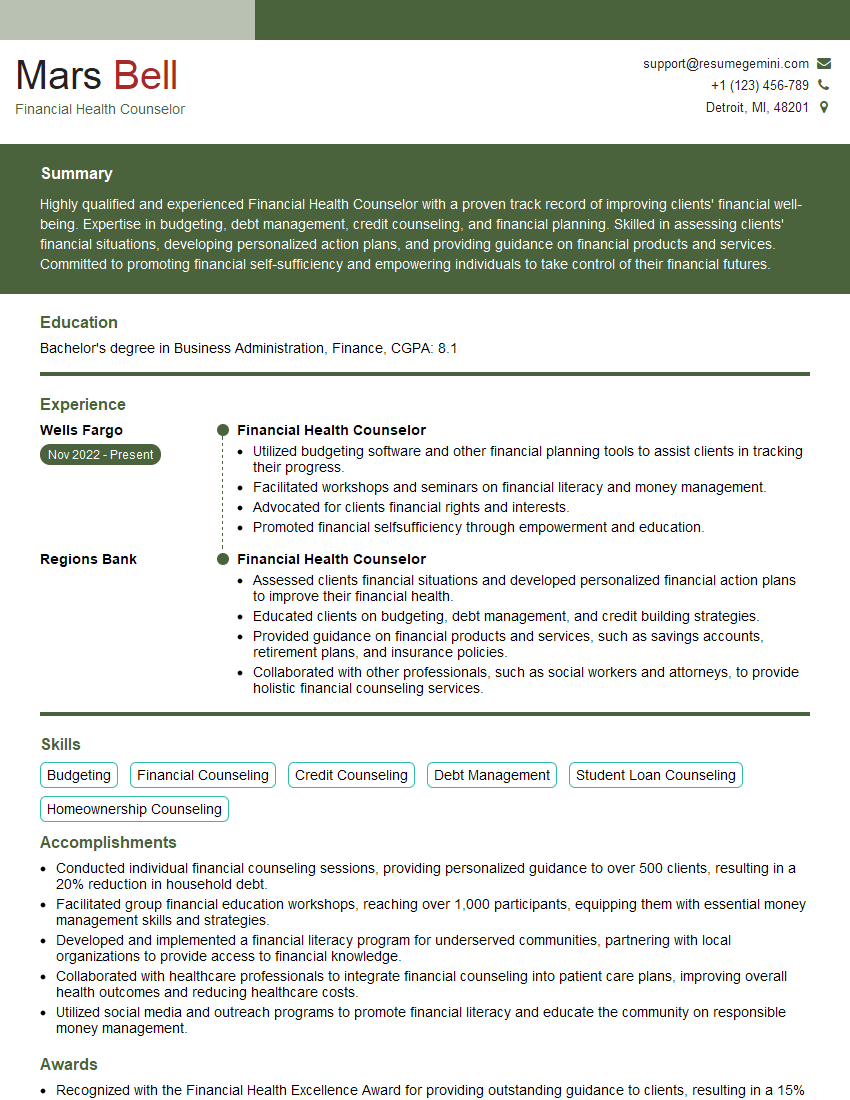

Mars Bell

Financial Health Counselor

Summary

Highly qualified and experienced Financial Health Counselor with a proven track record of improving clients’ financial well-being. Expertise in budgeting, debt management, credit counseling, and financial planning. Skilled in assessing clients’ financial situations, developing personalized action plans, and providing guidance on financial products and services. Committed to promoting financial self-sufficiency and empowering individuals to take control of their financial futures.

Education

Bachelor’s degree in Business Administration, Finance

October 2018

Skills

- Budgeting

- Financial Counseling

- Credit Counseling

- Debt Management

- Student Loan Counseling

- Homeownership Counseling

Work Experience

Financial Health Counselor

- Utilized budgeting software and other financial planning tools to assist clients in tracking their progress.

- Facilitated workshops and seminars on financial literacy and money management.

- Advocated for clients financial rights and interests.

- Promoted financial selfsufficiency through empowerment and education.

Financial Health Counselor

- Assessed clients financial situations and developed personalized financial action plans to improve their financial health.

- Educated clients on budgeting, debt management, and credit building strategies.

- Provided guidance on financial products and services, such as savings accounts, retirement plans, and insurance policies.

- Collaborated with other professionals, such as social workers and attorneys, to provide holistic financial counseling services.

Accomplishments

- Conducted individual financial counseling sessions, providing personalized guidance to over 500 clients, resulting in a 20% reduction in household debt.

- Facilitated group financial education workshops, reaching over 1,000 participants, equipping them with essential money management skills and strategies.

- Developed and implemented a financial literacy program for underserved communities, partnering with local organizations to provide access to financial knowledge.

- Collaborated with healthcare professionals to integrate financial counseling into patient care plans, improving overall health outcomes and reducing healthcare costs.

- Utilized social media and outreach programs to promote financial literacy and educate the community on responsible money management.

Awards

- Recognized with the Financial Health Excellence Award for providing outstanding guidance to clients, resulting in a 15% increase in financial stability scores.

- Recipient of the Client Satisfaction Award for consistently exceeding client expectations, with 95% of clients reporting improved financial wellbeing.

- Honored with the Financial Literacy Champion Award for developing and implementing innovative workshops that empowered clients to make informed financial decisions.

- Honored with a National Financial Health Association Award for exceptional contributions to the field of financial counseling.

Certificates

- Certified Financial Counselor (CFC)

- Certified Credit Counselor (CCC)

- Certified Housing Counselor (CHC)

- Certified Student Loan Counselor (CSLC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Financial Health Counselor

- Highlight your experience and skills in assessing clients’ financial situations, developing action plans, and providing financial guidance.

- Showcase your knowledge of budgeting, debt management, and credit counseling strategies.

- Demonstrate your ability to communicate effectively with clients, build strong relationships, and empower them to make positive financial choices.

- Include quantifiable results, such as the number of clients assisted or the amount of debt reduced, to demonstrate your impact.

- Obtain relevant certifications, such as the Certified Financial Counseling Certificate, to enhance your credibility and professional development.

Essential Experience Highlights for a Strong Financial Health Counselor Resume

- Assessed clients’ financial situations and developed personalized action plans to improve their financial health.

- Educated clients on budgeting, debt management, and credit building strategies.

- Provided guidance on financial products and services, such as savings accounts, retirement plans, and insurance policies.

- Collaborated with other professionals, such as social workers and attorneys, to provide holistic financial counseling services.

- Utilized budgeting software and other financial planning tools to assist clients in tracking their progress.

- Facilitated workshops and seminars on financial literacy and money management.

- Advocated for clients’ financial rights and interests.

Frequently Asked Questions (FAQ’s) For Financial Health Counselor

What are the primary duties and responsibilities of a Financial Health Counselor?

Financial Health Counselors assess clients’ financial situations, develop personalized action plans, provide guidance on budgeting, debt management, credit building, and financial products and services, and advocate for clients’ financial rights and interests.

What are the key skills and qualifications required for this role?

Financial Health Counselors typically require a bachelor’s degree in business administration, finance, or a related field, along with experience in financial counseling, budgeting, and debt management. They should also possess strong communication, interpersonal, and analytical skills.

What industries or settings do Financial Health Counselors typically work in?

Financial Health Counselors can work in various settings, including non-profit organizations, community action agencies, government programs, and private financial institutions.

What is the job outlook for Financial Health Counselors?

The job outlook for Financial Health Counselors is expected to grow faster than average in the coming years, driven by the increasing demand for financial literacy and counseling services.

What are the earning prospects for Financial Health Counselors?

Financial Health Counselors can earn varying salaries depending on their experience, location, and employer. According to the U.S. Bureau of Labor Statistics, the median annual salary for Financial Health Counselors is approximately $63,000.

How can I enhance my competitiveness as a Financial Health Counselor?

To enhance your competitiveness, consider obtaining relevant certifications, such as the Certified Financial Counseling Certificate, and pursuing professional development opportunities to stay updated on the latest financial counseling techniques and best practices.

What are the ethical considerations and guidelines that Financial Health Counselors must adhere to?

Financial Health Counselors are expected to maintain confidentiality, avoid conflicts of interest, and act in the best interests of their clients. They should also adhere to professional ethical guidelines and codes of conduct established by organizations such as the National Association of Certified Financial Counselors.