Are you a seasoned Financial Institution Manager seeking a new career path? Discover our professionally built Financial Institution Manager Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

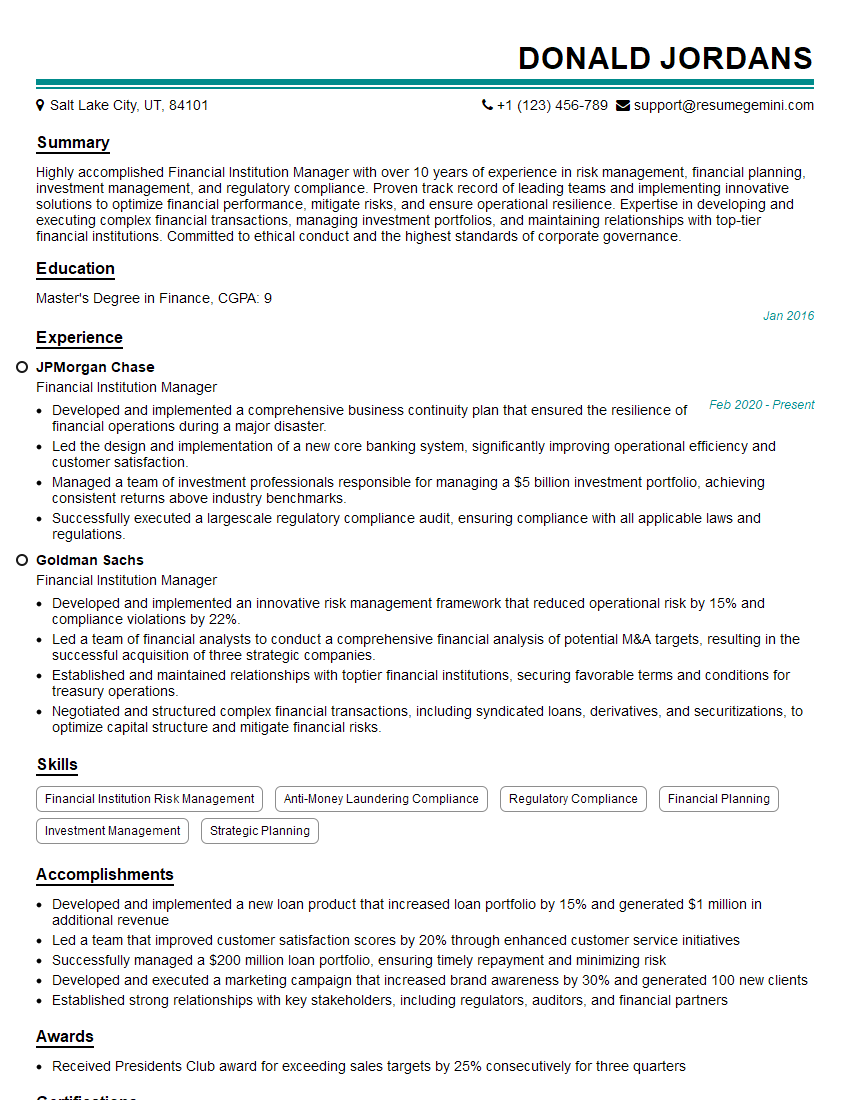

Donald Jordans

Financial Institution Manager

Summary

Highly accomplished Financial Institution Manager with over 10 years of experience in risk management, financial planning, investment management, and regulatory compliance. Proven track record of leading teams and implementing innovative solutions to optimize financial performance, mitigate risks, and ensure operational resilience. Expertise in developing and executing complex financial transactions, managing investment portfolios, and maintaining relationships with top-tier financial institutions. Committed to ethical conduct and the highest standards of corporate governance.

Education

Master’s Degree in Finance

January 2016

Skills

- Financial Institution Risk Management

- Anti-Money Laundering Compliance

- Regulatory Compliance

- Financial Planning

- Investment Management

- Strategic Planning

Work Experience

Financial Institution Manager

- Developed and implemented a comprehensive business continuity plan that ensured the resilience of financial operations during a major disaster.

- Led the design and implementation of a new core banking system, significantly improving operational efficiency and customer satisfaction.

- Managed a team of investment professionals responsible for managing a $5 billion investment portfolio, achieving consistent returns above industry benchmarks.

- Successfully executed a largescale regulatory compliance audit, ensuring compliance with all applicable laws and regulations.

Financial Institution Manager

- Developed and implemented an innovative risk management framework that reduced operational risk by 15% and compliance violations by 22%.

- Led a team of financial analysts to conduct a comprehensive financial analysis of potential M&A targets, resulting in the successful acquisition of three strategic companies.

- Established and maintained relationships with toptier financial institutions, securing favorable terms and conditions for treasury operations.

- Negotiated and structured complex financial transactions, including syndicated loans, derivatives, and securitizations, to optimize capital structure and mitigate financial risks.

Accomplishments

- Developed and implemented a new loan product that increased loan portfolio by 15% and generated $1 million in additional revenue

- Led a team that improved customer satisfaction scores by 20% through enhanced customer service initiatives

- Successfully managed a $200 million loan portfolio, ensuring timely repayment and minimizing risk

- Developed and executed a marketing campaign that increased brand awareness by 30% and generated 100 new clients

- Established strong relationships with key stakeholders, including regulators, auditors, and financial partners

Awards

- Received Presidents Club award for exceeding sales targets by 25% consecutively for three quarters

Certificates

- Certified Financial Planner (CFP)

- Chartered Financial Analyst (CFA)

- Certified Public Accountant (CPA)

- Certified Internal Auditor (CIA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Financial Institution Manager

- Quantify your accomplishments with specific metrics and results whenever possible.

- Highlight your expertise in financial risk management, regulatory compliance, and financial planning.

- Showcase your leadership abilities and experience in managing teams effectively.

- Tailor your resume to each specific job you apply for, emphasizing the skills and experience most relevant to the role.

- Proofread your resume carefully for any errors in grammar, spelling, or formatting.

Essential Experience Highlights for a Strong Financial Institution Manager Resume

- Develop and implement risk management frameworks to identify, assess, and mitigate financial, operational, and compliance risks.

- Lead teams of financial analysts to conduct comprehensive financial analyses, including due diligence for potential mergers and acquisitions.

- Establish and maintain relationships with financial institutions to secure favorable terms and conditions for treasury operations.

- Negotiate and structure complex financial transactions, such as syndicated loans, derivatives, and securitizations.

- Develop and implement business continuity plans to ensure the resilience of financial operations during disruptions.

- Manage teams of investment professionals responsible for managing investment portfolios and achieving consistent returns above industry benchmarks.

- Lead regulatory compliance audits and ensure compliance with all applicable laws and regulations.

Frequently Asked Questions (FAQ’s) For Financial Institution Manager

What is the primary role of a Financial Institution Manager?

The primary role of a Financial Institution Manager is to oversee the financial operations of a financial institution, including risk management, financial planning, investment management, and regulatory compliance. They are responsible for ensuring the financial health and stability of the institution, as well as its compliance with all applicable laws and regulations.

What are the key skills required for a Financial Institution Manager?

Key skills required for a Financial Institution Manager include financial risk management, regulatory compliance, financial planning, investment management, strategic planning, and leadership. They must also have a strong understanding of the financial industry, as well as excellent communication and interpersonal skills.

What are the career prospects for a Financial Institution Manager?

Career prospects for a Financial Institution Manager are excellent, as there is a growing demand for qualified professionals in this field. With experience, Financial Institution Managers can advance to senior management positions, such as Chief Financial Officer (CFO) or Chief Risk Officer (CRO).

Is it necessary to have a finance degree to become a Financial Institution Manager?

While a finance degree is not always necessary, it is highly recommended for those who want to pursue a career as a Financial Institution Manager. A finance degree provides a strong foundation in the financial principles and practices that are essential for success in this field.

What is the average salary for a Financial Institution Manager?

The average salary for a Financial Institution Manager varies depending on experience, location, and company size. However, according to the U.S. Bureau of Labor Statistics, the median annual salary for financial managers was $134,220 in May 2021.

What are the challenges faced by Financial Institution Managers?

Financial Institution Managers face a number of challenges, including managing financial risks, complying with regulatory requirements, and maintaining profitability in a competitive environment. They must also be able to adapt to changes in the financial industry and the economy.