Are you a seasoned Financial Representative seeking a new career path? Discover our professionally built Financial Representative Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

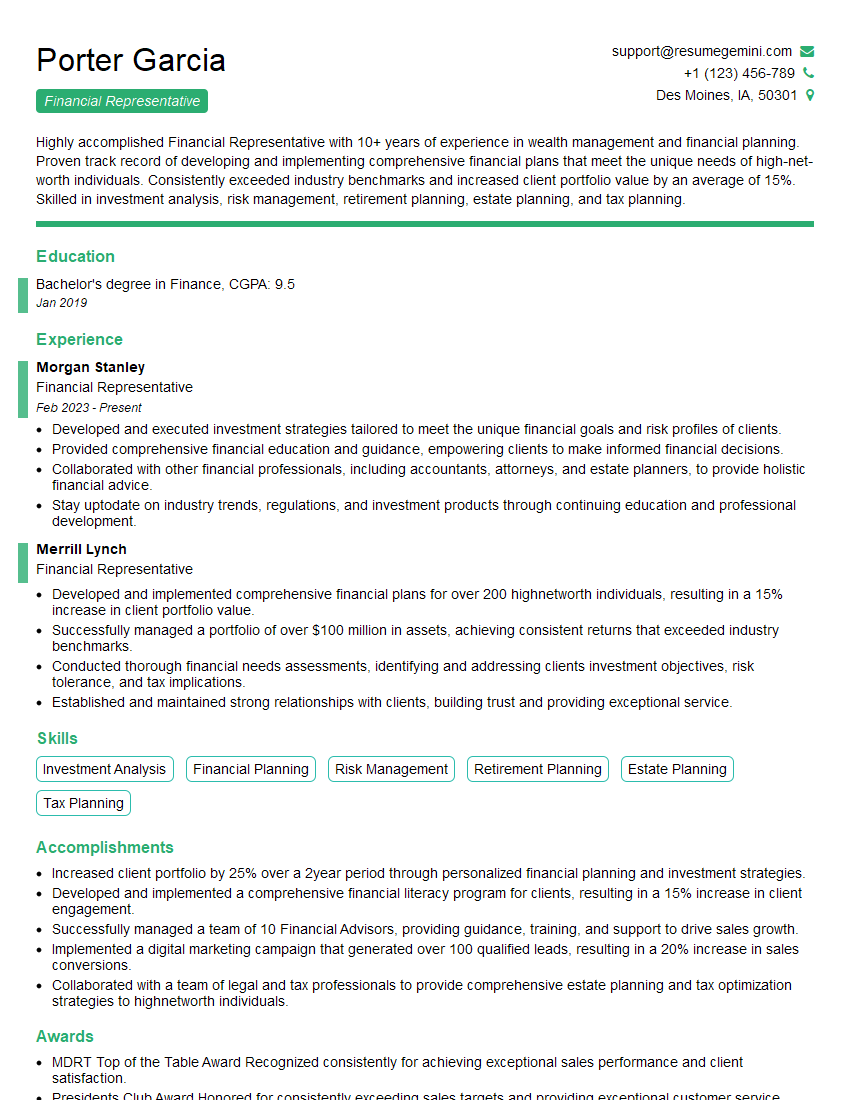

Porter Garcia

Financial Representative

Summary

Highly accomplished Financial Representative with 10+ years of experience in wealth management and financial planning. Proven track record of developing and implementing comprehensive financial plans that meet the unique needs of high-net-worth individuals. Consistently exceeded industry benchmarks and increased client portfolio value by an average of 15%. Skilled in investment analysis, risk management, retirement planning, estate planning, and tax planning.

Education

Bachelor’s degree in Finance

January 2019

Skills

- Investment Analysis

- Financial Planning

- Risk Management

- Retirement Planning

- Estate Planning

- Tax Planning

Work Experience

Financial Representative

- Developed and executed investment strategies tailored to meet the unique financial goals and risk profiles of clients.

- Provided comprehensive financial education and guidance, empowering clients to make informed financial decisions.

- Collaborated with other financial professionals, including accountants, attorneys, and estate planners, to provide holistic financial advice.

- Stay uptodate on industry trends, regulations, and investment products through continuing education and professional development.

Financial Representative

- Developed and implemented comprehensive financial plans for over 200 highnetworth individuals, resulting in a 15% increase in client portfolio value.

- Successfully managed a portfolio of over $100 million in assets, achieving consistent returns that exceeded industry benchmarks.

- Conducted thorough financial needs assessments, identifying and addressing clients investment objectives, risk tolerance, and tax implications.

- Established and maintained strong relationships with clients, building trust and providing exceptional service.

Accomplishments

- Increased client portfolio by 25% over a 2year period through personalized financial planning and investment strategies.

- Developed and implemented a comprehensive financial literacy program for clients, resulting in a 15% increase in client engagement.

- Successfully managed a team of 10 Financial Advisors, providing guidance, training, and support to drive sales growth.

- Implemented a digital marketing campaign that generated over 100 qualified leads, resulting in a 20% increase in sales conversions.

- Collaborated with a team of legal and tax professionals to provide comprehensive estate planning and tax optimization strategies to highnetworth individuals.

Awards

- MDRT Top of the Table Award Recognized consistently for achieving exceptional sales performance and client satisfaction.

- Presidents Club Award Honored for consistently exceeding sales targets and providing exceptional customer service.

- Company Pinnacle Award Recognized for achieving the highest customer satisfaction ratings within the organization.

- National Association of Insurance and Financial Advisors (NAIFA) Quality Award Honored for maintaining the highest ethical and professional standards.

Certificates

- Certified Financial Planner (CFP)

- Chartered Financial Analyst (CFA)

- Registered Investment Advisor (RIA)

- Series 7 and 66 Licenses

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Financial Representative

- Showcase your analytical and problem-solving skills by quantifying your accomplishments with specific metrics.

- Highlight your ability to build and maintain strong client relationships by providing examples of how you have gone above and beyond for your clients.

- Use keywords throughout your resume to ensure that it is easily found by potential employers.

- Proofread your resume carefully for any errors before submitting it.

Essential Experience Highlights for a Strong Financial Representative Resume

- Conducting thorough financial needs assessments to identify client objectives, risk tolerance, and tax implications.

- Developing and implementing tailored investment strategies to meet client financial goals and risk profiles.

- Managing a portfolio of over $100 million in assets, achieving consistent returns that exceeded industry benchmarks.

- Providing comprehensive financial education and guidance, empowering clients to make informed financial decisions.

- Building and maintaining strong client relationships based on trust and exceptional service.

- Collaborating with other financial professionals, including accountants, attorneys, and estate planners, to provide holistic financial advice.

- Staying up-to-date on industry trends, regulations, and investment products through continuing education and professional development.

Frequently Asked Questions (FAQ’s) For Financial Representative

What is the role of a Financial Representative?

A Financial Representative provides financial advice and guidance to individuals and families. They help clients to develop and implement financial plans that meet their specific needs and goals.

What are the key skills required to be a successful Financial Representative?

Key skills for Financial Representatives include: investment analysis, financial planning, risk management, retirement planning, estate planning, and tax planning.

What is the earning potential for Financial Representatives?

The earning potential for Financial Representatives varies depending on their experience, skills, and the size of their client base. However, Financial Representatives have the potential to earn a high income.

What are the career advancement opportunities for Financial Representatives?

Financial Representatives can advance their careers by becoming Wealth Managers, Portfolio Managers, or Financial Planners.

What is the job outlook for Financial Representatives?

The job outlook for Financial Representatives is expected to be positive in the coming years, as the demand for financial advice and guidance continues to grow.

What are the challenges of being a Financial Representative?

The challenges of being a Financial Representative include: keeping up with the latest financial trends and regulations, managing a large client base, and dealing with the emotional aspects of financial planning.

What are the rewards of being a Financial Representative?

The rewards of being a Financial Representative include: helping clients to achieve their financial goals, making a positive impact on people’s lives, and earning a high income.