Are you a seasoned Financial Reserve Clerk seeking a new career path? Discover our professionally built Financial Reserve Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

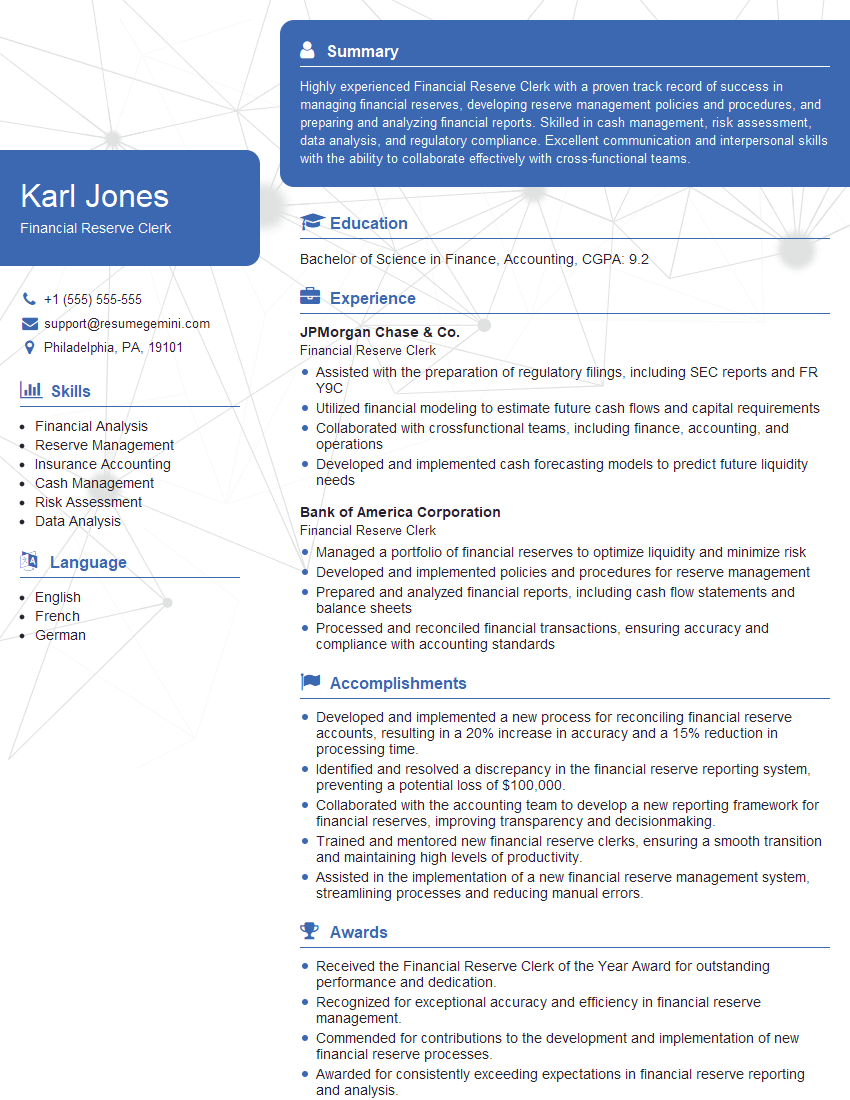

Karl Jones

Financial Reserve Clerk

Summary

Highly experienced Financial Reserve Clerk with a proven track record of success in managing financial reserves, developing reserve management policies and procedures, and preparing and analyzing financial reports. Skilled in cash management, risk assessment, data analysis, and regulatory compliance. Excellent communication and interpersonal skills with the ability to collaborate effectively with cross-functional teams.

Education

Bachelor of Science in Finance, Accounting

January 2016

Skills

- Financial Analysis

- Reserve Management

- Insurance Accounting

- Cash Management

- Risk Assessment

- Data Analysis

Work Experience

Financial Reserve Clerk

- Assisted with the preparation of regulatory filings, including SEC reports and FR Y9C

- Utilized financial modeling to estimate future cash flows and capital requirements

- Collaborated with crossfunctional teams, including finance, accounting, and operations

- Developed and implemented cash forecasting models to predict future liquidity needs

Financial Reserve Clerk

- Managed a portfolio of financial reserves to optimize liquidity and minimize risk

- Developed and implemented policies and procedures for reserve management

- Prepared and analyzed financial reports, including cash flow statements and balance sheets

- Processed and reconciled financial transactions, ensuring accuracy and compliance with accounting standards

Accomplishments

- Developed and implemented a new process for reconciling financial reserve accounts, resulting in a 20% increase in accuracy and a 15% reduction in processing time.

- Identified and resolved a discrepancy in the financial reserve reporting system, preventing a potential loss of $100,000.

- Collaborated with the accounting team to develop a new reporting framework for financial reserves, improving transparency and decisionmaking.

- Trained and mentored new financial reserve clerks, ensuring a smooth transition and maintaining high levels of productivity.

- Assisted in the implementation of a new financial reserve management system, streamlining processes and reducing manual errors.

Awards

- Received the Financial Reserve Clerk of the Year Award for outstanding performance and dedication.

- Recognized for exceptional accuracy and efficiency in financial reserve management.

- Commended for contributions to the development and implementation of new financial reserve processes.

- Awarded for consistently exceeding expectations in financial reserve reporting and analysis.

Certificates

- Chartered Financial Analyst (CFA)

- Fellow of the Society of Actuaries (FSA)

- Associate in Risk Management (ARM)

- Certified Public Accountant (CPA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Financial Reserve Clerk

- Highlight your experience in managing financial reserves and developing reserve management policies and procedures.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate your impact.

- Showcase your skills in cash management, risk assessment, data analysis, and regulatory compliance.

- Emphasize your communication and interpersonal skills, and your ability to collaborate effectively with cross-functional teams.

Essential Experience Highlights for a Strong Financial Reserve Clerk Resume

- Managed a portfolio of financial reserves to optimize liquidity and minimize risk.

- Developed and implemented policies and procedures for reserve management.

- Prepared and analyzed financial reports, including cash flow statements and balance sheets.

- Processed and reconciled financial transactions, ensuring accuracy and compliance with accounting standards.

- Assisted with the preparation of regulatory filings, including SEC reports and FR Y9C.

- Utilized financial modeling to estimate future cash flows and capital requirements.

Frequently Asked Questions (FAQ’s) For Financial Reserve Clerk

What are the key responsibilities of a Financial Reserve Clerk?

The key responsibilities of a Financial Reserve Clerk include managing financial reserves, developing reserve management policies and procedures, preparing and analyzing financial reports, processing and reconciling financial transactions, assisting with the preparation of regulatory filings, and utilizing financial modeling to estimate future cash flows and capital requirements.

What are the educational requirements for a Financial Reserve Clerk?

The educational requirements for a Financial Reserve Clerk typically include a Bachelor of Science degree in Finance, Accounting, or a related field.

What are the career prospects for a Financial Reserve Clerk?

The career prospects for a Financial Reserve Clerk are generally positive, as the demand for qualified professionals in this field is expected to grow in the coming years.

What are the key skills and experience required for a Financial Reserve Clerk?

The key skills and experience required for a Financial Reserve Clerk include financial analysis, reserve management, insurance accounting, cash management, risk assessment, and data analysis.