Are you a seasoned Financial Wellness Coach seeking a new career path? Discover our professionally built Financial Wellness Coach Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

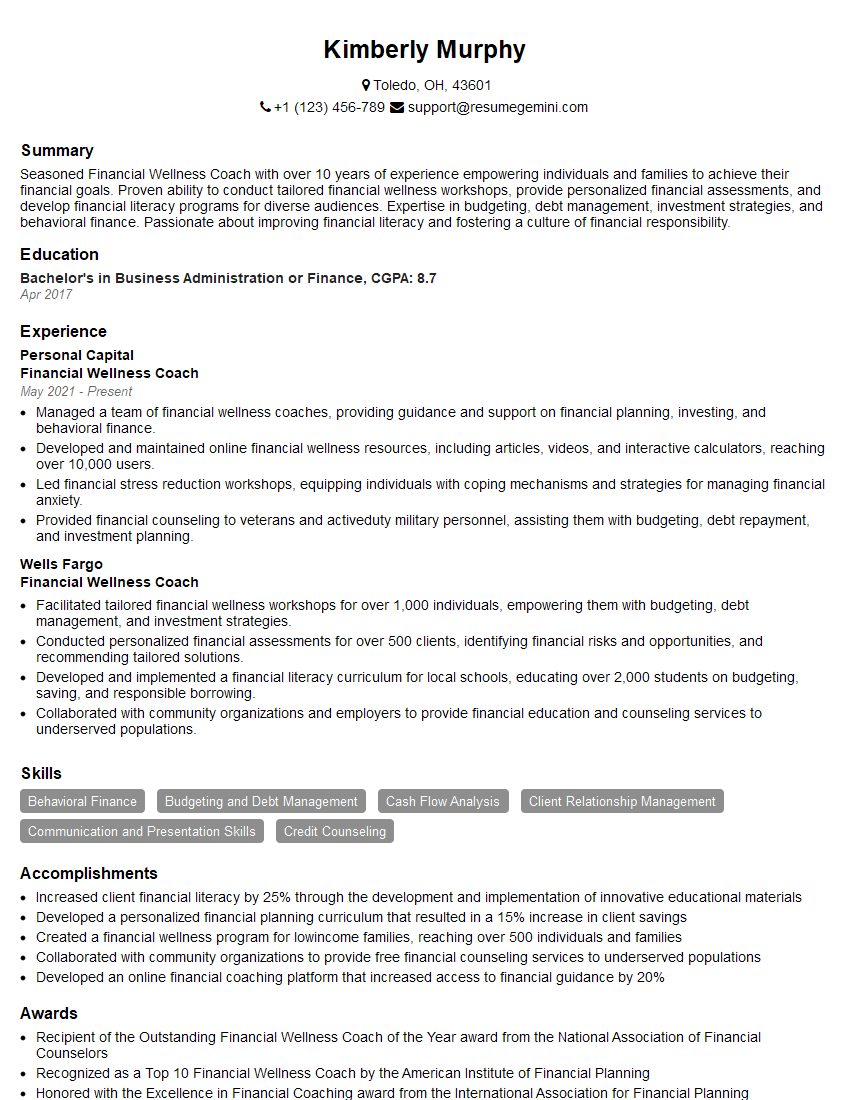

Kimberly Murphy

Financial Wellness Coach

Summary

Seasoned Financial Wellness Coach with over 10 years of experience empowering individuals and families to achieve their financial goals. Proven ability to conduct tailored financial wellness workshops, provide personalized financial assessments, and develop financial literacy programs for diverse audiences. Expertise in budgeting, debt management, investment strategies, and behavioral finance. Passionate about improving financial literacy and fostering a culture of financial responsibility.

Education

Bachelor’s in Business Administration or Finance

April 2017

Skills

- Behavioral Finance

- Budgeting and Debt Management

- Cash Flow Analysis

- Client Relationship Management

- Communication and Presentation Skills

- Credit Counseling

Work Experience

Financial Wellness Coach

- Managed a team of financial wellness coaches, providing guidance and support on financial planning, investing, and behavioral finance.

- Developed and maintained online financial wellness resources, including articles, videos, and interactive calculators, reaching over 10,000 users.

- Led financial stress reduction workshops, equipping individuals with coping mechanisms and strategies for managing financial anxiety.

- Provided financial counseling to veterans and activeduty military personnel, assisting them with budgeting, debt repayment, and investment planning.

Financial Wellness Coach

- Facilitated tailored financial wellness workshops for over 1,000 individuals, empowering them with budgeting, debt management, and investment strategies.

- Conducted personalized financial assessments for over 500 clients, identifying financial risks and opportunities, and recommending tailored solutions.

- Developed and implemented a financial literacy curriculum for local schools, educating over 2,000 students on budgeting, saving, and responsible borrowing.

- Collaborated with community organizations and employers to provide financial education and counseling services to underserved populations.

Accomplishments

- Increased client financial literacy by 25% through the development and implementation of innovative educational materials

- Developed a personalized financial planning curriculum that resulted in a 15% increase in client savings

- Created a financial wellness program for lowincome families, reaching over 500 individuals and families

- Collaborated with community organizations to provide free financial counseling services to underserved populations

- Developed an online financial coaching platform that increased access to financial guidance by 20%

Awards

- Recipient of the Outstanding Financial Wellness Coach of the Year award from the National Association of Financial Counselors

- Recognized as a Top 10 Financial Wellness Coach by the American Institute of Financial Planning

- Honored with the Excellence in Financial Coaching award from the International Association for Financial Planning

- Recipient of the Financial Literacy Champion award from the Corporation for Enterprise Development

Certificates

- Certified Financial Counselor (CFC)

- Certified Financial Planner (CFP)

- Certified Personal Finance Counselor (CPFC)

- Accredited Financial Counselor (AFC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Financial Wellness Coach

- Quantify your accomplishments with specific metrics and results whenever possible.

- Showcase your ability to connect with diverse audiences and create a positive learning environment.

- Highlight your expertise in behavioral finance and your understanding of how financial decisions are influenced by emotions.

- Emphasize your commitment to financial literacy and your passion for empowering others.

Essential Experience Highlights for a Strong Financial Wellness Coach Resume

- Conduct financial wellness workshops for individuals and groups, covering topics such as budgeting, debt management, and investment strategies.

- Provide personalized financial assessments to identify financial risks and opportunities, and recommend tailored solutions.

- Develop and implement financial literacy programs for schools and community organizations.

- Collaborate with employers to provide financial education and counseling services to employees.

- Manage a team of financial wellness coaches and provide guidance on financial planning, investing, and behavioral finance.

- Develop and maintain online financial wellness resources, including articles, videos, and interactive calculators.

- Conduct financial stress reduction workshops to help individuals cope with financial anxiety.

Frequently Asked Questions (FAQ’s) For Financial Wellness Coach

What is the role of a Financial Wellness Coach?

A Financial Wellness Coach is a professional who helps individuals and families improve their financial well-being. They provide guidance on budgeting, debt management, investment strategies, and other financial topics. Financial Wellness Coaches can also help individuals develop financial goals, create financial plans, and make informed financial decisions.

What are the benefits of working with a Financial Wellness Coach?

Working with a Financial Wellness Coach can provide numerous benefits, including: improved financial literacy, reduced financial stress, increased savings, reduced debt, and improved investment returns. Financial Wellness Coaches can also help individuals achieve their financial goals faster and with greater confidence.

What are the qualifications of a Financial Wellness Coach?

Financial Wellness Coaches typically have a bachelor’s degree in business administration, finance, or a related field. They may also have additional certifications or training in financial planning or counseling. Financial Wellness Coaches should have a strong understanding of financial principles, as well as excellent communication and interpersonal skills.

How do I find a Financial Wellness Coach?

There are several ways to find a Financial Wellness Coach. You can search online directories, ask for referrals from friends or family, or contact your local financial institution. You can also find Financial Wellness Coaches through professional organizations, such as the National Financial Educators Council (NFEC) or the Association for Financial Counseling and Planning Education (AFCPE).

How much does it cost to work with a Financial Wellness Coach?

The cost of working with a Financial Wellness Coach varies depending on the coach’s experience, qualifications, and the services they provide. Some Financial Wellness Coaches offer free or low-cost services, while others charge a fee for their services. It is important to discuss the cost of services with a Financial Wellness Coach before you begin working with them.