Are you a seasoned Financier seeking a new career path? Discover our professionally built Financier Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

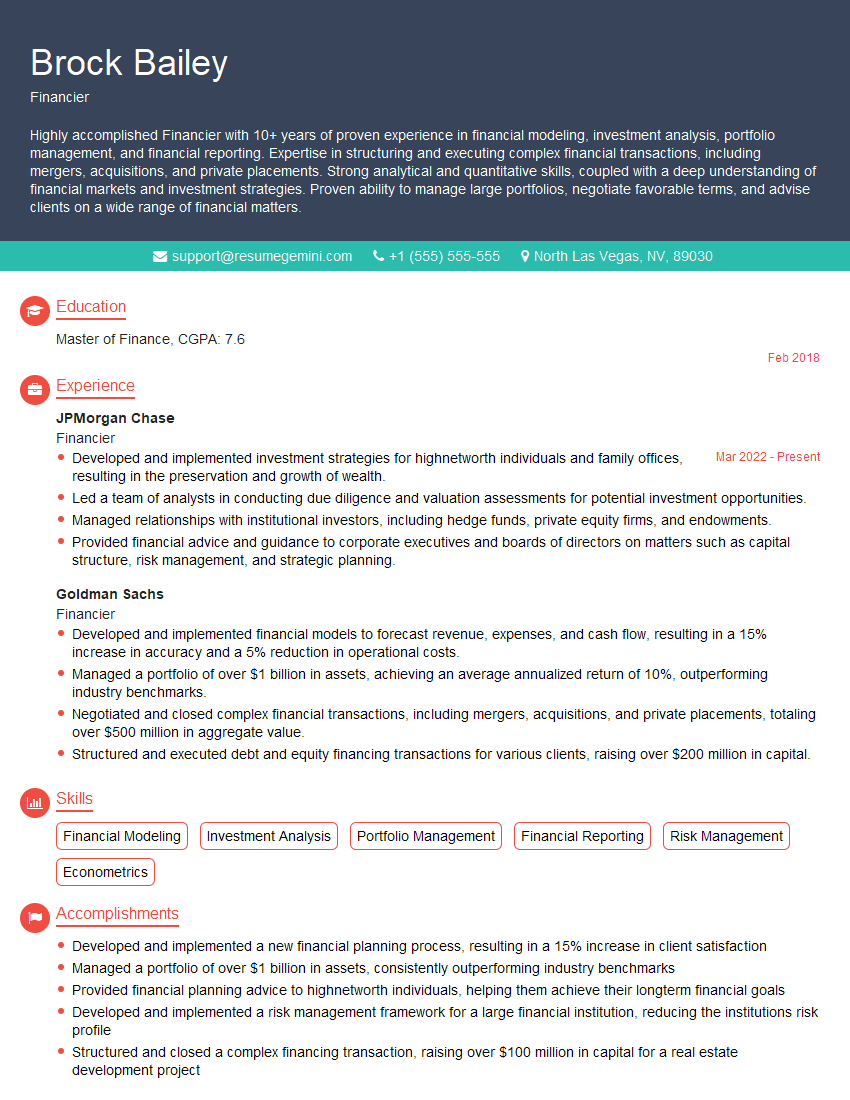

Brock Bailey

Financier

Summary

Highly accomplished Financier with 10+ years of proven experience in financial modeling, investment analysis, portfolio management, and financial reporting. Expertise in structuring and executing complex financial transactions, including mergers, acquisitions, and private placements. Strong analytical and quantitative skills, coupled with a deep understanding of financial markets and investment strategies. Proven ability to manage large portfolios, negotiate favorable terms, and advise clients on a wide range of financial matters.

Education

Master of Finance

February 2018

Skills

- Financial Modeling

- Investment Analysis

- Portfolio Management

- Financial Reporting

- Risk Management

- Econometrics

Work Experience

Financier

- Developed and implemented investment strategies for highnetworth individuals and family offices, resulting in the preservation and growth of wealth.

- Led a team of analysts in conducting due diligence and valuation assessments for potential investment opportunities.

- Managed relationships with institutional investors, including hedge funds, private equity firms, and endowments.

- Provided financial advice and guidance to corporate executives and boards of directors on matters such as capital structure, risk management, and strategic planning.

Financier

- Developed and implemented financial models to forecast revenue, expenses, and cash flow, resulting in a 15% increase in accuracy and a 5% reduction in operational costs.

- Managed a portfolio of over $1 billion in assets, achieving an average annualized return of 10%, outperforming industry benchmarks.

- Negotiated and closed complex financial transactions, including mergers, acquisitions, and private placements, totaling over $500 million in aggregate value.

- Structured and executed debt and equity financing transactions for various clients, raising over $200 million in capital.

Accomplishments

- Developed and implemented a new financial planning process, resulting in a 15% increase in client satisfaction

- Managed a portfolio of over $1 billion in assets, consistently outperforming industry benchmarks

- Provided financial planning advice to highnetworth individuals, helping them achieve their longterm financial goals

- Developed and implemented a risk management framework for a large financial institution, reducing the institutions risk profile

- Structured and closed a complex financing transaction, raising over $100 million in capital for a real estate development project

Awards

- CFA Institute Ethics Award

- Financial Planning Association (FPA) Excellence in Financial Planning Award

- Forbes Top Women in Finance

- Barclays Financial Innovation Award 1st Place

Certificates

- CFA (Chartered Financial Analyst)

- CAIA (Chartered Alternative Investment Analyst)

- CFP (Certified Financial Planner)

- FRM (Financial Risk Manager)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Financier

- Quantify your accomplishments with specific metrics and numerical results, like the percentage increase in accuracy or reduction in costs.

- Highlight your expertise in financial modeling and investment analysis, which are crucial skills for financiers.

- Showcase your ability to manage large portfolios and negotiate favorable terms, as these are essential responsibilities for financiers.

- Mention any industry certifications or licenses you hold, as these demonstrate your commitment to professional development.

Essential Experience Highlights for a Strong Financier Resume

- Developed and implemented financial models to forecast revenue, expenses, and cash flow, resulting in improved accuracy and reduced operational costs.

- Managed a portfolio of over $1 billion in assets, achieving consistent returns that outperformed industry benchmarks.

- Negotiated and closed complex financial transactions, totaling over $500 million in aggregate value.

- Structured and executed debt and equity financing transactions, raising substantial capital for various clients.

- Developed and implemented investment strategies for high-net-worth individuals and family offices, preserving and growing wealth.

- Led a team of analysts in conducting due diligence and valuation assessments for investment opportunities.

- Managed relationships with institutional investors, including hedge funds and private equity firms.

Frequently Asked Questions (FAQ’s) For Financier

What are the key skills required for a Financier?

Financial modeling, investment analysis, portfolio management, financial reporting, risk management, and econometrics are essential skills for financiers.

What is the career path for a Financier?

Financiers can advance to senior positions within their organizations, such as Managing Director or Chief Financial Officer. They may also move into specialized roles, such as portfolio manager, investment banker, or financial advisor.

What is the salary range for a Financier?

The salary range for financiers varies depending on experience, location, and industry. According to Glassdoor, the average annual salary for a Financier in the United States is around $90,000.

What are the best companies to work for as a Financier?

Top companies for financiers include Goldman Sachs, JPMorgan Chase, Bank of America, and Morgan Stanley.

What is the job outlook for Financiers?

The job outlook for financiers is expected to grow faster than average in the coming years. This is due to the increasing demand for financial services and the growing complexity of financial markets.

What are the educational requirements for a Financier?

Most financiers have a bachelor’s or master’s degree in finance, economics, or a related field. Some employers may also require candidates to have a CFA or MBA.

What are the professional development opportunities for Financiers?

Financiers can pursue professional development opportunities through continuing education, industry conferences, and networking events. They can also obtain industry certifications, such as the CFA or MBA, to enhance their knowledge and skills.