Are you a seasoned Fiscal Clerk seeking a new career path? Discover our professionally built Fiscal Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

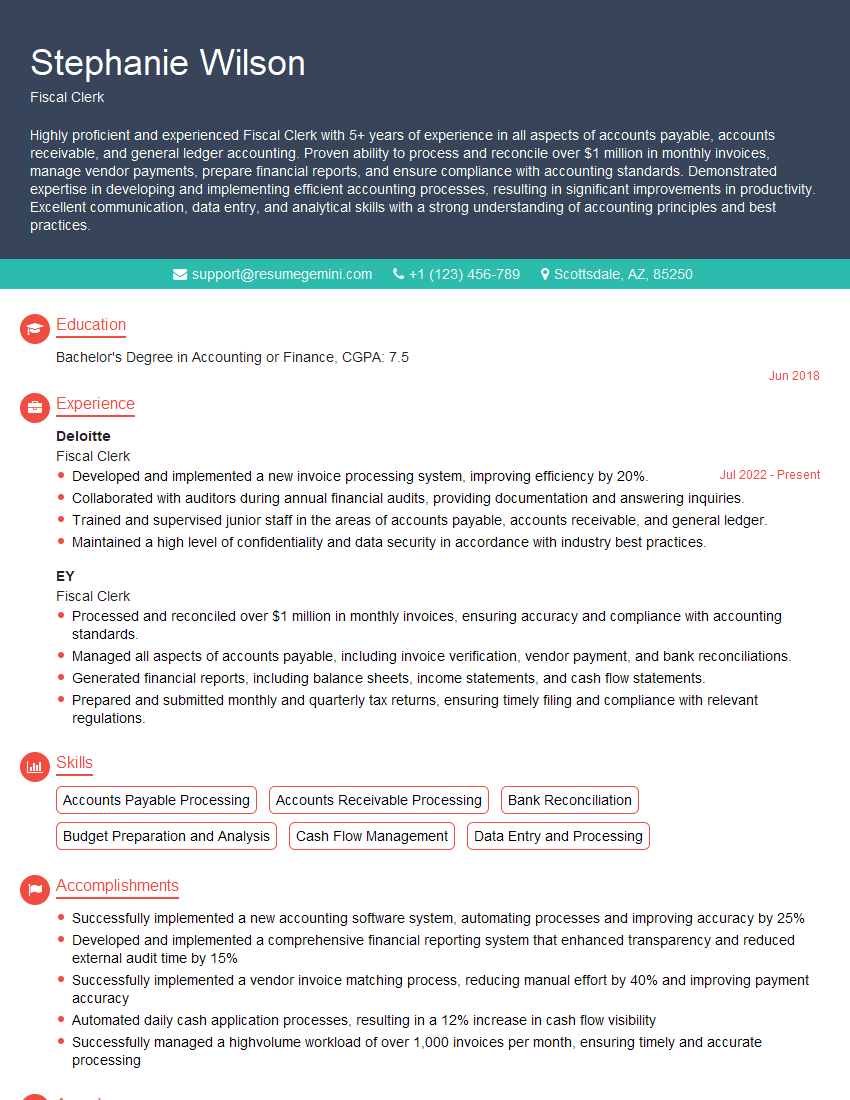

Stephanie Wilson

Fiscal Clerk

Summary

Highly proficient and experienced Fiscal Clerk with 5+ years of experience in all aspects of accounts payable, accounts receivable, and general ledger accounting. Proven ability to process and reconcile over $1 million in monthly invoices, manage vendor payments, prepare financial reports, and ensure compliance with accounting standards. Demonstrated expertise in developing and implementing efficient accounting processes, resulting in significant improvements in productivity. Excellent communication, data entry, and analytical skills with a strong understanding of accounting principles and best practices.

Education

Bachelor’s Degree in Accounting or Finance

June 2018

Skills

- Accounts Payable Processing

- Accounts Receivable Processing

- Bank Reconciliation

- Budget Preparation and Analysis

- Cash Flow Management

- Data Entry and Processing

Work Experience

Fiscal Clerk

- Developed and implemented a new invoice processing system, improving efficiency by 20%.

- Collaborated with auditors during annual financial audits, providing documentation and answering inquiries.

- Trained and supervised junior staff in the areas of accounts payable, accounts receivable, and general ledger.

- Maintained a high level of confidentiality and data security in accordance with industry best practices.

Fiscal Clerk

- Processed and reconciled over $1 million in monthly invoices, ensuring accuracy and compliance with accounting standards.

- Managed all aspects of accounts payable, including invoice verification, vendor payment, and bank reconciliations.

- Generated financial reports, including balance sheets, income statements, and cash flow statements.

- Prepared and submitted monthly and quarterly tax returns, ensuring timely filing and compliance with relevant regulations.

Accomplishments

- Successfully implemented a new accounting software system, automating processes and improving accuracy by 25%

- Developed and implemented a comprehensive financial reporting system that enhanced transparency and reduced external audit time by 15%

- Successfully implemented a vendor invoice matching process, reducing manual effort by 40% and improving payment accuracy

- Automated daily cash application processes, resulting in a 12% increase in cash flow visibility

- Successfully managed a highvolume workload of over 1,000 invoices per month, ensuring timely and accurate processing

Awards

- Received the Employee of the Year Award for exceptional performance in fiscal management

- Recognized for outstanding contributions to the Accounts Payable team, resulting in a 10% reduction in invoice processing time

- Awarded the Team Excellence Award for collaboration and innovation in streamlining monthend closing procedures

- Honored with the Innovation Award for developing a data analysis tool that identified costsaving opportunities

Certificates

- Certified Public Accountant (CPA)

- Certified Management Accountant (CMA)

- Certified Internal Auditor (CIA)

- Certified Fraud Examiner (CFE)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Fiscal Clerk

- Highlight your experience in processing and reconciling high volumes of invoices.

- Showcase your proficiency in managing accounts payable and accounts receivable functions.

- Demonstrate your ability to prepare and analyze financial reports.

- Emphasize your technical skills in accounting software and data entry.

Essential Experience Highlights for a Strong Fiscal Clerk Resume

- Processed and reconciled over $1 million in monthly invoices, ensuring accuracy and compliance with accounting standards.

- Managed all aspects of accounts payable, including invoice verification, vendor payment, and bank reconciliations.

- Generated financial reports, including balance sheets, income statements, and cash flow statements.

- Prepared and submitted monthly and quarterly tax returns, ensuring timely filing and compliance with relevant regulations.

- Developed and implemented a new invoice processing system, improving efficiency by 20%.

- Collaborated with auditors during annual financial audits, providing documentation and answering inquiries.

- Trained and supervised junior staff in the areas of accounts payable, accounts receivable, and general ledger.

Frequently Asked Questions (FAQ’s) For Fiscal Clerk

What is the primary role of a Fiscal Clerk?

The primary role of a Fiscal Clerk is to manage and maintain financial records, ensuring the accuracy and compliance of financial transactions.

What are the key responsibilities of a Fiscal Clerk?

Key responsibilities of a Fiscal Clerk include processing invoices, reconciling bank accounts, generating financial reports, and preparing tax returns.

What skills are required to be a successful Fiscal Clerk?

To be successful in this role, Fiscal Clerks should possess strong accounting knowledge, proficiency in accounting software, and excellent attention to detail.

What is the career progression path for a Fiscal Clerk?

With experience and additional qualifications, Fiscal Clerks can advance to positions such as Senior Accountant, Financial Analyst, or Controller.

What are the key challenges faced by Fiscal Clerks?

Fiscal Clerks often face challenges such as managing large volumes of financial transactions, ensuring compliance with regulations, and keeping up with changes in accounting practices.

What is the job outlook for Fiscal Clerks?

The job outlook for Fiscal Clerks is expected to remain stable or grow slightly, driven by the increasing demand for accurate and timely financial reporting.