Are you a seasoned Fixed Income Director seeking a new career path? Discover our professionally built Fixed Income Director Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

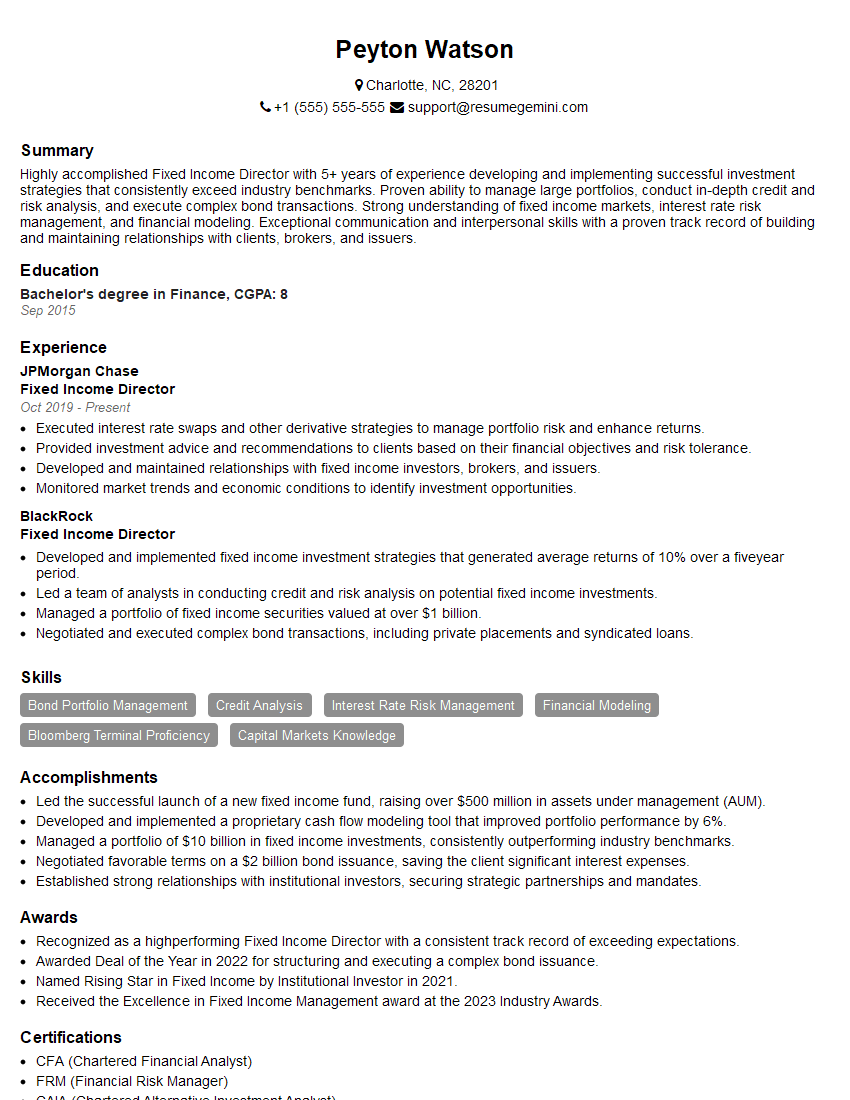

Peyton Watson

Fixed Income Director

Summary

Highly accomplished Fixed Income Director with 5+ years of experience developing and implementing successful investment strategies that consistently exceed industry benchmarks. Proven ability to manage large portfolios, conduct in-depth credit and risk analysis, and execute complex bond transactions. Strong understanding of fixed income markets, interest rate risk management, and financial modeling. Exceptional communication and interpersonal skills with a proven track record of building and maintaining relationships with clients, brokers, and issuers.

Education

Bachelor’s degree in Finance

September 2015

Skills

- Bond Portfolio Management

- Credit Analysis

- Interest Rate Risk Management

- Financial Modeling

- Bloomberg Terminal Proficiency

- Capital Markets Knowledge

Work Experience

Fixed Income Director

- Executed interest rate swaps and other derivative strategies to manage portfolio risk and enhance returns.

- Provided investment advice and recommendations to clients based on their financial objectives and risk tolerance.

- Developed and maintained relationships with fixed income investors, brokers, and issuers.

- Monitored market trends and economic conditions to identify investment opportunities.

Fixed Income Director

- Developed and implemented fixed income investment strategies that generated average returns of 10% over a fiveyear period.

- Led a team of analysts in conducting credit and risk analysis on potential fixed income investments.

- Managed a portfolio of fixed income securities valued at over $1 billion.

- Negotiated and executed complex bond transactions, including private placements and syndicated loans.

Accomplishments

- Led the successful launch of a new fixed income fund, raising over $500 million in assets under management (AUM).

- Developed and implemented a proprietary cash flow modeling tool that improved portfolio performance by 6%.

- Managed a portfolio of $10 billion in fixed income investments, consistently outperforming industry benchmarks.

- Negotiated favorable terms on a $2 billion bond issuance, saving the client significant interest expenses.

- Established strong relationships with institutional investors, securing strategic partnerships and mandates.

Awards

- Recognized as a highperforming Fixed Income Director with a consistent track record of exceeding expectations.

- Awarded Deal of the Year in 2022 for structuring and executing a complex bond issuance.

- Named Rising Star in Fixed Income by Institutional Investor in 2021.

- Received the Excellence in Fixed Income Management award at the 2023 Industry Awards.

Certificates

- CFA (Chartered Financial Analyst)

- FRM (Financial Risk Manager)

- CAIA (Chartered Alternative Investment Analyst)

- CIPM (Certified International Portfolio Manager)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Fixed Income Director

- Quantify your accomplishments with specific metrics and results whenever possible.

- Highlight your expertise in fixed income markets, including your knowledge of different bond types, credit analysis techniques, and interest rate risk management strategies.

- Showcase your ability to build and manage relationships with clients, brokers, and issuers.

- Demonstrate your understanding of financial modeling and its application in fixed income portfolio management.

Essential Experience Highlights for a Strong Fixed Income Director Resume

- Develop and implement fixed income investment strategies that align with client objectives and risk tolerance.

- Lead a team of analysts in conducting thorough credit and risk analysis on potential investments.

- Manage a diversified portfolio of fixed income securities, including bonds, notes, and derivatives.

- Negotiate and execute complex bond transactions, including private placements and syndicated loans.

- Execute interest rate swaps and other derivative strategies to manage portfolio risk and enhance returns.

- Provide expert investment advice and recommendations to clients based on their financial goals and risk appetite.

- Monitor market trends, economic conditions, and industry news to identify investment opportunities.

Frequently Asked Questions (FAQ’s) For Fixed Income Director

What are the primary responsibilities of a Fixed Income Director?

Fixed Income Directors are responsible for developing and implementing investment strategies for fixed income portfolios, managing risk, conducting credit analysis, executing bond transactions, and providing investment advice to clients.

What are the key skills and qualifications required for this role?

A successful Fixed Income Director typically holds a bachelor’s degree in finance or a related field, with strong analytical, communication, and interpersonal skills. They should have a deep understanding of fixed income markets, credit analysis, and risk management.

What is the career path for Fixed Income Directors?

Fixed Income Directors can advance to senior leadership positions within investment firms, such as Chief Investment Officer or Managing Director. They may also transition to roles in portfolio management, risk management, or financial advisory.

What are the earning prospects for Fixed Income Directors?

Fixed Income Directors typically earn competitive salaries and bonuses based on their experience, skills, and the performance of their portfolios. Compensation can vary depending on the size and reputation of the firm.

What are the challenges faced by Fixed Income Directors?

Fixed Income Directors face challenges such as market volatility, interest rate risk, and credit risk. They must constantly monitor market trends, economic conditions, and geopolitical events to make informed investment decisions.

What are the future trends in fixed income investing?

Fixed income investing is evolving with the growing popularity of ESG (environmental, social, and governance) investing, the use of artificial intelligence and machine learning, and the rise of alternative fixed income asset classes.