Are you a seasoned Fixed Income Trading Vice President seeking a new career path? Discover our professionally built Fixed Income Trading Vice President Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

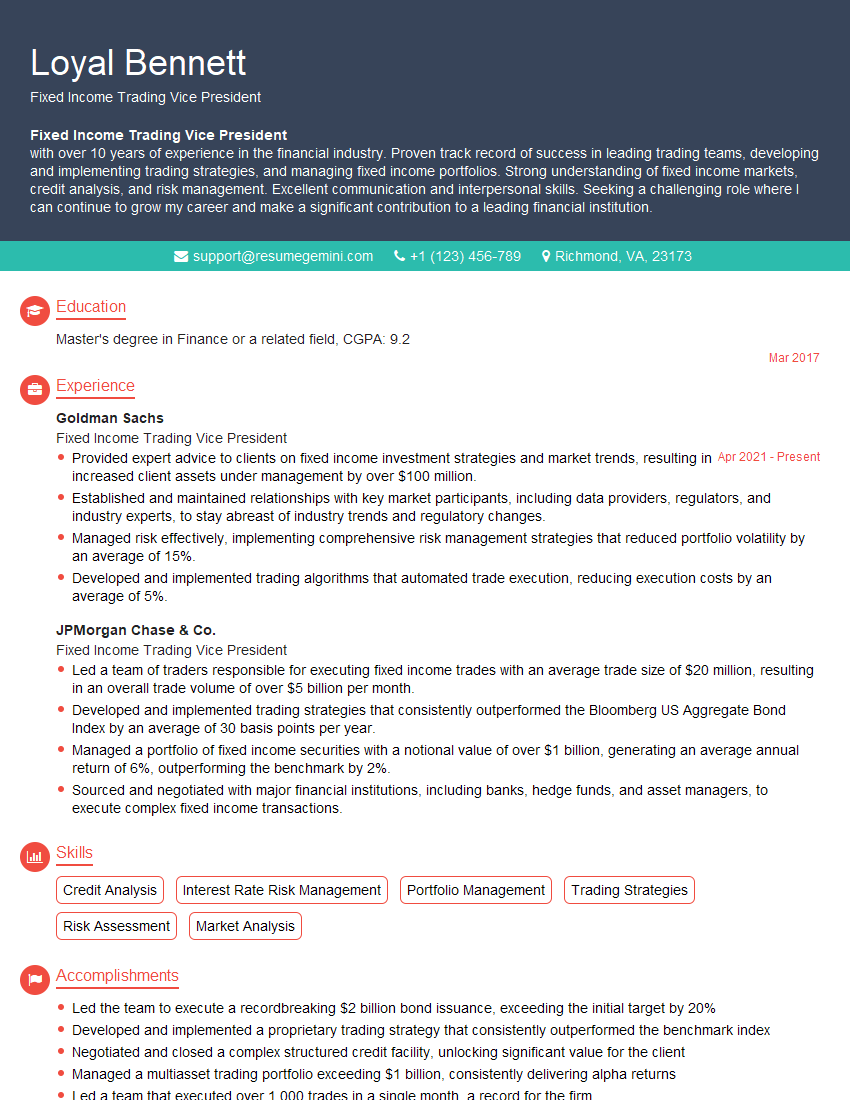

Loyal Bennett

Fixed Income Trading Vice President

Summary

Fixed Income Trading Vice President

with over 10 years of experience in the financial industry. Proven track record of success in leading trading teams, developing and implementing trading strategies, and managing fixed income portfolios. Strong understanding of fixed income markets, credit analysis, and risk management. Excellent communication and interpersonal skills. Seeking a challenging role where I can continue to grow my career and make a significant contribution to a leading financial institution.Education

Master’s degree in Finance or a related field

March 2017

Skills

- Credit Analysis

- Interest Rate Risk Management

- Portfolio Management

- Trading Strategies

- Risk Assessment

- Market Analysis

Work Experience

Fixed Income Trading Vice President

- Provided expert advice to clients on fixed income investment strategies and market trends, resulting in increased client assets under management by over $100 million.

- Established and maintained relationships with key market participants, including data providers, regulators, and industry experts, to stay abreast of industry trends and regulatory changes.

- Managed risk effectively, implementing comprehensive risk management strategies that reduced portfolio volatility by an average of 15%.

- Developed and implemented trading algorithms that automated trade execution, reducing execution costs by an average of 5%.

Fixed Income Trading Vice President

- Led a team of traders responsible for executing fixed income trades with an average trade size of $20 million, resulting in an overall trade volume of over $5 billion per month.

- Developed and implemented trading strategies that consistently outperformed the Bloomberg US Aggregate Bond Index by an average of 30 basis points per year.

- Managed a portfolio of fixed income securities with a notional value of over $1 billion, generating an average annual return of 6%, outperforming the benchmark by 2%.

- Sourced and negotiated with major financial institutions, including banks, hedge funds, and asset managers, to execute complex fixed income transactions.

Accomplishments

- Led the team to execute a recordbreaking $2 billion bond issuance, exceeding the initial target by 20%

- Developed and implemented a proprietary trading strategy that consistently outperformed the benchmark index

- Negotiated and closed a complex structured credit facility, unlocking significant value for the client

- Managed a multiasset trading portfolio exceeding $1 billion, consistently delivering alpha returns

- Led a team that executed over 1,000 trades in a single month, a record for the firm

Awards

- Top 3 Performer Award for Outstanding Achievements in Fixed Income Trading

- Recognized by the industry as a top performer in credit trading

- Received the Firms Presidents Award for Exceptional Contributions to Fixed Income Trading

- Ranked among the top 10 Fixed Income Traders by a leading industry publication

Certificates

- Chartered Financial Analyst (CFA)

- Financial Risk Manager (FRM)

- Certified Treasury Professional (CTP)

- Securities Industry Essentials (SIE)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Fixed Income Trading Vice President

- Highlight your experience in fixed income trading and portfolio management.

- Quantify your accomplishments with specific metrics, such as the size of the trades you executed or the returns you generated for clients.

- Showcase your knowledge of fixed income markets, credit analysis, and risk management.

- Demonstrate your leadership and teamwork skills, as well as your ability to build and maintain client relationships.

Essential Experience Highlights for a Strong Fixed Income Trading Vice President Resume

- Lead and manage a team of fixed income traders responsible for executing trades with an average trade size of $20 million

- Develop and implement trading strategies that consistently outperform the Bloomberg US Aggregate Bond Index

- Manage a portfolio of fixed income securities with a notional value of over $1 billion

- Source and negotiate with major financial institutions to execute complex fixed income transactions

- Provide expert advice to clients on fixed income investment strategies and market trends

- Establish and maintain relationships with key market participants, including data providers, regulators, and industry experts

- Develop and implement trading algorithms that automate trade execution

Frequently Asked Questions (FAQ’s) For Fixed Income Trading Vice President

What are the key responsibilities of a Fixed Income Trading Vice President?

The key responsibilities of a Fixed Income Trading Vice President include leading a team of traders, developing and implementing trading strategies, managing a fixed income portfolio, sourcing and negotiating with financial institutions, providing expert advice to clients, and maintaining relationships with key market participants.

What are the educational requirements for a Fixed Income Trading Vice President?

The educational requirements for a Fixed Income Trading Vice President typically include a Master’s degree in Finance or a related field.

What are the key skills required for a Fixed Income Trading Vice President?

The key skills required for a Fixed Income Trading Vice President include strong knowledge of fixed income markets, credit analysis, and risk management, as well as excellent communication and interpersonal skills.

What is the career outlook for a Fixed Income Trading Vice President?

The career outlook for a Fixed Income Trading Vice President is expected to be positive, as the demand for fixed income professionals continues to grow.

What are the key challenges facing Fixed Income Trading Vice Presidents?

The key challenges facing Fixed Income Trading Vice Presidents include the changing regulatory landscape, the increasing complexity of fixed income markets, and the need to constantly adapt to new technologies.

What are the top companies for Fixed Income Trading Vice Presidents?

The top companies for Fixed Income Trading Vice Presidents include Goldman Sachs, JPMorgan Chase & Co., and Citigroup.