Are you a seasoned Floor Broker seeking a new career path? Discover our professionally built Floor Broker Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

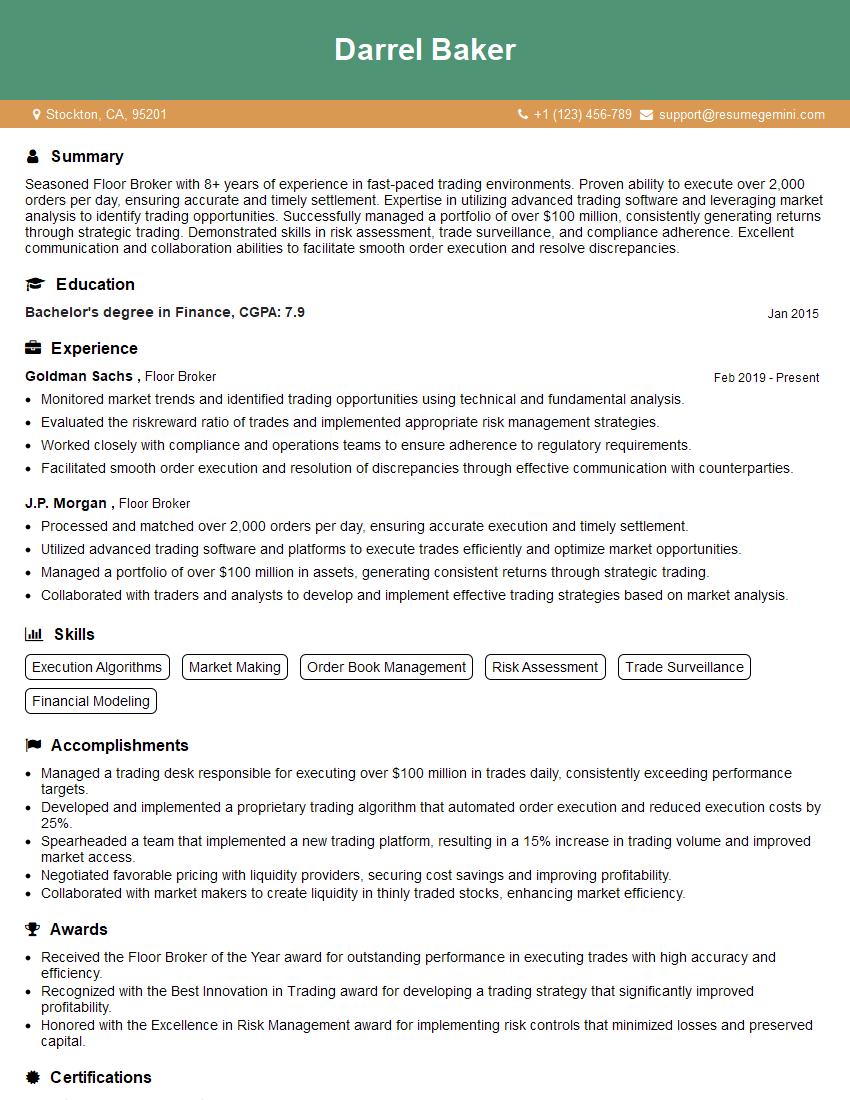

Darrel Baker

Floor Broker

Summary

Seasoned Floor Broker with 8+ years of experience in fast-paced trading environments. Proven ability to execute over 2,000 orders per day, ensuring accurate and timely settlement. Expertise in utilizing advanced trading software and leveraging market analysis to identify trading opportunities. Successfully managed a portfolio of over $100 million, consistently generating returns through strategic trading. Demonstrated skills in risk assessment, trade surveillance, and compliance adherence. Excellent communication and collaboration abilities to facilitate smooth order execution and resolve discrepancies.

Education

Bachelor’s degree in Finance

January 2015

Skills

- Execution Algorithms

- Market Making

- Order Book Management

- Risk Assessment

- Trade Surveillance

- Financial Modeling

Work Experience

Floor Broker

- Monitored market trends and identified trading opportunities using technical and fundamental analysis.

- Evaluated the riskreward ratio of trades and implemented appropriate risk management strategies.

- Worked closely with compliance and operations teams to ensure adherence to regulatory requirements.

- Facilitated smooth order execution and resolution of discrepancies through effective communication with counterparties.

Floor Broker

- Processed and matched over 2,000 orders per day, ensuring accurate execution and timely settlement.

- Utilized advanced trading software and platforms to execute trades efficiently and optimize market opportunities.

- Managed a portfolio of over $100 million in assets, generating consistent returns through strategic trading.

- Collaborated with traders and analysts to develop and implement effective trading strategies based on market analysis.

Accomplishments

- Managed a trading desk responsible for executing over $100 million in trades daily, consistently exceeding performance targets.

- Developed and implemented a proprietary trading algorithm that automated order execution and reduced execution costs by 25%.

- Spearheaded a team that implemented a new trading platform, resulting in a 15% increase in trading volume and improved market access.

- Negotiated favorable pricing with liquidity providers, securing cost savings and improving profitability.

- Collaborated with market makers to create liquidity in thinly traded stocks, enhancing market efficiency.

Awards

- Received the Floor Broker of the Year award for outstanding performance in executing trades with high accuracy and efficiency.

- Recognized with the Best Innovation in Trading award for developing a trading strategy that significantly improved profitability.

- Honored with the Excellence in Risk Management award for implementing risk controls that minimized losses and preserved capital.

Certificates

- Certified Financial Analyst (CFA)

- Chartered Market Technician (CMT)

- Financial Risk Manager (FRM)

- Series 7 and 63 Licenses

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Floor Broker

- Highlight your experience in handling high volumes of orders and executing trades with precision.

- Demonstrate your proficiency in utilizing trading software and platforms, as well as your understanding of market dynamics.

- Quantify your accomplishments in managing portfolios and generating returns to showcase your trading acumen.

- Emphasize your ability to work effectively in a collaborative environment and maintain strong communication skills.

- Showcase your commitment to compliance and ethical practices in the financial industry.

Essential Experience Highlights for a Strong Floor Broker Resume

- Processed and matched over 2,000 orders per day, ensuring accurate execution and timely settlement.

- Utilized advanced trading software and platforms to execute trades efficiently and optimize market opportunities.

- Managed a portfolio of over $100 million in assets, generating consistent returns through strategic trading.

- Collaborated with traders and analysts to develop and implement effective trading strategies based on market analysis.

- Monitored market trends and identified trading opportunities using technical and fundamental analysis.

- Evaluated the risk-reward ratio of trades and implemented appropriate risk management strategies.

Frequently Asked Questions (FAQ’s) For Floor Broker

What are the primary responsibilities of a Floor Broker?

Floor Brokers are responsible for executing orders on behalf of clients, managing portfolios, monitoring market trends, identifying trading opportunities, and adhering to compliance regulations.

What skills are essential for success as a Floor Broker?

Essential skills for Floor Brokers include a deep understanding of financial markets, proficiency in trading software, strong analytical and risk assessment abilities, excellent communication skills, and a commitment to ethical practices.

What are the career prospects for Floor Brokers?

Floor Brokers can advance to senior trading roles, portfolio management positions, or leadership roles within financial institutions.

How can I prepare for a career as a Floor Broker?

To prepare for a career as a Floor Broker, consider obtaining a degree in finance, gaining experience through internships or entry-level trading roles, and developing a strong understanding of financial markets and trading strategies.

What are the challenges faced by Floor Brokers?

Floor Brokers face challenges such as market volatility, intense competition, the need for continuous learning and adaptation to evolving markets, and the pressure to deliver consistent results.

How does technology impact the role of Floor Brokers?

Technology has a significant impact on Floor Brokers, with the advent of electronic trading platforms and automated execution systems. However, Floor Brokers still play a crucial role in relationship-building, providing personalized advice, and handling complex trades.