Are you a seasoned Foreclosure Clerk seeking a new career path? Discover our professionally built Foreclosure Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

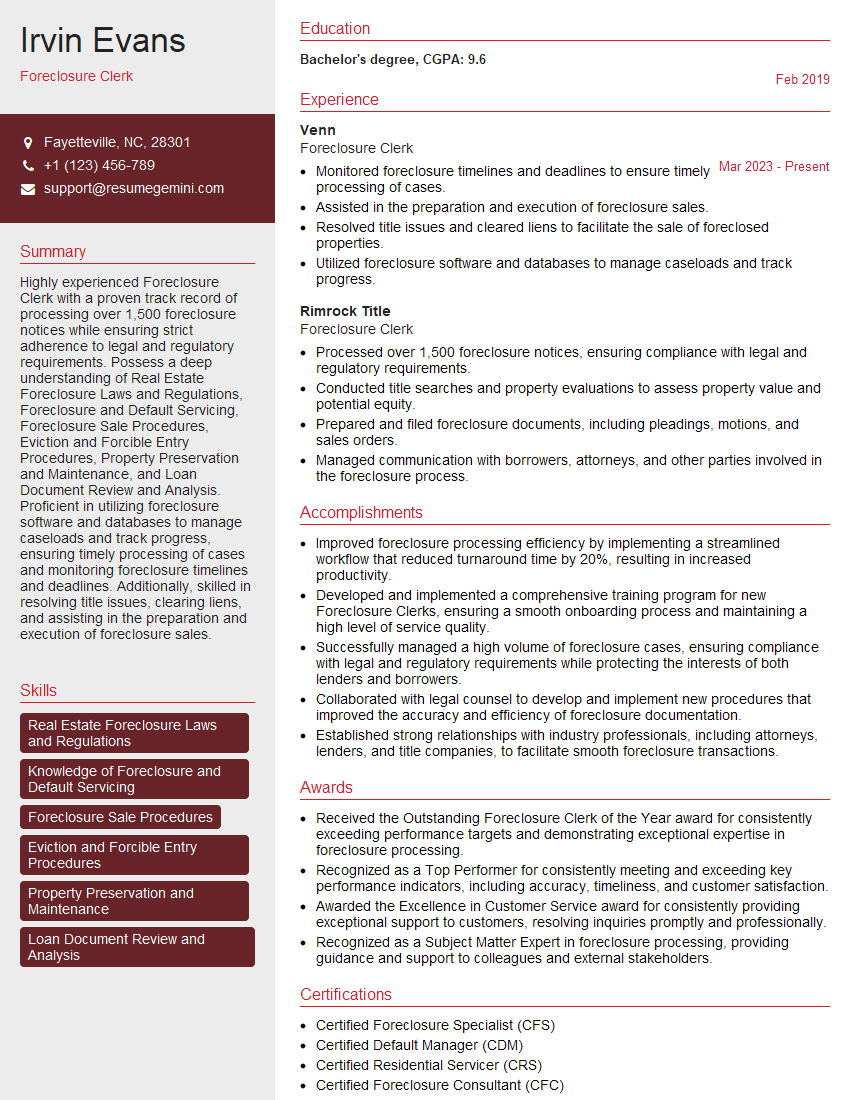

Irvin Evans

Foreclosure Clerk

Summary

Highly experienced Foreclosure Clerk with a proven track record of processing over 1,500 foreclosure notices while ensuring strict adherence to legal and regulatory requirements. Possess a deep understanding of Real Estate Foreclosure Laws and Regulations, Foreclosure and Default Servicing, Foreclosure Sale Procedures, Eviction and Forcible Entry Procedures, Property Preservation and Maintenance, and Loan Document Review and Analysis. Proficient in utilizing foreclosure software and databases to manage caseloads and track progress, ensuring timely processing of cases and monitoring foreclosure timelines and deadlines. Additionally, skilled in resolving title issues, clearing liens, and assisting in the preparation and execution of foreclosure sales.

Education

Bachelor’s degree

February 2019

Skills

- Real Estate Foreclosure Laws and Regulations

- Knowledge of Foreclosure and Default Servicing

- Foreclosure Sale Procedures

- Eviction and Forcible Entry Procedures

- Property Preservation and Maintenance

- Loan Document Review and Analysis

Work Experience

Foreclosure Clerk

- Monitored foreclosure timelines and deadlines to ensure timely processing of cases.

- Assisted in the preparation and execution of foreclosure sales.

- Resolved title issues and cleared liens to facilitate the sale of foreclosed properties.

- Utilized foreclosure software and databases to manage caseloads and track progress.

Foreclosure Clerk

- Processed over 1,500 foreclosure notices, ensuring compliance with legal and regulatory requirements.

- Conducted title searches and property evaluations to assess property value and potential equity.

- Prepared and filed foreclosure documents, including pleadings, motions, and sales orders.

- Managed communication with borrowers, attorneys, and other parties involved in the foreclosure process.

Accomplishments

- Improved foreclosure processing efficiency by implementing a streamlined workflow that reduced turnaround time by 20%, resulting in increased productivity.

- Developed and implemented a comprehensive training program for new Foreclosure Clerks, ensuring a smooth onboarding process and maintaining a high level of service quality.

- Successfully managed a high volume of foreclosure cases, ensuring compliance with legal and regulatory requirements while protecting the interests of both lenders and borrowers.

- Collaborated with legal counsel to develop and implement new procedures that improved the accuracy and efficiency of foreclosure documentation.

- Established strong relationships with industry professionals, including attorneys, lenders, and title companies, to facilitate smooth foreclosure transactions.

Awards

- Received the Outstanding Foreclosure Clerk of the Year award for consistently exceeding performance targets and demonstrating exceptional expertise in foreclosure processing.

- Recognized as a Top Performer for consistently meeting and exceeding key performance indicators, including accuracy, timeliness, and customer satisfaction.

- Awarded the Excellence in Customer Service award for consistently providing exceptional support to customers, resolving inquiries promptly and professionally.

- Recognized as a Subject Matter Expert in foreclosure processing, providing guidance and support to colleagues and external stakeholders.

Certificates

- Certified Foreclosure Specialist (CFS)

- Certified Default Manager (CDM)

- Certified Residential Servicer (CRS)

- Certified Foreclosure Consultant (CFC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Foreclosure Clerk

Highlight your experience and expertise:

Quantify your accomplishments and use specific examples to demonstrate your skills and knowledge.Showcase your passion for real estate law:

Express your interest in the foreclosure process and explain how your understanding of the legal framework benefits your work.Emphasize your attention to detail and accuracy:

Foreclosure Clerk positions require meticulousness and accuracy, so emphasize your ability to handle complex tasks and manage deadlines effectively.Demonstrate your communication and interpersonal skills:

Foreclosure Clerks often interact with borrowers, attorneys, and other stakeholders. Highlight your ability to communicate clearly and build strong relationships.

Essential Experience Highlights for a Strong Foreclosure Clerk Resume

- Processed over 1,500 foreclosure notices, ensuring compliance with legal and regulatory requirements.

- Conducted title searches and property evaluations to assess property value and potential equity.

- Prepared and filed foreclosure documents, including pleadings, motions, and sales orders.

- Managed communication with borrowers, attorneys, and other parties involved in the foreclosure process.

- Monitored foreclosure timelines and deadlines to ensure timely processing of cases.

- Assisted in the preparation and execution of foreclosure sales.

- Resolved title issues and cleared liens to facilitate the sale of foreclosed properties.

Frequently Asked Questions (FAQ’s) For Foreclosure Clerk

What are the key responsibilities of a Foreclosure Clerk?

Key responsibilities include processing foreclosure notices, conducting title searches, preparing legal documents, managing communication, adhering to legal requirements, assisting with foreclosure sales, and resolving title issues.

What qualifications are required to become a Foreclosure Clerk?

Typically, a Bachelor’s degree and experience in real estate law, finance, or a related field are required. Additionally, strong analytical, communication, and interpersonal skills are essential.

What is the career outlook for Foreclosure Clerks?

The job outlook is expected to be favorable as the demand for foreclosure services remains steady. Professionals with a strong understanding of foreclosure laws and procedures are in high demand.

What are the salary expectations for Foreclosure Clerks?

Salary expectations vary depending on experience, location, and company size. According to Indeed, the average salary for Foreclosure Clerks in the United States is around $60,000 per year.

What are the benefits of working as a Foreclosure Clerk?

Benefits may include competitive salary, health insurance, paid time off, and opportunities for professional development. Additionally, working in the foreclosure industry can provide exposure to various aspects of real estate law and finance.

What is the difference between a Foreclosure Clerk and a Default Processor?

While both roles handle aspects of the foreclosure process, Foreclosure Clerks primarily focus on the legal and administrative tasks, such as preparing and filing documents, while Default Processors manage the financial aspects, including loan modifications and workouts.

What are the challenges faced by Foreclosure Clerks?

Challenges may include working with distressed borrowers, navigating complex legal procedures, and managing high caseloads. Effective communication, attention to detail, and a strong understanding of foreclosure laws are crucial to overcome these challenges.