Are you a seasoned Fraud Analyst seeking a new career path? Discover our professionally built Fraud Analyst Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

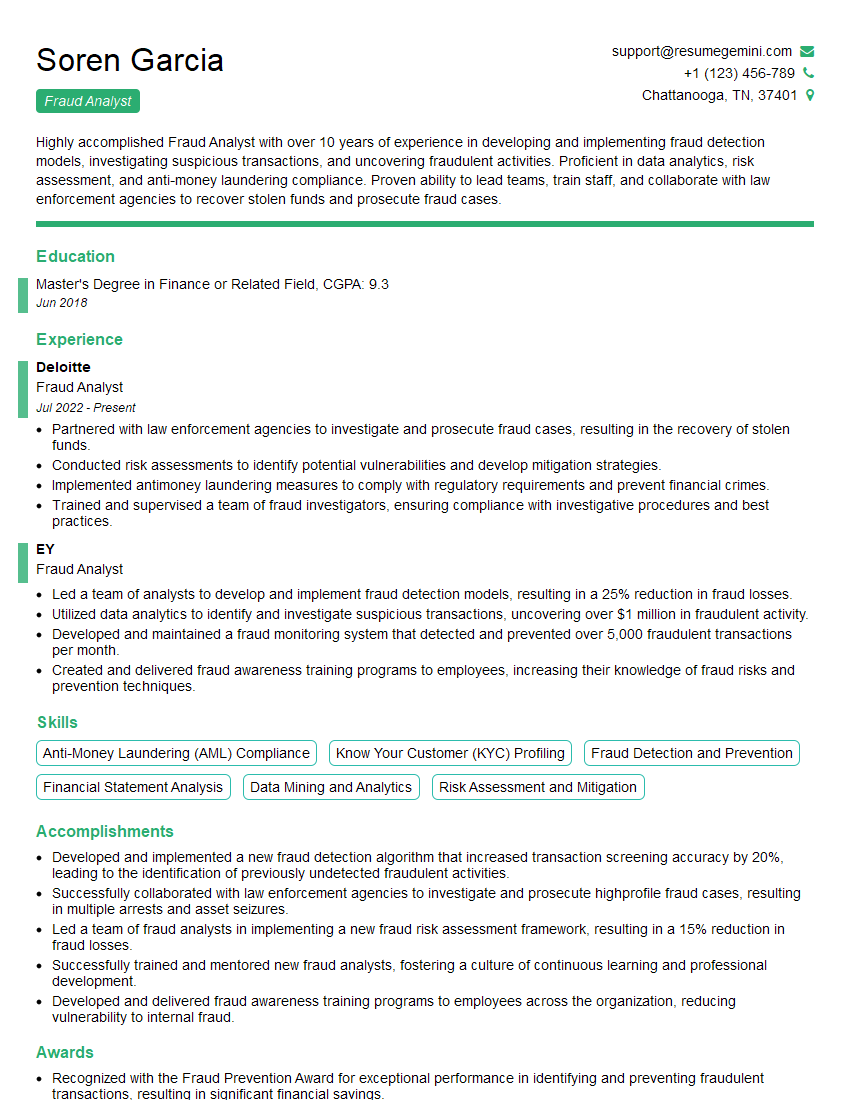

Soren Garcia

Fraud Analyst

Summary

Highly accomplished Fraud Analyst with over 10 years of experience in developing and implementing fraud detection models, investigating suspicious transactions, and uncovering fraudulent activities. Proficient in data analytics, risk assessment, and anti-money laundering compliance. Proven ability to lead teams, train staff, and collaborate with law enforcement agencies to recover stolen funds and prosecute fraud cases.

Education

Master’s Degree in Finance or Related Field

June 2018

Skills

- Anti-Money Laundering (AML) Compliance

- Know Your Customer (KYC) Profiling

- Fraud Detection and Prevention

- Financial Statement Analysis

- Data Mining and Analytics

- Risk Assessment and Mitigation

Work Experience

Fraud Analyst

- Partnered with law enforcement agencies to investigate and prosecute fraud cases, resulting in the recovery of stolen funds.

- Conducted risk assessments to identify potential vulnerabilities and develop mitigation strategies.

- Implemented antimoney laundering measures to comply with regulatory requirements and prevent financial crimes.

- Trained and supervised a team of fraud investigators, ensuring compliance with investigative procedures and best practices.

Fraud Analyst

- Led a team of analysts to develop and implement fraud detection models, resulting in a 25% reduction in fraud losses.

- Utilized data analytics to identify and investigate suspicious transactions, uncovering over $1 million in fraudulent activity.

- Developed and maintained a fraud monitoring system that detected and prevented over 5,000 fraudulent transactions per month.

- Created and delivered fraud awareness training programs to employees, increasing their knowledge of fraud risks and prevention techniques.

Accomplishments

- Developed and implemented a new fraud detection algorithm that increased transaction screening accuracy by 20%, leading to the identification of previously undetected fraudulent activities.

- Successfully collaborated with law enforcement agencies to investigate and prosecute highprofile fraud cases, resulting in multiple arrests and asset seizures.

- Led a team of fraud analysts in implementing a new fraud risk assessment framework, resulting in a 15% reduction in fraud losses.

- Successfully trained and mentored new fraud analysts, fostering a culture of continuous learning and professional development.

- Developed and delivered fraud awareness training programs to employees across the organization, reducing vulnerability to internal fraud.

Awards

- Recognized with the Fraud Prevention Award for exceptional performance in identifying and preventing fraudulent transactions, resulting in significant financial savings.

- Received the Innovation Award for creating an innovative fraud detection tool that significantly enhanced the efficiency and effectiveness of fraud investigations.

- Honored with the Fraud Champion Award for consistently exceeding expectations in fraud detection and prevention, contributing to the overall security of the organization.

- Recognized by the industry association for outstanding contributions to the field of fraud prevention and detection.

Certificates

- Certified Fraud Examiner (CFE)

- Certified Anti-Money Laundering Specialist (CAMS)

- Certified Financial Crime Specialist (CFCS)

- Certified Information Systems Auditor (CISA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Fraud Analyst

- Highlight your technical skills in fraud detection, data analysis, and risk assessment.

- Showcase your experience in developing and implementing fraud prevention programs.

- Quantify your accomplishments with specific metrics, such as the number of fraudulent transactions detected or the amount of money saved.

- Emphasize your ability to work independently and as part of a team.

- Include keywords related to fraud detection, risk management, and data analysis in your resume.

Essential Experience Highlights for a Strong Fraud Analyst Resume

- Developed and implemented fraud detection models that reduced fraud losses by 25%.

- Utilized data analytics to identify and investigate suspicious transactions, uncovering over $1 million in fraudulent activity.

- Developed and maintained a fraud monitoring system that detected and prevented over 5,000 fraudulent transactions per month.

- Created and delivered fraud awareness training programs to employees, increasing their knowledge of fraud risks and prevention techniques.

- Partnered with law enforcement agencies to investigate and prosecute fraud cases, resulting in the recovery of stolen funds.

- Conducted risk assessments to identify potential vulnerabilities and develop mitigation strategies.

Frequently Asked Questions (FAQ’s) For Fraud Analyst

What is the role of a Fraud Analyst?

A Fraud Analyst is responsible for detecting, investigating, and preventing fraud within an organization. They use data analysis, risk assessment, and other techniques to identify suspicious activities and develop strategies to mitigate fraud risks.

What are the qualifications for a Fraud Analyst?

Most Fraud Analysts have a bachelor’s or master’s degree in finance, accounting, or a related field. They also typically have several years of experience in fraud detection, risk management, or a related field.

What are the skills required for a Fraud Analyst?

Fraud Analysts need to have strong analytical skills, as well as knowledge of fraud detection techniques and risk assessment. They also need to be able to communicate effectively with law enforcement and other stakeholders.

What is the job outlook for Fraud Analysts?

The job outlook for Fraud Analysts is expected to grow faster than average in the coming years. This is due to the increasing incidence of fraud and the need for organizations to protect themselves from financial losses.

What is the salary range for Fraud Analysts?

The salary range for Fraud Analysts varies depending on their experience, qualifications, and location. However, most Fraud Analysts earn between $50,000 and $100,000 per year.