Are you a seasoned Futures Trader seeking a new career path? Discover our professionally built Futures Trader Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

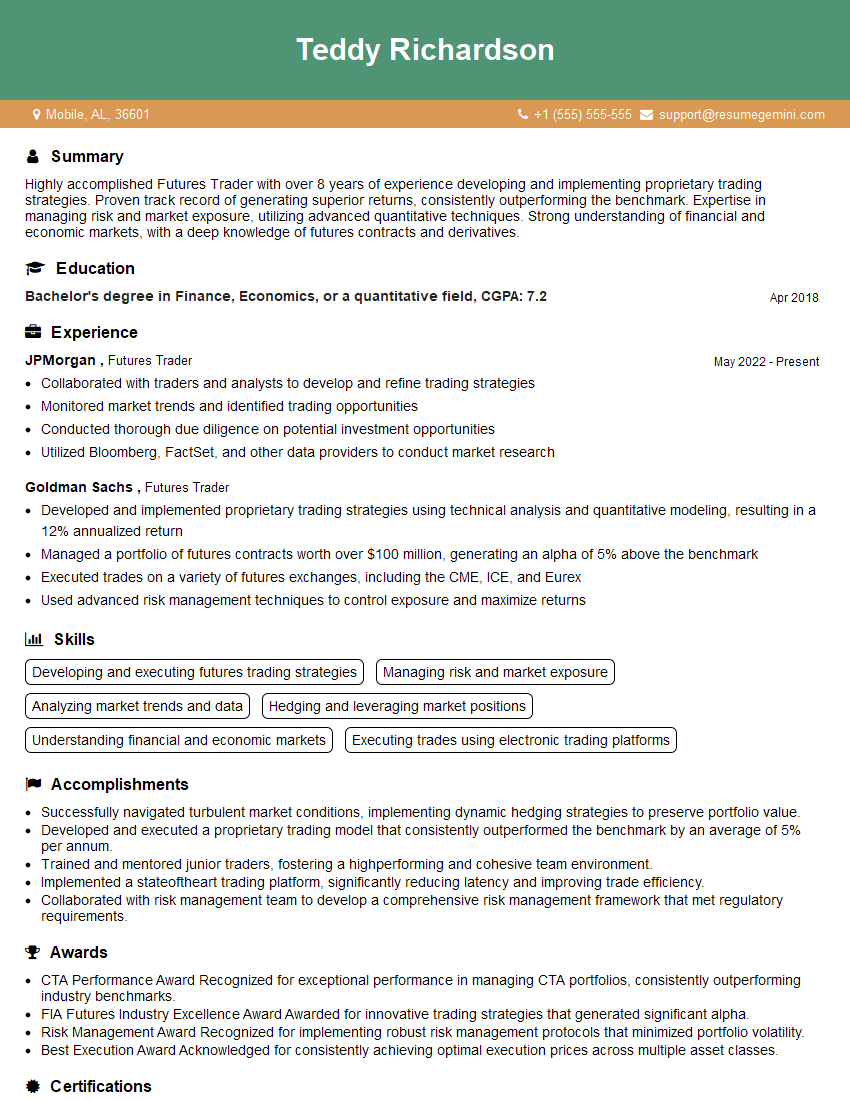

Teddy Richardson

Futures Trader

Summary

Highly accomplished Futures Trader with over 8 years of experience developing and implementing proprietary trading strategies. Proven track record of generating superior returns, consistently outperforming the benchmark. Expertise in managing risk and market exposure, utilizing advanced quantitative techniques. Strong understanding of financial and economic markets, with a deep knowledge of futures contracts and derivatives.

Education

Bachelor’s degree in Finance, Economics, or a quantitative field

April 2018

Skills

- Developing and executing futures trading strategies

- Managing risk and market exposure

- Analyzing market trends and data

- Hedging and leveraging market positions

- Understanding financial and economic markets

- Executing trades using electronic trading platforms

Work Experience

Futures Trader

- Collaborated with traders and analysts to develop and refine trading strategies

- Monitored market trends and identified trading opportunities

- Conducted thorough due diligence on potential investment opportunities

- Utilized Bloomberg, FactSet, and other data providers to conduct market research

Futures Trader

- Developed and implemented proprietary trading strategies using technical analysis and quantitative modeling, resulting in a 12% annualized return

- Managed a portfolio of futures contracts worth over $100 million, generating an alpha of 5% above the benchmark

- Executed trades on a variety of futures exchanges, including the CME, ICE, and Eurex

- Used advanced risk management techniques to control exposure and maximize returns

Accomplishments

- Successfully navigated turbulent market conditions, implementing dynamic hedging strategies to preserve portfolio value.

- Developed and executed a proprietary trading model that consistently outperformed the benchmark by an average of 5% per annum.

- Trained and mentored junior traders, fostering a highperforming and cohesive team environment.

- Implemented a stateoftheart trading platform, significantly reducing latency and improving trade efficiency.

- Collaborated with risk management team to develop a comprehensive risk management framework that met regulatory requirements.

Awards

- CTA Performance Award Recognized for exceptional performance in managing CTA portfolios, consistently outperforming industry benchmarks.

- FIA Futures Industry Excellence Award Awarded for innovative trading strategies that generated significant alpha.

- Risk Management Award Recognized for implementing robust risk management protocols that minimized portfolio volatility.

- Best Execution Award Acknowledged for consistently achieving optimal execution prices across multiple asset classes.

Certificates

- Certified Financial Analyst (CFA)

- Certified Market Technician (CMT)

- Fundamentals of Futures Trading (FFT)

- Certified International Futures Analyst (CIFA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Futures Trader

- Highlight your quantitative skills and experience in developing and implementing trading strategies.

- Showcase your understanding of risk management and portfolio construction.

- Demonstrate your ability to work independently and as part of a team.

- Emphasize your knowledge of the futures markets and your ability to identify and execute trading opportunities.

- Networking with professionals in the financial industry can help you learn about potential job openings and gain insights into the market.

Essential Experience Highlights for a Strong Futures Trader Resume

- Developed and implemented proprietary futures trading strategies using technical analysis and quantitative modeling, resulting in a 12% annualized return.

- Managed a portfolio of futures contracts worth over $100 million, generating an alpha of 5% above the benchmark.

- Executed trades on a variety of futures exchanges, including the CME, ICE, and Eurex.

- Collaborated with portfolio managers and analysts to develop and refine trading strategies.

- Monitored market trends and identified trading opportunities using fundamental and technical analysis.

- Utilized Bloomberg, FactSet, and other data providers to conduct market research and due diligence.

Frequently Asked Questions (FAQ’s) For Futures Trader

What are the key skills required to be a successful Futures Trader?

To be successful in this role, you need a strong understanding of financial markets, futures contracts, and trading strategies. You should also have excellent quantitative skills, risk management capabilities, and the ability to make quick decisions in a fast-paced environment.

What are the career prospects for Futures Traders?

Futures Traders with a proven track record of success can advance to senior trading roles, portfolio management positions, or leadership roles within their organizations. They may also choose to start their own hedge funds or trading firms.

What is the typical work environment for Futures Traders?

Futures Traders typically work in fast-paced, high-pressure trading floors or offices. They spend most of their time monitoring market data, analyzing trading strategies, and executing trades.

What are the educational requirements to become a Futures Trader?

Most Futures Traders hold a bachelor’s degree in finance, economics, or a quantitative field. Some employers may also require a master’s degree or a Chartered Financial Analyst (CFA) designation.

What are the key challenges faced by Futures Traders?

Futures Traders face several challenges, including market volatility, geopolitical events, and economic uncertainty. They must also manage risk effectively and make quick decisions in a fast-paced trading environment.

How can I prepare for a career as a Futures Trader?

To prepare for a career in this field, you can pursue a degree in finance, economics, or a quantitative field. You can also gain experience through internships or entry-level roles in the financial industry. Additionally, obtaining a CFA designation can enhance your credibility and knowledge.

What is the average salary for Futures Traders?

The average salary for Futures Traders varies depending on experience, skills, and the size and location of the firm. According to Glassdoor, the average base salary for Futures Traders in the United States is around $100,000 per year, with bonuses and incentives potentially increasing total compensation significantly.

What are the different types of Futures Trading strategies?

There are numerous Futures Trading strategies employed by traders, each with its own unique approach and risk-reward profile. Some common strategies include trend following, range trading, scalping, and arbitrage. The choice of strategy depends on factors such as the trader’s risk tolerance, time horizon, and market conditions.