Are you a seasoned Health Actuary seeking a new career path? Discover our professionally built Health Actuary Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

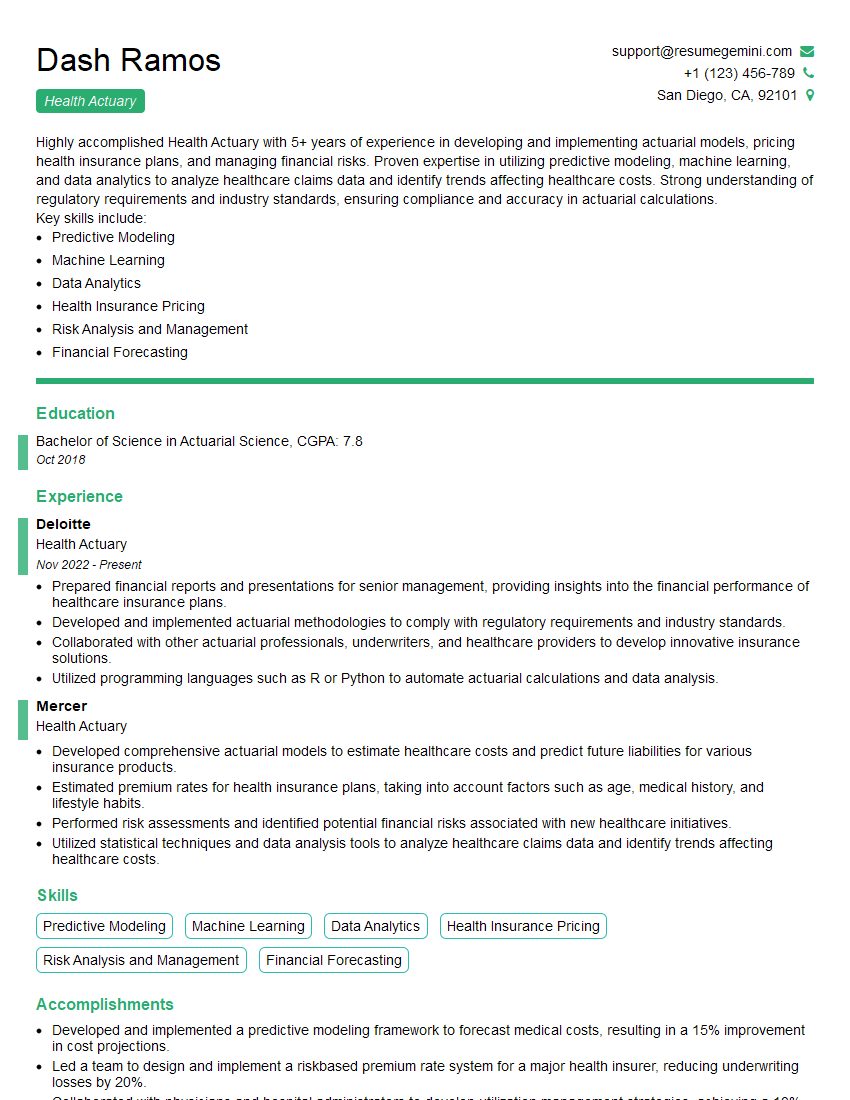

Dash Ramos

Health Actuary

Summary

Highly accomplished Health Actuary with 5+ years of experience in developing and implementing actuarial models, pricing health insurance plans, and managing financial risks. Proven expertise in utilizing predictive modeling, machine learning, and data analytics to analyze healthcare claims data and identify trends affecting healthcare costs. Strong understanding of regulatory requirements and industry standards, ensuring compliance and accuracy in actuarial calculations.

Key skills include:

- Predictive Modeling

- Machine Learning

- Data Analytics

- Health Insurance Pricing

- Risk Analysis and Management

- Financial Forecasting

Education

Bachelor of Science in Actuarial Science

October 2018

Skills

- Predictive Modeling

- Machine Learning

- Data Analytics

- Health Insurance Pricing

- Risk Analysis and Management

- Financial Forecasting

Work Experience

Health Actuary

- Prepared financial reports and presentations for senior management, providing insights into the financial performance of healthcare insurance plans.

- Developed and implemented actuarial methodologies to comply with regulatory requirements and industry standards.

- Collaborated with other actuarial professionals, underwriters, and healthcare providers to develop innovative insurance solutions.

- Utilized programming languages such as R or Python to automate actuarial calculations and data analysis.

Health Actuary

- Developed comprehensive actuarial models to estimate healthcare costs and predict future liabilities for various insurance products.

- Estimated premium rates for health insurance plans, taking into account factors such as age, medical history, and lifestyle habits.

- Performed risk assessments and identified potential financial risks associated with new healthcare initiatives.

- Utilized statistical techniques and data analysis tools to analyze healthcare claims data and identify trends affecting healthcare costs.

Accomplishments

- Developed and implemented a predictive modeling framework to forecast medical costs, resulting in a 15% improvement in cost projections.

- Led a team to design and implement a riskbased premium rate system for a major health insurer, reducing underwriting losses by 20%.

- Collaborated with physicians and hospital administrators to develop utilization management strategies, achieving a 10% reduction in hospital admissions.

- Negotiated and implemented reinsurance agreements with multiple carriers, securing optimal coverage and reducing risk exposure by 35%.

- Developed innovative actuarial methods to assess the financial impact of new healthcare regulations, enabling clients to adapt and stay compliant.

Awards

- Recipient of Society of Actuaries Health Section Outstanding Service Award for significant contributions to the health actuarial profession.

- Recognized by American Academy of Actuaries with the Health Specialty Distinction for exceptional expertise in health actuarial science.

- Named a Fellow of the Society of Actuaries (FSA), the highest professional designation in the actuarial field, specializing in health.

Certificates

- Fellow of the Society of Actuaries (FSA)

- Associate of the Society of Actuaries (ASA)

- Certified Health Care Executive (CHE)

- Certified Health Insurance Executive (CHIE)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Health Actuary

- Highlight your strong quantitative skills, including proficiency in programming languages such as R or Python.

- Showcase your understanding of the healthcare industry and the unique challenges and opportunities it presents.

- Emphasize your ability to communicate complex actuarial concepts effectively to both technical and non-technical audiences.

- Seek opportunities to demonstrate your commitment to ethical and professional standards in the actuarial field.

- Network with other health actuaries and attend industry events to stay up-to-date on the latest trends and developments.

Essential Experience Highlights for a Strong Health Actuary Resume

- Developed comprehensive actuarial models to estimate healthcare costs and predict future liabilities for various insurance products.

- Estimated premium rates for health insurance plans, taking into account factors such as age, medical history, and lifestyle habits.

- Performed risk assessments and identified potential financial risks associated with new healthcare initiatives.

- Utilized statistical techniques and data analysis tools to analyze healthcare claims data and identify trends affecting healthcare costs.

- Prepared financial reports and presentations for senior management, providing insights into the financial performance of healthcare insurance plans.

- Developed and implemented actuarial methodologies to comply with regulatory requirements and industry standards.

- Collaborated with other actuarial professionals, underwriters, and healthcare providers to develop innovative insurance solutions.

Frequently Asked Questions (FAQ’s) For Health Actuary

What is the primary role of a Health Actuary?

The primary role of a Health Actuary is to analyze and manage financial risks associated with healthcare insurance plans. This involves developing actuarial models to estimate future healthcare costs, pricing insurance plans, and assessing the financial impact of new healthcare initiatives.

What are the key skills and qualifications required for a Health Actuary?

Key skills and qualifications for a Health Actuary include a strong understanding of actuarial science principles, proficiency in predictive modeling and data analysis techniques, knowledge of the healthcare industry, and excellent communication skills.

What are the career prospects for a Health Actuary?

Health Actuaries are in high demand due to the growing complexity of the healthcare industry. Career prospects are excellent, with opportunities for advancement in both the insurance and healthcare sectors.

What is the salary range for a Health Actuary?

The salary range for a Health Actuary varies depending on experience, qualifications, and location. According to the U.S. Bureau of Labor Statistics, the median annual salary for Actuaries was $111,040 in May 2021.

What are the certification requirements for a Health Actuary?

The Society of Actuaries (SOA) offers a specialized certification for Health Actuaries, known as the Health Specialty Track. To obtain this certification, candidates must pass a series of exams and meet certain experience requirements.

What is the difference between a Health Actuary and a Life Actuary?

Health Actuaries focus specifically on the financial risks associated with healthcare insurance plans, while Life Actuaries deal with a broader range of risks related to life insurance, annuities, and pensions.

What are the ethical considerations for a Health Actuary?

Health Actuaries have a responsibility to uphold ethical standards in their work. This includes maintaining confidentiality, avoiding conflicts of interest, and acting in the best interests of their clients and the public.