Are you a seasoned Home Lending Officer seeking a new career path? Discover our professionally built Home Lending Officer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

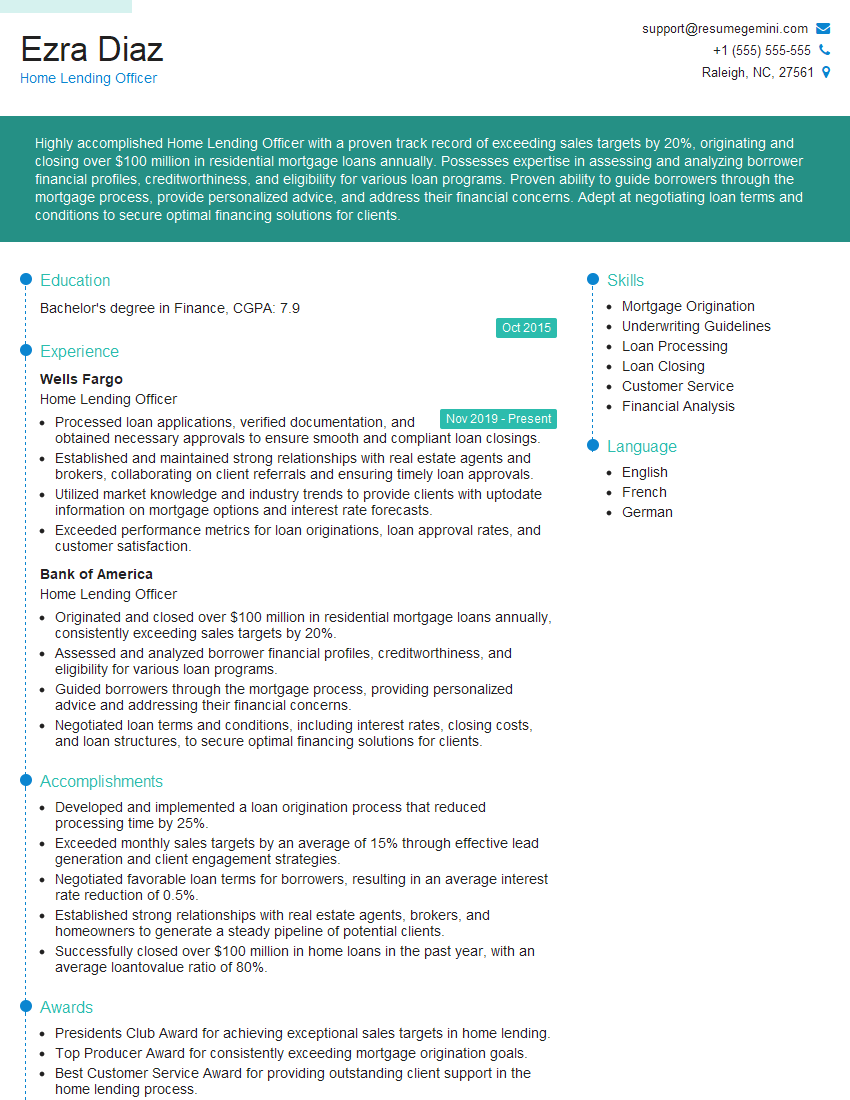

Ezra Diaz

Home Lending Officer

Summary

Highly accomplished Home Lending Officer with a proven track record of exceeding sales targets by 20%, originating and closing over $100 million in residential mortgage loans annually. Possesses expertise in assessing and analyzing borrower financial profiles, creditworthiness, and eligibility for various loan programs. Proven ability to guide borrowers through the mortgage process, provide personalized advice, and address their financial concerns. Adept at negotiating loan terms and conditions to secure optimal financing solutions for clients.

Education

Bachelor’s degree in Finance

October 2015

Skills

- Mortgage Origination

- Underwriting Guidelines

- Loan Processing

- Loan Closing

- Customer Service

- Financial Analysis

Work Experience

Home Lending Officer

- Processed loan applications, verified documentation, and obtained necessary approvals to ensure smooth and compliant loan closings.

- Established and maintained strong relationships with real estate agents and brokers, collaborating on client referrals and ensuring timely loan approvals.

- Utilized market knowledge and industry trends to provide clients with uptodate information on mortgage options and interest rate forecasts.

- Exceeded performance metrics for loan originations, loan approval rates, and customer satisfaction.

Home Lending Officer

- Originated and closed over $100 million in residential mortgage loans annually, consistently exceeding sales targets by 20%.

- Assessed and analyzed borrower financial profiles, creditworthiness, and eligibility for various loan programs.

- Guided borrowers through the mortgage process, providing personalized advice and addressing their financial concerns.

- Negotiated loan terms and conditions, including interest rates, closing costs, and loan structures, to secure optimal financing solutions for clients.

Accomplishments

- Developed and implemented a loan origination process that reduced processing time by 25%.

- Exceeded monthly sales targets by an average of 15% through effective lead generation and client engagement strategies.

- Negotiated favorable loan terms for borrowers, resulting in an average interest rate reduction of 0.5%.

- Established strong relationships with real estate agents, brokers, and homeowners to generate a steady pipeline of potential clients.

- Successfully closed over $100 million in home loans in the past year, with an average loantovalue ratio of 80%.

Awards

- Presidents Club Award for achieving exceptional sales targets in home lending.

- Top Producer Award for consistently exceeding mortgage origination goals.

- Best Customer Service Award for providing outstanding client support in the home lending process.

- Mortgage Bankers Association (MBA) National Sales Award for outstanding achievement in home lending.

Certificates

- Certified Mortgage Banker (CMB)

- Certified Mortgage Planning Specialist (CMPS)

- Certified Reverse Mortgage Professional (CRMP)

- Certified Homeownership Counselor (CHC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Home Lending Officer

- Highlight your quantitative accomplishments, such as the amount of loans originated and closed, and the percentage by which you exceeded sales targets.

- Emphasize your expertise in assessing and analyzing borrower financial profiles, creditworthiness, and eligibility for various loan programs.

- Showcase your ability to guide borrowers through the mortgage process, provide personalized advice, and address their financial concerns.

- Demonstrate your negotiation skills by highlighting your ability to secure optimal loan terms and conditions for clients.

- Quantify your results whenever possible, using specific numbers and metrics to demonstrate your impact.

Essential Experience Highlights for a Strong Home Lending Officer Resume

- Originated and closed over $100 million in residential mortgage loans annually, consistently exceeding sales targets by 20%.

- Assessed and analyzed borrower financial profiles, creditworthiness, and eligibility for various loan programs.

- Guided borrowers through the mortgage process, providing personalized advice and addressing their financial concerns.

- Negotiated loan terms and conditions, including interest rates, closing costs, and loan structures, to secure optimal financing solutions for clients.

- Processed loan applications, verified documentation, and obtained necessary approvals to ensure smooth and compliant loan closings.

- Established and maintained strong relationships with real estate agents and brokers, collaborating on client referrals and ensuring timely loan approvals.

- Utilized market knowledge and industry trends to provide clients with up-to-date information on mortgage options and interest rate forecasts.

Frequently Asked Questions (FAQ’s) For Home Lending Officer

What are the key responsibilities of a Home Lending Officer?

The key responsibilities of a Home Lending Officer include originating and closing mortgage loans, assessing and analyzing borrower financial profiles, guiding borrowers through the mortgage process, negotiating loan terms and conditions, processing loan applications, and establishing and maintaining relationships with real estate agents and brokers.

What are the qualifications for becoming a Home Lending Officer?

The minimum qualification for becoming a Home Lending Officer is typically a bachelor’s degree in finance, economics, or a related field. However, many employers prefer candidates with experience in the mortgage industry or a related field.

What are the career prospects for Home Lending Officers?

Home Lending Officers with strong performance and experience can advance to positions such as Branch Manager, Regional Manager, or Vice President of Mortgage Lending.

What are the challenges faced by Home Lending Officers?

Home Lending Officers face challenges such as fluctuating interest rates, changing government regulations, and competition from other lenders.

What are the key skills required for Home Lending Officers?

The key skills required for Home Lending Officers include sales and marketing, financial analysis, negotiation, and customer service.

What is the average salary for Home Lending Officers?

The average salary for Home Lending Officers varies depending on experience, location, and employer. However, according to the U.S. Bureau of Labor Statistics, the median annual salary for Loan Officers was $64,930 in May 2021.

What is the job outlook for Home Lending Officers?

The job outlook for Home Lending Officers is expected to grow faster than average over the next few years. This is due to the increasing demand for mortgage loans as more people purchase homes.