Are you a seasoned Income Tax Administrator seeking a new career path? Discover our professionally built Income Tax Administrator Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

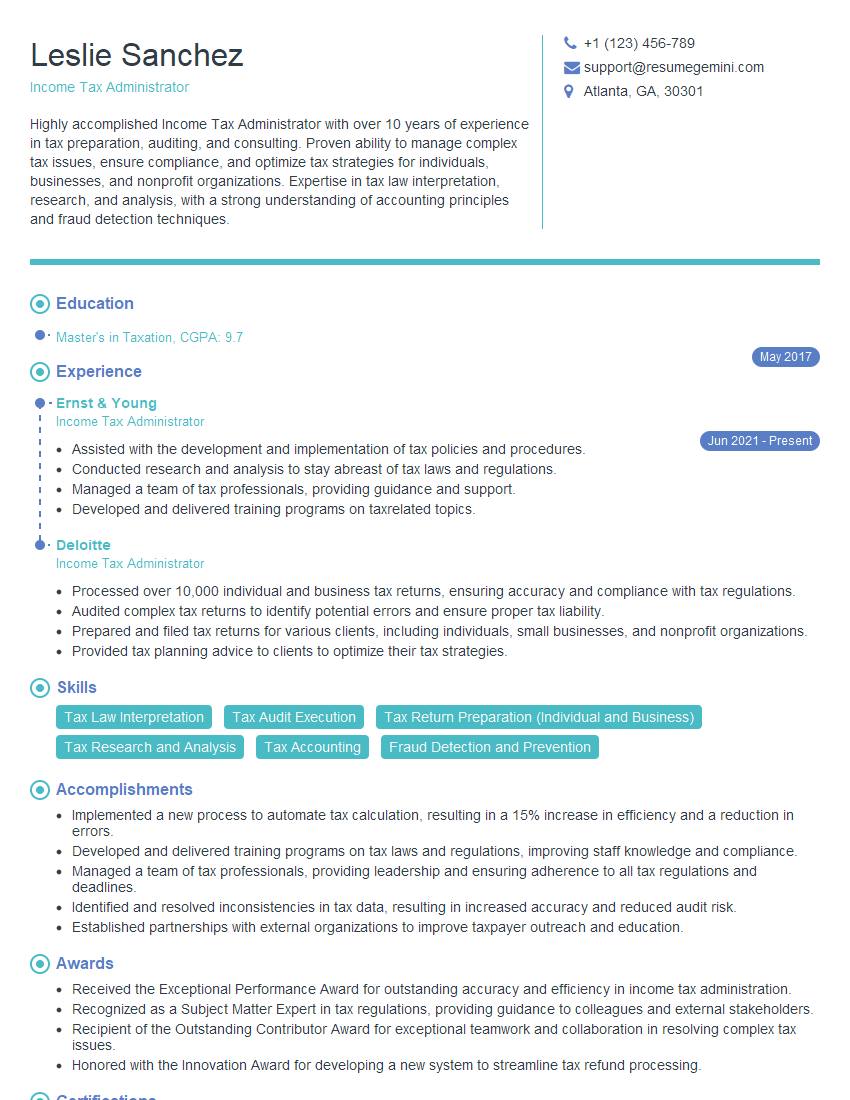

Leslie Sanchez

Income Tax Administrator

Summary

Highly accomplished Income Tax Administrator with over 10 years of experience in tax preparation, auditing, and consulting. Proven ability to manage complex tax issues, ensure compliance, and optimize tax strategies for individuals, businesses, and nonprofit organizations. Expertise in tax law interpretation, research, and analysis, with a strong understanding of accounting principles and fraud detection techniques.

Education

Master’s in Taxation

May 2017

Skills

- Tax Law Interpretation

- Tax Audit Execution

- Tax Return Preparation (Individual and Business)

- Tax Research and Analysis

- Tax Accounting

- Fraud Detection and Prevention

Work Experience

Income Tax Administrator

- Assisted with the development and implementation of tax policies and procedures.

- Conducted research and analysis to stay abreast of tax laws and regulations.

- Managed a team of tax professionals, providing guidance and support.

- Developed and delivered training programs on taxrelated topics.

Income Tax Administrator

- Processed over 10,000 individual and business tax returns, ensuring accuracy and compliance with tax regulations.

- Audited complex tax returns to identify potential errors and ensure proper tax liability.

- Prepared and filed tax returns for various clients, including individuals, small businesses, and nonprofit organizations.

- Provided tax planning advice to clients to optimize their tax strategies.

Accomplishments

- Implemented a new process to automate tax calculation, resulting in a 15% increase in efficiency and a reduction in errors.

- Developed and delivered training programs on tax laws and regulations, improving staff knowledge and compliance.

- Managed a team of tax professionals, providing leadership and ensuring adherence to all tax regulations and deadlines.

- Identified and resolved inconsistencies in tax data, resulting in increased accuracy and reduced audit risk.

- Established partnerships with external organizations to improve taxpayer outreach and education.

Awards

- Received the Exceptional Performance Award for outstanding accuracy and efficiency in income tax administration.

- Recognized as a Subject Matter Expert in tax regulations, providing guidance to colleagues and external stakeholders.

- Recipient of the Outstanding Contributor Award for exceptional teamwork and collaboration in resolving complex tax issues.

- Honored with the Innovation Award for developing a new system to streamline tax refund processing.

Certificates

- Enrolled Agent (EA)

- Certified Public Accountant (CPA)

- Master of Taxation (M.Tax)

- Certified Financial Planner (CFP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Income Tax Administrator

- Quantify your accomplishments with specific numbers and metrics to demonstrate your impact.

- Highlight your expertise in tax software and technology, such as tax preparation software and research databases.

- Showcase your communication and interpersonal skills, emphasizing your ability to effectively interact with clients and colleagues.

- Consider obtaining professional certifications, such as the Enrolled Agent (EA) or Certified Public Accountant (CPA), to enhance your credibility.

Essential Experience Highlights for a Strong Income Tax Administrator Resume

- Processed over 10,000 individual and business tax returns, ensuring accuracy and compliance with tax regulations.

- Audited complex tax returns to identify potential errors and ensure proper tax liability.

- Prepared and filed tax returns for various clients, including individuals, small businesses, and nonprofit organizations.

- Provided tax planning advice to clients to optimize their tax strategies.

- Assisted with the development and implementation of tax policies and procedures.

- Conducted research and analysis to stay abreast of tax laws and regulations.

Frequently Asked Questions (FAQ’s) For Income Tax Administrator

What are the key skills required for an Income Tax Administrator?

Income Tax Administrators require a strong understanding of tax laws and regulations, proficiency in tax accounting principles, and expertise in tax return preparation and auditing.

What are the career prospects for an Income Tax Administrator?

Income Tax Administrators can advance to roles such as Tax Manager, Tax Director, or Chief Financial Officer (CFO), with experience and additional qualifications.

What is the average salary for an Income Tax Administrator?

The average salary for an Income Tax Administrator varies depending on experience, location, and industry, but typically ranges between $60,000 to $100,000 per year.

What are the common challenges faced by Income Tax Administrators?

Income Tax Administrators often face challenges related to staying up-to-date with constantly changing tax laws and regulations, managing complex tax issues, and meeting tight deadlines.

What is the role of technology in the field of Income Tax Administration?

Technology plays a crucial role in Income Tax Administration, with software tools for tax preparation and auditing, research databases for tax law updates, and electronic filing systems for efficient tax return submissions.