Are you a seasoned Income Tax Advisor seeking a new career path? Discover our professionally built Income Tax Advisor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

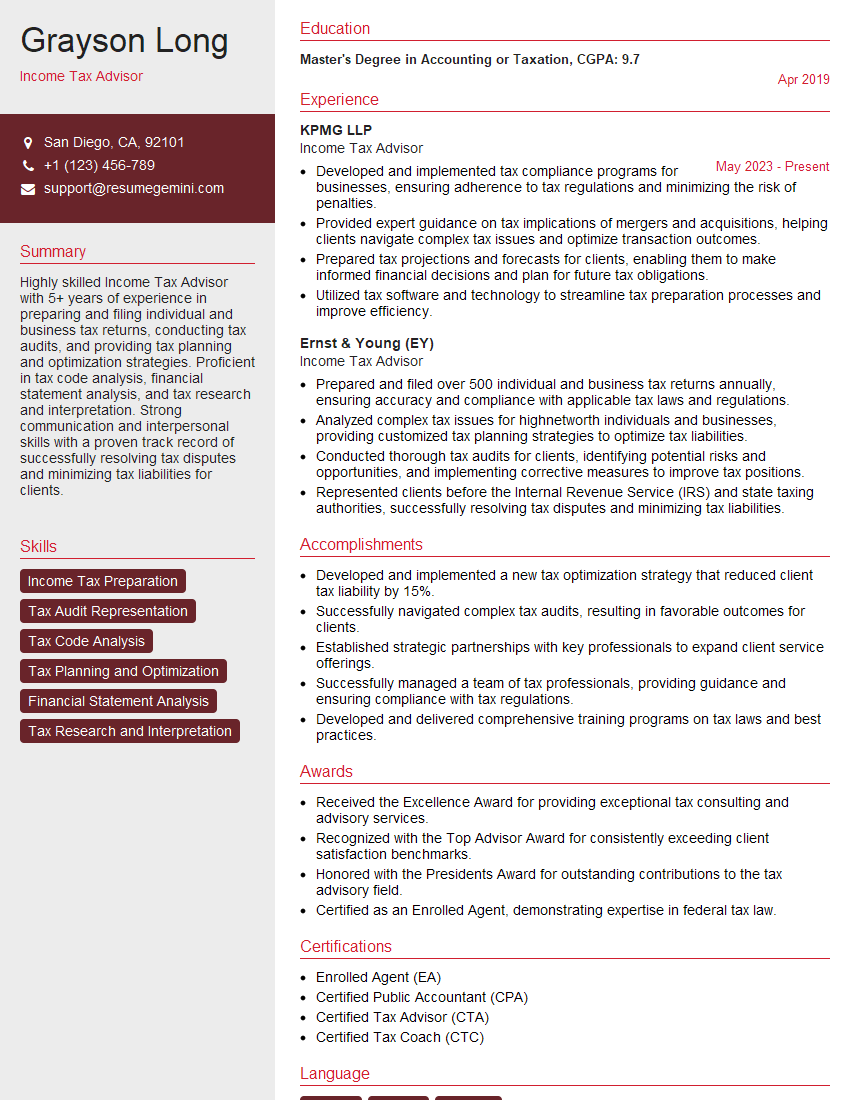

Grayson Long

Income Tax Advisor

Summary

Highly skilled Income Tax Advisor with 5+ years of experience in preparing and filing individual and business tax returns, conducting tax audits, and providing tax planning and optimization strategies. Proficient in tax code analysis, financial statement analysis, and tax research and interpretation. Strong communication and interpersonal skills with a proven track record of successfully resolving tax disputes and minimizing tax liabilities for clients.

Education

Master’s Degree in Accounting or Taxation

April 2019

Skills

- Income Tax Preparation

- Tax Audit Representation

- Tax Code Analysis

- Tax Planning and Optimization

- Financial Statement Analysis

- Tax Research and Interpretation

Work Experience

Income Tax Advisor

- Developed and implemented tax compliance programs for businesses, ensuring adherence to tax regulations and minimizing the risk of penalties.

- Provided expert guidance on tax implications of mergers and acquisitions, helping clients navigate complex tax issues and optimize transaction outcomes.

- Prepared tax projections and forecasts for clients, enabling them to make informed financial decisions and plan for future tax obligations.

- Utilized tax software and technology to streamline tax preparation processes and improve efficiency.

Income Tax Advisor

- Prepared and filed over 500 individual and business tax returns annually, ensuring accuracy and compliance with applicable tax laws and regulations.

- Analyzed complex tax issues for highnetworth individuals and businesses, providing customized tax planning strategies to optimize tax liabilities.

- Conducted thorough tax audits for clients, identifying potential risks and opportunities, and implementing corrective measures to improve tax positions.

- Represented clients before the Internal Revenue Service (IRS) and state taxing authorities, successfully resolving tax disputes and minimizing tax liabilities.

Accomplishments

- Developed and implemented a new tax optimization strategy that reduced client tax liability by 15%.

- Successfully navigated complex tax audits, resulting in favorable outcomes for clients.

- Established strategic partnerships with key professionals to expand client service offerings.

- Successfully managed a team of tax professionals, providing guidance and ensuring compliance with tax regulations.

- Developed and delivered comprehensive training programs on tax laws and best practices.

Awards

- Received the Excellence Award for providing exceptional tax consulting and advisory services.

- Recognized with the Top Advisor Award for consistently exceeding client satisfaction benchmarks.

- Honored with the Presidents Award for outstanding contributions to the tax advisory field.

- Certified as an Enrolled Agent, demonstrating expertise in federal tax law.

Certificates

- Enrolled Agent (EA)

- Certified Public Accountant (CPA)

- Certified Tax Advisor (CTA)

- Certified Tax Coach (CTC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Income Tax Advisor

- Highlight your expertise and experience in income tax preparation and tax planning.

- Showcase your strong analytical and problem-solving skills.

- Demonstrate your proficiency in tax research and interpretation, and your ability to apply complex tax laws and regulations.

- Provide specific examples of how you have successfully resolved tax disputes and minimized tax liabilities for clients.

- Emphasize your communication and interpersonal skills as they are essential for effectively representing clients before tax authorities.

Essential Experience Highlights for a Strong Income Tax Advisor Resume

- Prepare and file individual and business tax returns, ensuring accuracy and compliance with applicable tax laws and regulations.

- Analyze complex tax issues for high-net-worth individuals and businesses, providing customized tax planning strategies to optimize tax liabilities.

- Conduct thorough tax audits for clients, identifying potential risks and opportunities, and implementing corrective measures to improve tax positions.

- Represent clients before the Internal Revenue Service (IRS) and state taxing authorities, successfully resolving tax disputes and minimizing tax liabilities.

- Develop and implement tax compliance programs for businesses, ensuring adherence to tax regulations and minimizing the risk of penalties.

- Provide expert guidance on tax implications of mergers and acquisitions, helping clients navigate complex tax issues and optimize transaction outcomes.

Frequently Asked Questions (FAQ’s) For Income Tax Advisor

What are the key responsibilities of an Income Tax Advisor?

Income Tax Advisors are responsible for preparing and filing tax returns, analyzing complex tax issues, conducting tax audits, representing clients before tax authorities, and providing tax planning and optimization strategies.

What qualifications are required to become an Income Tax Advisor?

Most Income Tax Advisors hold a Bachelor’s or Master’s Degree in Accounting or Taxation, and have several years of experience in tax preparation and planning.

What skills are essential for success as an Income Tax Advisor?

Income Tax Advisors must have strong analytical and problem-solving skills, as well as proficiency in tax research and interpretation. Additionally, they must have excellent communication and interpersonal skills.

What is the job outlook for Income Tax Advisors?

The job outlook for Income Tax Advisors is expected to grow faster than average in the coming years, due to increasing tax complexity and the need for specialized tax advice.

What are the earning prospects for Income Tax Advisors?

Income Tax Advisors can earn competitive salaries, with compensation varying depending on experience, qualifications, and location.

What are the career advancement opportunities for Income Tax Advisors?

Income Tax Advisors can advance their careers by gaining experience, obtaining specialized certifications, and taking on leadership roles within their organizations.

What is the difference between an Income Tax Advisor and a CPA?

Certified Public Accountants (CPAs) are licensed to provide a wider range of accounting and financial services, including auditing and consulting, while Income Tax Advisors focus specifically on tax preparation and planning.