Are you a seasoned Income Tax Auditor seeking a new career path? Discover our professionally built Income Tax Auditor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

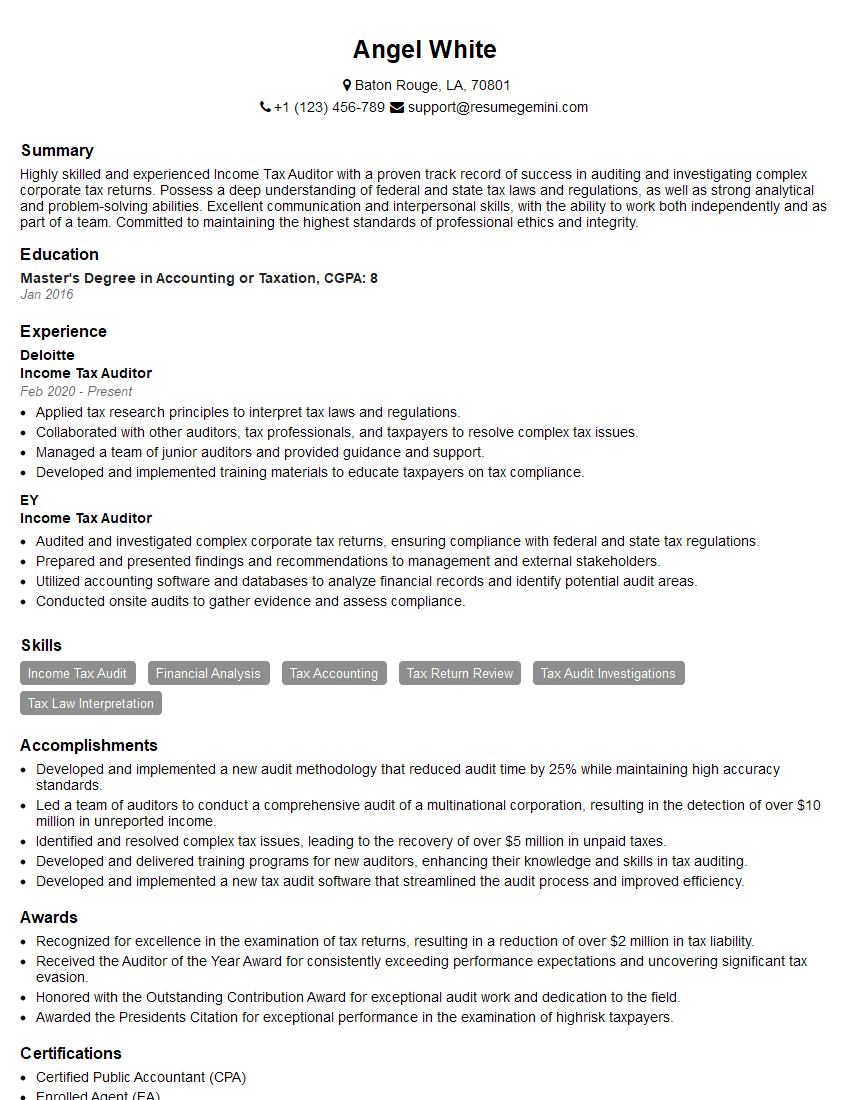

Angel White

Income Tax Auditor

Summary

Highly skilled and experienced Income Tax Auditor with a proven track record of success in auditing and investigating complex corporate tax returns. Possess a deep understanding of federal and state tax laws and regulations, as well as strong analytical and problem-solving abilities. Excellent communication and interpersonal skills, with the ability to work both independently and as part of a team. Committed to maintaining the highest standards of professional ethics and integrity.

Education

Master’s Degree in Accounting or Taxation

January 2016

Skills

- Income Tax Audit

- Financial Analysis

- Tax Accounting

- Tax Return Review

- Tax Audit Investigations

- Tax Law Interpretation

Work Experience

Income Tax Auditor

- Applied tax research principles to interpret tax laws and regulations.

- Collaborated with other auditors, tax professionals, and taxpayers to resolve complex tax issues.

- Managed a team of junior auditors and provided guidance and support.

- Developed and implemented training materials to educate taxpayers on tax compliance.

Income Tax Auditor

- Audited and investigated complex corporate tax returns, ensuring compliance with federal and state tax regulations.

- Prepared and presented findings and recommendations to management and external stakeholders.

- Utilized accounting software and databases to analyze financial records and identify potential audit areas.

- Conducted onsite audits to gather evidence and assess compliance.

Accomplishments

- Developed and implemented a new audit methodology that reduced audit time by 25% while maintaining high accuracy standards.

- Led a team of auditors to conduct a comprehensive audit of a multinational corporation, resulting in the detection of over $10 million in unreported income.

- Identified and resolved complex tax issues, leading to the recovery of over $5 million in unpaid taxes.

- Developed and delivered training programs for new auditors, enhancing their knowledge and skills in tax auditing.

- Developed and implemented a new tax audit software that streamlined the audit process and improved efficiency.

Awards

- Recognized for excellence in the examination of tax returns, resulting in a reduction of over $2 million in tax liability.

- Received the Auditor of the Year Award for consistently exceeding performance expectations and uncovering significant tax evasion.

- Honored with the Outstanding Contribution Award for exceptional audit work and dedication to the field.

- Awarded the Presidents Citation for exceptional performance in the examination of highrisk taxpayers.

Certificates

- Certified Public Accountant (CPA)

- Enrolled Agent (EA)

- Certified Internal Auditor (CIA)

- Certified Fraud Examiner (CFE)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Income Tax Auditor

- Highlight your relevant skills and experience in your resume, such as your expertise in tax accounting, tax audit investigations, and tax law interpretation.

- Quantify your accomplishments whenever possible. For example, instead of simply stating that you audited corporate tax returns, you could say that you audited over 100 corporate tax returns, resulting in the identification of over $1 million in tax savings.

- Tailor your resume to each job you apply for. Be sure to highlight the skills and experience that are most relevant to the specific job requirements.

- Proofread your resume carefully before submitting it. Make sure there are no errors in grammar or spelling.

- Get feedback on your resume from a friend, family member, or career counselor.

Essential Experience Highlights for a Strong Income Tax Auditor Resume

- Audited and investigated complex corporate tax returns, ensuring compliance with federal and state tax regulations.

- Prepared and presented findings and recommendations to management and external stakeholders.

- Utilized accounting software and databases to analyze financial records and identify potential audit areas.

- Conducted onsite audits to gather evidence and assess compliance.

- Applied tax research principles to interpret tax laws and regulations.

- Collaborated with other auditors, tax professionals, and taxpayers to resolve complex tax issues.

- Managed a team of junior auditors and provided guidance and support.

Frequently Asked Questions (FAQ’s) For Income Tax Auditor

What is the role of an Income Tax Auditor?

An Income Tax Auditor is responsible for examining an individual’s or organization’s tax return to ensure that the information reported is correct and that all taxes owed have been paid.

What are the qualifications for becoming an Income Tax Auditor?

Most Income Tax Auditors have a bachelor’s degree in accounting or a related field, as well as several years of experience working in the tax field.

What are the key skills required for an Income Tax Auditor?

Income Tax Auditors need to have strong analytical and problem-solving skills, as well as a deep understanding of tax laws and regulations.

What is the career outlook for Income Tax Auditors?

The career outlook for Income Tax Auditors is expected to be good over the next few years, as the demand for qualified auditors continues to grow.

What is the average salary for an Income Tax Auditor?

The average salary for an Income Tax Auditor is around $70,000 per year.

What are the benefits of working as an Income Tax Auditor?

There are many benefits to working as an Income Tax Auditor, including the opportunity to work in a challenging and rewarding field, the chance to make a difference in the lives of others, and the potential to earn a high salary.