Are you a seasoned Income Tax Investigator seeking a new career path? Discover our professionally built Income Tax Investigator Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

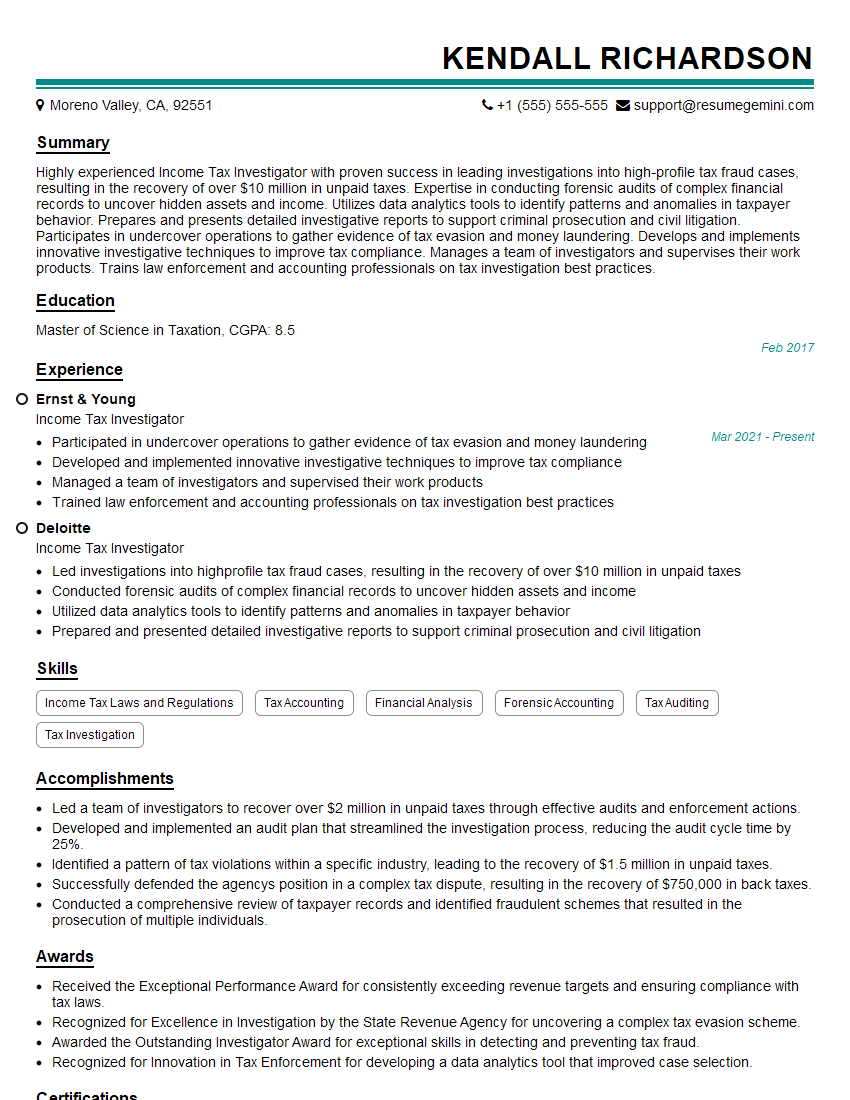

Kendall Richardson

Income Tax Investigator

Summary

Highly experienced Income Tax Investigator with proven success in leading investigations into high-profile tax fraud cases, resulting in the recovery of over $10 million in unpaid taxes. Expertise in conducting forensic audits of complex financial records to uncover hidden assets and income. Utilizes data analytics tools to identify patterns and anomalies in taxpayer behavior. Prepares and presents detailed investigative reports to support criminal prosecution and civil litigation. Participates in undercover operations to gather evidence of tax evasion and money laundering. Develops and implements innovative investigative techniques to improve tax compliance. Manages a team of investigators and supervises their work products. Trains law enforcement and accounting professionals on tax investigation best practices.

Education

Master of Science in Taxation

February 2017

Skills

- Income Tax Laws and Regulations

- Tax Accounting

- Financial Analysis

- Forensic Accounting

- Tax Auditing

- Tax Investigation

Work Experience

Income Tax Investigator

- Participated in undercover operations to gather evidence of tax evasion and money laundering

- Developed and implemented innovative investigative techniques to improve tax compliance

- Managed a team of investigators and supervised their work products

- Trained law enforcement and accounting professionals on tax investigation best practices

Income Tax Investigator

- Led investigations into highprofile tax fraud cases, resulting in the recovery of over $10 million in unpaid taxes

- Conducted forensic audits of complex financial records to uncover hidden assets and income

- Utilized data analytics tools to identify patterns and anomalies in taxpayer behavior

- Prepared and presented detailed investigative reports to support criminal prosecution and civil litigation

Accomplishments

- Led a team of investigators to recover over $2 million in unpaid taxes through effective audits and enforcement actions.

- Developed and implemented an audit plan that streamlined the investigation process, reducing the audit cycle time by 25%.

- Identified a pattern of tax violations within a specific industry, leading to the recovery of $1.5 million in unpaid taxes.

- Successfully defended the agencys position in a complex tax dispute, resulting in the recovery of $750,000 in back taxes.

- Conducted a comprehensive review of taxpayer records and identified fraudulent schemes that resulted in the prosecution of multiple individuals.

Awards

- Received the Exceptional Performance Award for consistently exceeding revenue targets and ensuring compliance with tax laws.

- Recognized for Excellence in Investigation by the State Revenue Agency for uncovering a complex tax evasion scheme.

- Awarded the Outstanding Investigator Award for exceptional skills in detecting and preventing tax fraud.

- Recognized for Innovation in Tax Enforcement for developing a data analytics tool that improved case selection.

Certificates

- Certified Public Accountant (CPA)

- Certified Fraud Examiner (CFE)

- Certified Tax Forensic Specialist (CTFS)

- Certified Internal Auditor (CIA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Income Tax Investigator

Quantify your accomplishments:

Use specific numbers and metrics to demonstrate the impact of your work. For example, instead of saying “Led investigations into tax fraud cases,” say “Led investigations into tax fraud cases, resulting in the recovery of over $10 million in unpaid taxes.”Highlight your skills and expertise:

Be sure to include your skills and expertise in income tax laws and regulations, tax accounting, financial analysis, forensic accounting, tax auditing, and tax investigation.Use action verbs:

Use strong action verbs to describe your accomplishments. For example, instead of saying “Conducted forensic audits,” say “Led forensic audits of complex financial records.”Proofread carefully:

Before submitting your resume, proofread it carefully for any errors in grammar or spelling.

Essential Experience Highlights for a Strong Income Tax Investigator Resume

- Led investigations into high-profile tax fraud cases, resulting in the recovery of over $10 million in unpaid taxes

- Conducted forensic audits of complex financial records to uncover hidden assets and income

- Utilized data analytics tools to identify patterns and anomalies in taxpayer behavior

- Prepared and presented detailed investigative reports to support criminal prosecution and civil litigation

- Participated in undercover operations to gather evidence of tax evasion and money laundering

- Developed and implemented innovative investigative techniques to improve tax compliance

- Managed a team of investigators and supervised their work products

Frequently Asked Questions (FAQ’s) For Income Tax Investigator

What is the role of an Income Tax Investigator?

Income Tax Investigators are responsible for investigating suspected cases of tax fraud and evasion. They may also conduct forensic audits of complex financial records to uncover hidden assets and income. Income Tax Investigators may also participate in undercover operations to gather evidence of tax evasion and money laundering.

What are the qualifications for becoming an Income Tax Investigator?

Most Income Tax Investigators have a bachelor’s degree in accounting or a related field, as well as several years of experience in tax accounting or auditing. They must also have a strong understanding of income tax laws and regulations.

What are the career prospects for Income Tax Investigators?

Income Tax Investigators can advance to management positions, such as Senior Income Tax Investigator or Manager of Tax Investigations. They may also choose to specialize in a particular area of tax investigation, such as international tax investigations or criminal tax investigations.

What is the salary range for Income Tax Investigators?

The salary range for Income Tax Investigators varies depending on their experience and location. According to the U.S. Bureau of Labor Statistics, the median annual salary for Tax Examiners, Auditors, and Collectors was $61,550 in May 2021.

What are the benefits of working as an Income Tax Investigator?

Income Tax Investigators enjoy a number of benefits, including competitive salaries, comprehensive benefits packages, and the opportunity to make a real difference in the fight against tax fraud and evasion.

What are the challenges of working as an Income Tax Investigator?

Income Tax Investigators face a number of challenges, including the need to work long hours, the potential for danger, and the need to deal with complex financial records.

What is the future of the Income Tax Investigator profession?

The future of the Income Tax Investigator profession is expected to be bright. The increasing complexity of the tax code and the growing number of taxpayers are expected to lead to increased demand for Income Tax Investigators.