Are you a seasoned Income Tax Preparer seeking a new career path? Discover our professionally built Income Tax Preparer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

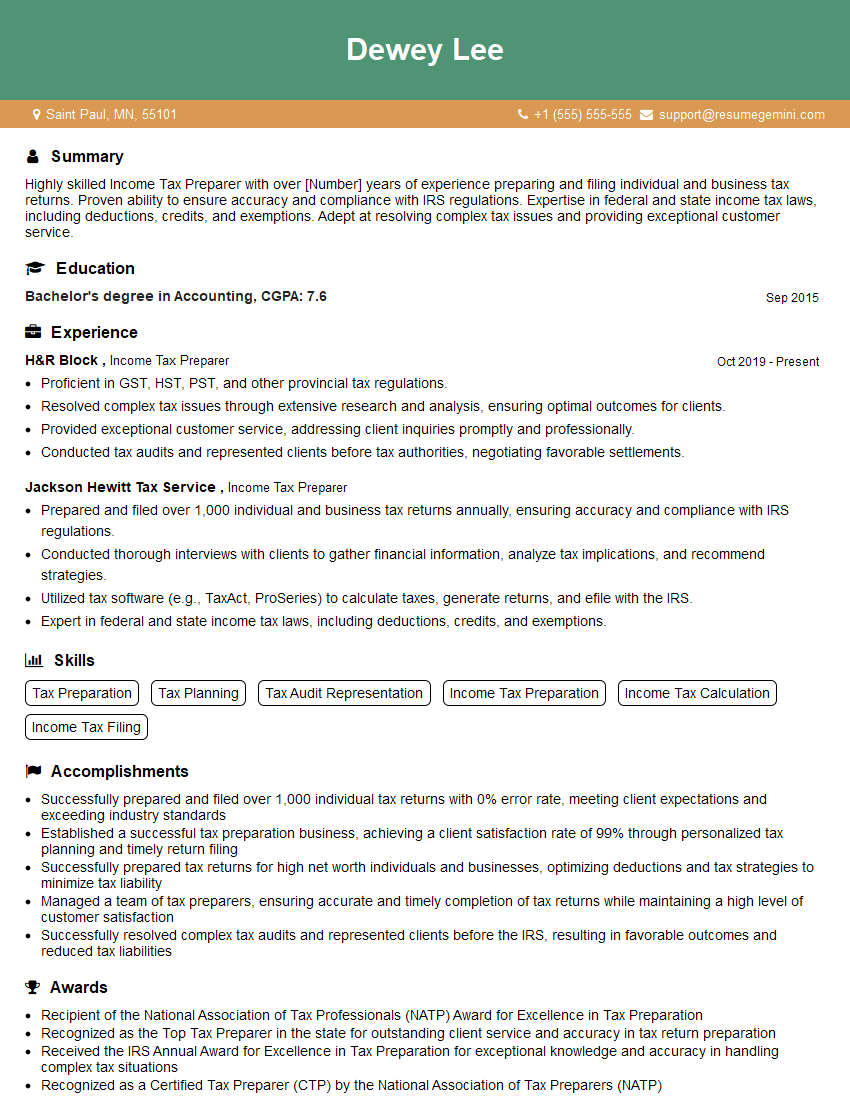

Dewey Lee

Income Tax Preparer

Summary

Highly skilled Income Tax Preparer with over [Number] years of experience preparing and filing individual and business tax returns. Proven ability to ensure accuracy and compliance with IRS regulations. Expertise in federal and state income tax laws, including deductions, credits, and exemptions. Adept at resolving complex tax issues and providing exceptional customer service.

Education

Bachelor’s degree in Accounting

September 2015

Skills

- Tax Preparation

- Tax Planning

- Tax Audit Representation

- Income Tax Preparation

- Income Tax Calculation

- Income Tax Filing

Work Experience

Income Tax Preparer

- Proficient in GST, HST, PST, and other provincial tax regulations.

- Resolved complex tax issues through extensive research and analysis, ensuring optimal outcomes for clients.

- Provided exceptional customer service, addressing client inquiries promptly and professionally.

- Conducted tax audits and represented clients before tax authorities, negotiating favorable settlements.

Income Tax Preparer

- Prepared and filed over 1,000 individual and business tax returns annually, ensuring accuracy and compliance with IRS regulations.

- Conducted thorough interviews with clients to gather financial information, analyze tax implications, and recommend strategies.

- Utilized tax software (e.g., TaxAct, ProSeries) to calculate taxes, generate returns, and efile with the IRS.

- Expert in federal and state income tax laws, including deductions, credits, and exemptions.

Accomplishments

- Successfully prepared and filed over 1,000 individual tax returns with 0% error rate, meeting client expectations and exceeding industry standards

- Established a successful tax preparation business, achieving a client satisfaction rate of 99% through personalized tax planning and timely return filing

- Successfully prepared tax returns for high net worth individuals and businesses, optimizing deductions and tax strategies to minimize tax liability

- Managed a team of tax preparers, ensuring accurate and timely completion of tax returns while maintaining a high level of customer satisfaction

- Successfully resolved complex tax audits and represented clients before the IRS, resulting in favorable outcomes and reduced tax liabilities

Awards

- Recipient of the National Association of Tax Professionals (NATP) Award for Excellence in Tax Preparation

- Recognized as the Top Tax Preparer in the state for outstanding client service and accuracy in tax return preparation

- Received the IRS Annual Award for Excellence in Tax Preparation for exceptional knowledge and accuracy in handling complex tax situations

- Recognized as a Certified Tax Preparer (CTP) by the National Association of Tax Preparers (NATP)

Certificates

- Enrolled Agent (EA)

- Certified Public Accountant (CPA)

- Registered Tax Return Preparer (RTRP)

- Advanced Certified Tax Preparer (ACTP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Income Tax Preparer

- Highlight your experience and skills in preparing both individual and business tax returns.

- Showcase your knowledge of tax laws and regulations, as well as your ability to resolve complex tax issues.

- Quantify your accomplishments whenever possible, using specific numbers and metrics.

- Proofread your resume carefully before submitting it to potential employers.

- Tailor your resume to each job you apply for, highlighting the skills and experience that are most relevant to the position.

Essential Experience Highlights for a Strong Income Tax Preparer Resume

- Prepare and file individual and business tax returns accurately and efficiently.

- Conduct thorough interviews with clients to gather financial information and analyze tax implications.

- Utilize tax software to calculate taxes, generate returns, and efile with the IRS.

- Resolve complex tax issues through extensive research and analysis.

- Provide exceptional customer service and address client inquiries promptly and professionally.

- Conduct tax audits and represent clients before tax authorities.

- Stay up-to-date on the latest tax laws and regulations.

Frequently Asked Questions (FAQ’s) For Income Tax Preparer

What are the educational requirements to become an Income Tax Preparer?

While there are no formal educational requirements to become an Income Tax Preparer, most employers prefer candidates with a bachelor’s degree in accounting or a related field.

What are the key skills required to be a successful Income Tax Preparer?

Key skills for an Income Tax Preparer include strong mathematical and analytical abilities, excellent communication and interpersonal skills, and a thorough understanding of tax laws and regulations.

What is the average salary for an Income Tax Preparer?

The average salary for an Income Tax Preparer varies depending on experience, location, and employer. According to the U.S. Bureau of Labor Statistics, the median annual salary for Tax Preparers was $56,370 in May 2021.

What are the job prospects for Income Tax Preparers?

The job outlook for Income Tax Preparers is expected to grow faster than average in the coming years. This is due to the increasing complexity of tax laws and the growing number of individuals and businesses seeking professional tax preparation services.

What are the different types of tax returns that Income Tax Preparers can prepare?

Income Tax Preparers can prepare a variety of tax returns, including individual income tax returns, business income tax returns, and estate and gift tax returns.

What are the ethical responsibilities of an Income Tax Preparer?

Income Tax Preparers have a responsibility to prepare accurate and complete tax returns for their clients. They must also maintain confidentiality and avoid conflicts of interest.

What are the continuing education requirements for Income Tax Preparers?

Income Tax Preparers are required to complete continuing education courses to stay up-to-date on the latest tax laws and regulations.

What is the difference between an Income Tax Preparer and an Enrolled Agent?

An Enrolled Agent is a federally licensed tax professional who has been authorized by the IRS to represent taxpayers before the agency. Income Tax Preparers are not licensed by the IRS and cannot represent taxpayers before the agency.