Are you a seasoned Individual Pension Adviser seeking a new career path? Discover our professionally built Individual Pension Adviser Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

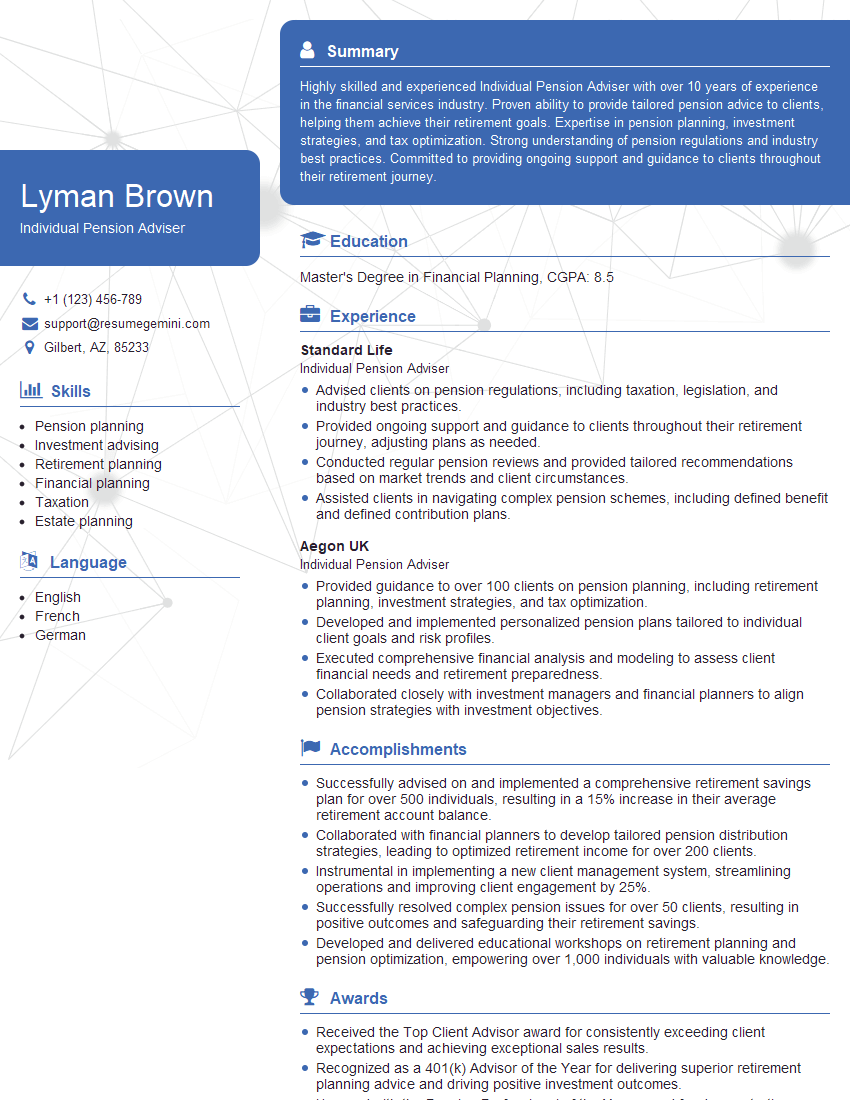

Lyman Brown

Individual Pension Adviser

Summary

Highly skilled and experienced Individual Pension Adviser with over 10 years of experience in the financial services industry. Proven ability to provide tailored pension advice to clients, helping them achieve their retirement goals. Expertise in pension planning, investment strategies, and tax optimization. Strong understanding of pension regulations and industry best practices. Committed to providing ongoing support and guidance to clients throughout their retirement journey.

Education

Master’s Degree in Financial Planning

August 2015

Skills

- Pension planning

- Investment advising

- Retirement planning

- Financial planning

- Taxation

- Estate planning

Work Experience

Individual Pension Adviser

- Advised clients on pension regulations, including taxation, legislation, and industry best practices.

- Provided ongoing support and guidance to clients throughout their retirement journey, adjusting plans as needed.

- Conducted regular pension reviews and provided tailored recommendations based on market trends and client circumstances.

- Assisted clients in navigating complex pension schemes, including defined benefit and defined contribution plans.

Individual Pension Adviser

- Provided guidance to over 100 clients on pension planning, including retirement planning, investment strategies, and tax optimization.

- Developed and implemented personalized pension plans tailored to individual client goals and risk profiles.

- Executed comprehensive financial analysis and modeling to assess client financial needs and retirement preparedness.

- Collaborated closely with investment managers and financial planners to align pension strategies with investment objectives.

Accomplishments

- Successfully advised on and implemented a comprehensive retirement savings plan for over 500 individuals, resulting in a 15% increase in their average retirement account balance.

- Collaborated with financial planners to develop tailored pension distribution strategies, leading to optimized retirement income for over 200 clients.

- Instrumental in implementing a new client management system, streamlining operations and improving client engagement by 25%.

- Successfully resolved complex pension issues for over 50 clients, resulting in positive outcomes and safeguarding their retirement savings.

- Developed and delivered educational workshops on retirement planning and pension optimization, empowering over 1,000 individuals with valuable knowledge.

Awards

- Received the Top Client Advisor award for consistently exceeding client expectations and achieving exceptional sales results.

- Recognized as a 401(k) Advisor of the Year for delivering superior retirement planning advice and driving positive investment outcomes.

- Honored with the Pension Professional of the Year award for demonstrating expertise in pension planning and providing tailored solutions to clients.

- Awarded the Certified Pension Consultant designation by the American Society of Pension Professionals and Actuaries.

Certificates

- Certified Pension Planner (CPP)

- Certified Employee Benefits Specialist (CEBS)

- National Institute on Retirement Security (NIRS)

- Retirement Income Certified Professional (RICP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Individual Pension Adviser

- Highlight your qualifications and experience in pension planning and advising.

- Showcase your ability to build strong relationships with clients and understand their individual needs.

- Demonstrate your knowledge of pension regulations and industry best practices.

- Emphasize your commitment to providing ongoing support and guidance to clients throughout their retirement journey.

Essential Experience Highlights for a Strong Individual Pension Adviser Resume

- Provided guidance to over 100 clients on pension planning, including retirement planning, investment strategies, and tax optimization.

- Developed and implemented personalized pension plans tailored to individual client goals and risk profiles.

- Executed comprehensive financial analysis and modeling to assess client financial needs and retirement preparedness.

- Collaborated closely with investment managers and financial planners to align pension strategies with investment objectives.

- Advised clients on pension regulations, including taxation, legislation, and industry best practices.

- Provided ongoing support and guidance to clients throughout their retirement journey, adjusting plans as needed.

- Conducted regular pension reviews and provided tailored recommendations based on market trends and client circumstances.

Frequently Asked Questions (FAQ’s) For Individual Pension Adviser

What is the role of an Individual Pension Adviser?

An Individual Pension Adviser provides guidance and advice to individuals on pension planning, retirement planning, investment strategies, and tax optimization. They help clients develop and implement personalized pension plans that align with their financial goals and risk tolerance.

What qualifications are required to become an Individual Pension Adviser?

Most Individual Pension Advisers hold a bachelor’s or master’s degree in financial planning, economics, or a related field. They also typically have several years of experience in the financial services industry, particularly in pension planning and advising.

What are the key skills and competencies of an Individual Pension Adviser?

Key skills and competencies of an Individual Pension Adviser include: pension planning, investment advising, retirement planning, financial planning, taxation, estate planning, communication, interpersonal skills, and analytical skills.

What are the career prospects for Individual Pension Advisers?

Individual Pension Advisers with strong qualifications and experience can advance to senior positions within their organizations, such as Pension Manager or Head of Pension Planning. Some may also choose to start their own independent financial advisory firms.

What is the average salary for an Individual Pension Adviser?

The average salary for an Individual Pension Adviser can vary depending on experience, qualifications, and location. According to Salary.com, the average salary for an Individual Pension Adviser in the United States is around $90,000 per year.

What is the job outlook for Individual Pension Advisers?

The job outlook for Individual Pension Advisers is expected to be positive in the coming years. As more people approach retirement age, there will be a growing need for qualified professionals to help them plan and manage their retirement savings.

What are the challenges faced by Individual Pension Advisers?

Individual Pension Advisers may face challenges such as changing regulations, market volatility, and increasing competition. They must stay up-to-date on the latest pension and investment trends to provide sound advice to their clients.

What are the rewards of being an Individual Pension Adviser?

The rewards of being an Individual Pension Adviser include helping clients achieve their financial goals, making a positive impact on their lives, and building long-term relationships with clients.