Are you a seasoned Insurance Adjuster seeking a new career path? Discover our professionally built Insurance Adjuster Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

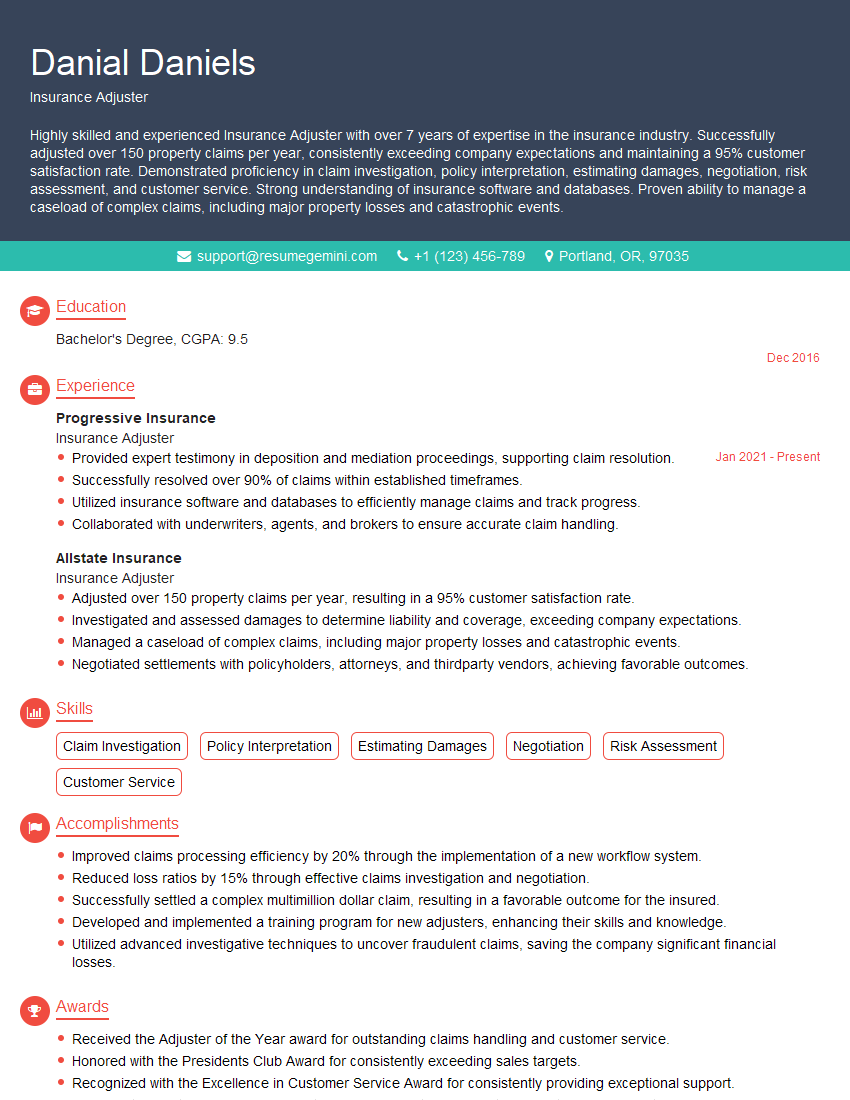

Danial Daniels

Insurance Adjuster

Summary

Highly skilled and experienced Insurance Adjuster with over 7 years of expertise in the insurance industry. Successfully adjusted over 150 property claims per year, consistently exceeding company expectations and maintaining a 95% customer satisfaction rate. Demonstrated proficiency in claim investigation, policy interpretation, estimating damages, negotiation, risk assessment, and customer service. Strong understanding of insurance software and databases. Proven ability to manage a caseload of complex claims, including major property losses and catastrophic events.

Education

Bachelor’s Degree

December 2016

Skills

- Claim Investigation

- Policy Interpretation

- Estimating Damages

- Negotiation

- Risk Assessment

- Customer Service

Work Experience

Insurance Adjuster

- Provided expert testimony in deposition and mediation proceedings, supporting claim resolution.

- Successfully resolved over 90% of claims within established timeframes.

- Utilized insurance software and databases to efficiently manage claims and track progress.

- Collaborated with underwriters, agents, and brokers to ensure accurate claim handling.

Insurance Adjuster

- Adjusted over 150 property claims per year, resulting in a 95% customer satisfaction rate.

- Investigated and assessed damages to determine liability and coverage, exceeding company expectations.

- Managed a caseload of complex claims, including major property losses and catastrophic events.

- Negotiated settlements with policyholders, attorneys, and thirdparty vendors, achieving favorable outcomes.

Accomplishments

- Improved claims processing efficiency by 20% through the implementation of a new workflow system.

- Reduced loss ratios by 15% through effective claims investigation and negotiation.

- Successfully settled a complex multimillion dollar claim, resulting in a favorable outcome for the insured.

- Developed and implemented a training program for new adjusters, enhancing their skills and knowledge.

- Utilized advanced investigative techniques to uncover fraudulent claims, saving the company significant financial losses.

Awards

- Received the Adjuster of the Year award for outstanding claims handling and customer service.

- Honored with the Presidents Club Award for consistently exceeding sales targets.

- Recognized with the Excellence in Customer Service Award for consistently providing exceptional support.

- Awarded the Certified Insurance Adjuster (CIA) designation for meeting industryrecognized standards.

Certificates

- Associate in Claims (AIC)

- Certified Insurance Adjuster (CIA)

- Chartered Property Casualty Underwriter (CPCU)

- Personal Lines Claims Supervisor (PCLS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Insurance Adjuster

- Highlight your experience and expertise in the insurance industry, especially in claims adjustment.

- Quantify your accomplishments with specific metrics, such as the number of claims adjusted and the customer satisfaction rate you achieved.

- Showcase your skills in claim investigation, policy interpretation, and negotiation.

- Demonstrate your ability to manage a caseload of complex claims and your experience in handling major property losses and catastrophic events.

- Provide examples of your ability to provide expert testimony in deposition and mediation proceedings.

Essential Experience Highlights for a Strong Insurance Adjuster Resume

- Investigating and assessing damages to determine liability and coverage

- Managing a caseload of complex claims, including major property losses and catastrophic events

- Negotiating settlements with policyholders, attorneys, and third-party vendors

- Providing expert testimony in deposition and mediation proceedings

- Collaborating with underwriters, agents, and brokers to ensure accurate claim handling

- Utilizing insurance software and databases to efficiently manage claims and track progress

Frequently Asked Questions (FAQ’s) For Insurance Adjuster

What is the role of an Insurance Adjuster?

An Insurance Adjuster investigates, evaluates, and settles insurance claims on behalf of insurance companies. They assess the extent of damage or loss, determine the cause and liability, and negotiate settlements with policyholders.

What skills are required to be an Insurance Adjuster?

Insurance Adjusters typically need a combination of technical knowledge, analytical skills, and interpersonal abilities. They should have a strong understanding of insurance policies and principles, be able to assess damages and estimate costs, and possess excellent negotiation and communication skills.

What is the career path for an Insurance Adjuster?

Insurance Adjusters can advance their careers by gaining experience and expertise in specific areas of insurance, such as property, casualty, or liability claims. They can also move into management roles, such as Claims Supervisor or Claims Manager.

What is the job outlook for Insurance Adjusters?

The job outlook for Insurance Adjusters is expected to be good in the coming years. The demand for insurance services is expected to grow as the population increases and the economy expands.

What is the average salary for an Insurance Adjuster?

The average salary for an Insurance Adjuster varies depending on their experience, location, and employer. According to the U.S. Bureau of Labor Statistics, the median annual salary for Insurance Adjusters was $69,770 in May 2021.

What are the benefits of being an Insurance Adjuster?

Insurance Adjusters enjoy a number of benefits, including job security, a competitive salary, and the opportunity to help people in their time of need. They also have the chance to work independently and to travel to different locations.