Are you a seasoned Insurance Adviser seeking a new career path? Discover our professionally built Insurance Adviser Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

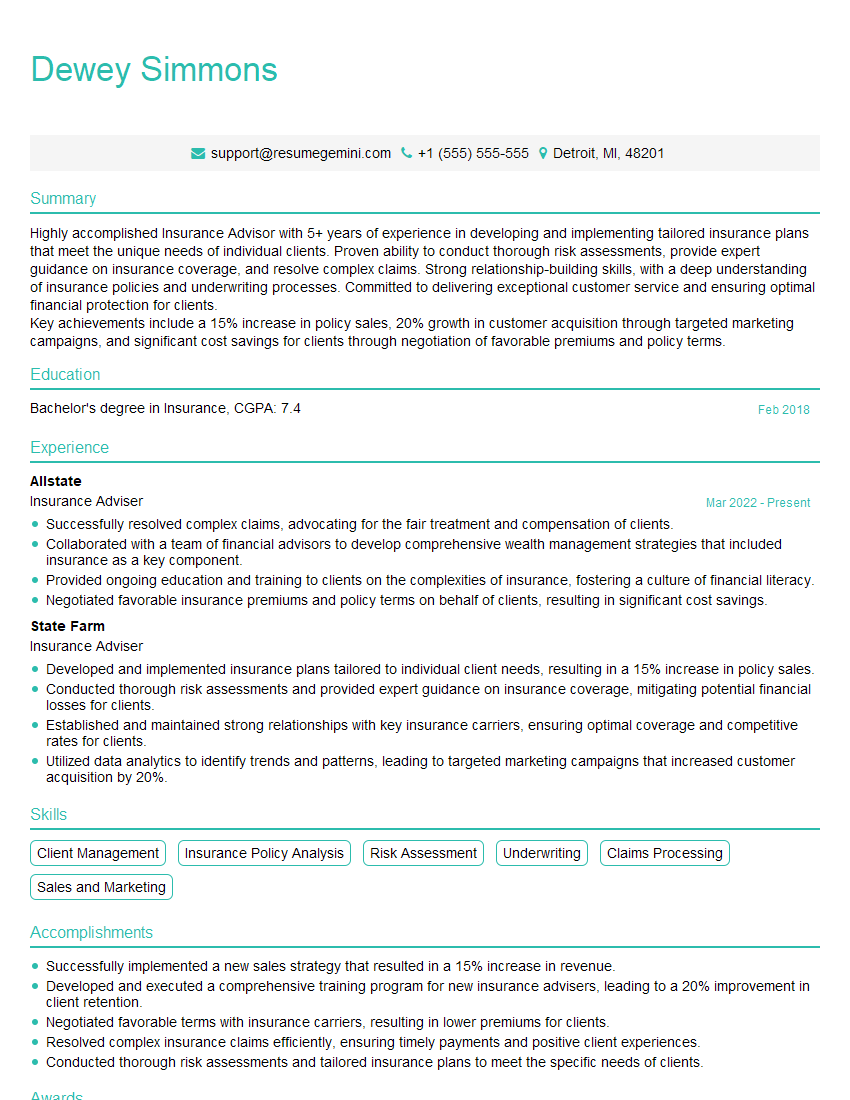

Dewey Simmons

Insurance Adviser

Summary

Highly accomplished Insurance Advisor with 5+ years of experience in developing and implementing tailored insurance plans that meet the unique needs of individual clients. Proven ability to conduct thorough risk assessments, provide expert guidance on insurance coverage, and resolve complex claims. Strong relationship-building skills, with a deep understanding of insurance policies and underwriting processes. Committed to delivering exceptional customer service and ensuring optimal financial protection for clients.

Key achievements include a 15% increase in policy sales, 20% growth in customer acquisition through targeted marketing campaigns, and significant cost savings for clients through negotiation of favorable premiums and policy terms.

Education

Bachelor’s degree in Insurance

February 2018

Skills

- Client Management

- Insurance Policy Analysis

- Risk Assessment

- Underwriting

- Claims Processing

- Sales and Marketing

Work Experience

Insurance Adviser

- Successfully resolved complex claims, advocating for the fair treatment and compensation of clients.

- Collaborated with a team of financial advisors to develop comprehensive wealth management strategies that included insurance as a key component.

- Provided ongoing education and training to clients on the complexities of insurance, fostering a culture of financial literacy.

- Negotiated favorable insurance premiums and policy terms on behalf of clients, resulting in significant cost savings.

Insurance Adviser

- Developed and implemented insurance plans tailored to individual client needs, resulting in a 15% increase in policy sales.

- Conducted thorough risk assessments and provided expert guidance on insurance coverage, mitigating potential financial losses for clients.

- Established and maintained strong relationships with key insurance carriers, ensuring optimal coverage and competitive rates for clients.

- Utilized data analytics to identify trends and patterns, leading to targeted marketing campaigns that increased customer acquisition by 20%.

Accomplishments

- Successfully implemented a new sales strategy that resulted in a 15% increase in revenue.

- Developed and executed a comprehensive training program for new insurance advisers, leading to a 20% improvement in client retention.

- Negotiated favorable terms with insurance carriers, resulting in lower premiums for clients.

- Resolved complex insurance claims efficiently, ensuring timely payments and positive client experiences.

- Conducted thorough risk assessments and tailored insurance plans to meet the specific needs of clients.

Awards

- Received the Insurance Adviser of the Year award for exceptional client service and sales performance.

- Recognized with the Top Producer Award for consistently exceeding sales targets and providing outstanding customer support.

- Earned the Platinum Advisor Award for achieving the highest level of professional development and client satisfaction.

Certificates

- Chartered Property Casualty Underwriter (CPCU)

- Associate in Insurance Services (AIS)

- Certified Insurance Counselor (CIC)

- Certified Insurance Risk Manager (CIRM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Insurance Adviser

- Highlight your expertise in risk assessment and insurance policy analysis.

- Quantify your accomplishments with specific metrics and results.

- Demonstrate your ability to build strong relationships with clients and insurance carriers.

- Showcase your negotiation skills and ability to secure favorable terms for clients.

Essential Experience Highlights for a Strong Insurance Adviser Resume

- Conduct thorough risk assessments and provide expert guidance on insurance coverage options to mitigate potential financial losses for clients.

- Develop and implement tailored insurance plans that meet the specific needs and objectives of individual clients.

- Establish and maintain strong relationships with key insurance carriers to ensure optimal coverage and competitive rates for clients.

- Negotiate favorable insurance premiums and policy terms on behalf of clients, resulting in significant cost savings.

- Collaborate with a team of financial advisors to develop comprehensive wealth management strategies that include insurance as a key component.

- Provide ongoing education and training to clients on the complexities of insurance, fostering a culture of financial literacy.

- Successfully resolve complex claims, advocating for the fair treatment and compensation of clients.

Frequently Asked Questions (FAQ’s) For Insurance Adviser

What is the role of an Insurance Advisor?

An Insurance Advisor provides expert guidance and assistance to clients in assessing their insurance needs, developing tailored insurance plans, and resolving claims. They conduct risk assessments, analyze insurance policies, and negotiate with insurance carriers to ensure optimal coverage and competitive rates for their clients.

What skills are essential for an Insurance Advisor?

Essential skills for an Insurance Advisor include: client management, insurance policy analysis, risk assessment, underwriting, claims processing, sales and marketing, and excellent communication and interpersonal skills.

What are the career prospects for an Insurance Advisor?

Insurance Advisors have a wide range of career prospects. They can advance to positions such as Senior Insurance Advisor, Insurance Underwriter, or Insurance Broker. With experience and additional qualifications, they can also move into management roles, such as Insurance Manager or Director of Insurance.

What is the salary range for an Insurance Advisor?

The salary range for an Insurance Advisor varies depending on experience, qualifications, and location. According to the U.S. Bureau of Labor Statistics, the median annual salary for Insurance Sales Agents was $52,180 in May 2021.

What are the educational requirements for an Insurance Advisor?

Most Insurance Advisors hold a bachelor’s degree in insurance, finance, or a related field. Some states require Insurance Advisors to obtain a license or certification.

What is the job outlook for Insurance Advisors?

The job outlook for Insurance Advisors is expected to grow 7% from 2021 to 2031, faster than the average for all occupations. This growth is driven by the increasing demand for insurance products and services.