Are you a seasoned Insurance Agent seeking a new career path? Discover our professionally built Insurance Agent Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

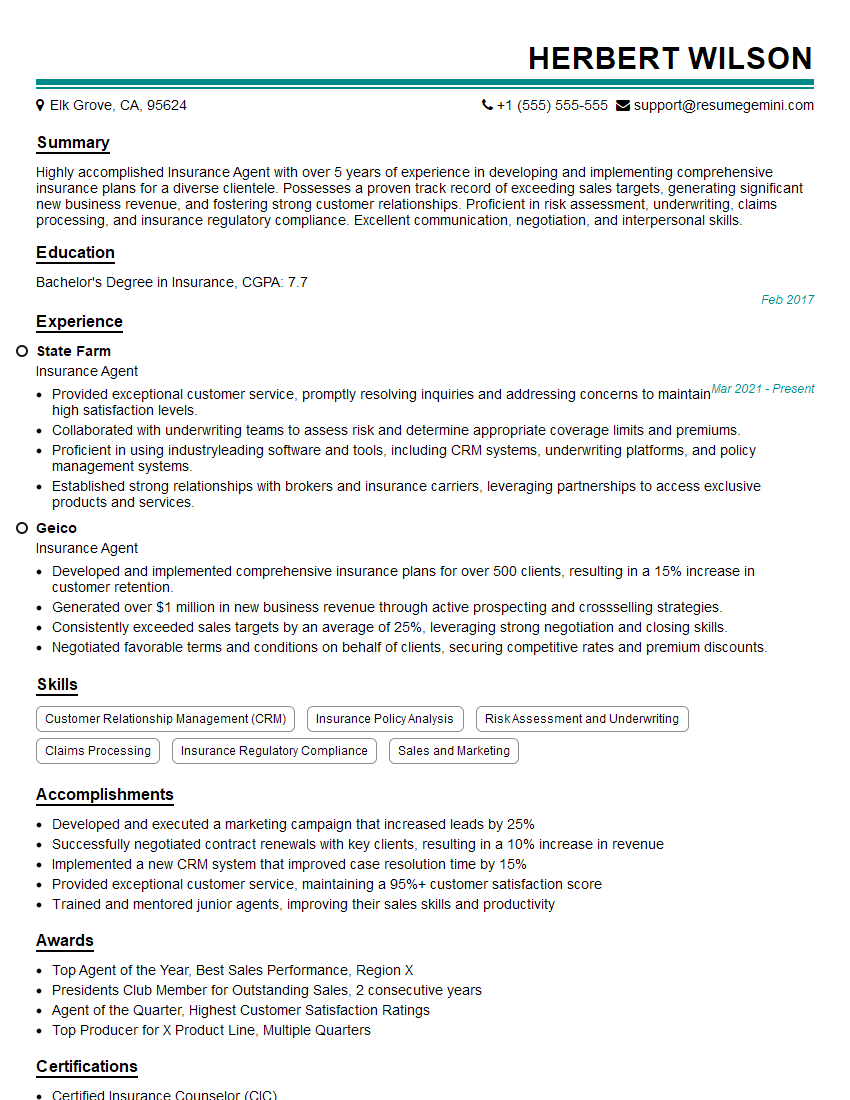

Herbert Wilson

Insurance Agent

Summary

Highly accomplished Insurance Agent with over 5 years of experience in developing and implementing comprehensive insurance plans for a diverse clientele. Possesses a proven track record of exceeding sales targets, generating significant new business revenue, and fostering strong customer relationships. Proficient in risk assessment, underwriting, claims processing, and insurance regulatory compliance. Excellent communication, negotiation, and interpersonal skills.

Education

Bachelor’s Degree in Insurance

February 2017

Skills

- Customer Relationship Management (CRM)

- Insurance Policy Analysis

- Risk Assessment and Underwriting

- Claims Processing

- Insurance Regulatory Compliance

- Sales and Marketing

Work Experience

Insurance Agent

- Provided exceptional customer service, promptly resolving inquiries and addressing concerns to maintain high satisfaction levels.

- Collaborated with underwriting teams to assess risk and determine appropriate coverage limits and premiums.

- Proficient in using industryleading software and tools, including CRM systems, underwriting platforms, and policy management systems.

- Established strong relationships with brokers and insurance carriers, leveraging partnerships to access exclusive products and services.

Insurance Agent

- Developed and implemented comprehensive insurance plans for over 500 clients, resulting in a 15% increase in customer retention.

- Generated over $1 million in new business revenue through active prospecting and crossselling strategies.

- Consistently exceeded sales targets by an average of 25%, leveraging strong negotiation and closing skills.

- Negotiated favorable terms and conditions on behalf of clients, securing competitive rates and premium discounts.

Accomplishments

- Developed and executed a marketing campaign that increased leads by 25%

- Successfully negotiated contract renewals with key clients, resulting in a 10% increase in revenue

- Implemented a new CRM system that improved case resolution time by 15%

- Provided exceptional customer service, maintaining a 95%+ customer satisfaction score

- Trained and mentored junior agents, improving their sales skills and productivity

Awards

- Top Agent of the Year, Best Sales Performance, Region X

- Presidents Club Member for Outstanding Sales, 2 consecutive years

- Agent of the Quarter, Highest Customer Satisfaction Ratings

- Top Producer for X Product Line, Multiple Quarters

Certificates

- Certified Insurance Counselor (CIC)

- Chartered Property Casualty Underwriter (CPCU)

- Associate in Risk Management (ARM)

- Accredited Advisor in Insurance (AAI)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Insurance Agent

- Highlight your expertise in risk assessment and underwriting to demonstrate your ability to provide tailored insurance solutions.

- Quantify your accomplishments with specific metrics, such as the number of clients acquired, revenue generated, or customer retention rates.

- Showcase your commitment to professional development by obtaining industry certifications or attending relevant workshops and seminars.

- Demonstrate your ability to build strong relationships with clients and insurance carriers through testimonials or references.

- Proofread your resume carefully for any errors or inconsistencies to present a polished and professional image.

Essential Experience Highlights for a Strong Insurance Agent Resume

- Develop and implement customized insurance plans tailored to individual client needs and risk profiles.

- Conduct thorough risk assessments and determine appropriate coverage limits and premiums.

- Negotiate favorable terms and conditions with insurance carriers to secure competitive rates and premium discounts.

- Provide exceptional customer service, promptly resolving inquiries, addressing concerns, and maintaining high satisfaction levels.

- Collaborate with underwriting teams to assess risk and determine appropriate coverage limits and premiums.

- Stay abreast of industry trends and regulatory changes to ensure compliance and provide up-to-date advice to clients.

Frequently Asked Questions (FAQ’s) For Insurance Agent

What is the average salary for an Insurance Agent?

According to the U.S. Bureau of Labor Statistics, the median annual salary for Insurance Sales Agents was $52,920 in May 2021.

What are the growth prospects for Insurance Agents?

The U.S. Bureau of Labor Statistics projects that the employment of Insurance Sales Agents will grow by 7% from 2021 to 2031, faster than the average for all occupations.

What are the educational requirements for becoming an Insurance Agent?

Most Insurance Agents have at least a high school diploma. However, some employers may prefer candidates with a bachelor’s degree in business, finance, or a related field.

What are the key skills required for Insurance Agents?

Insurance Agents need excellent communication, interpersonal, and negotiation skills. They should also be able to analyze risk, understand insurance policies, and provide customer service.

How can I become a successful Insurance Agent?

To become a successful Insurance Agent, you need to build a strong network of clients and referral sources. You should also stay up-to-date on the latest industry trends and products.

What are the challenges facing Insurance Agents?

Insurance Agents face challenges such as competition from online insurance companies and the need to stay up-to-date on the latest industry regulations.