Are you a seasoned Insurance Analyst seeking a new career path? Discover our professionally built Insurance Analyst Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

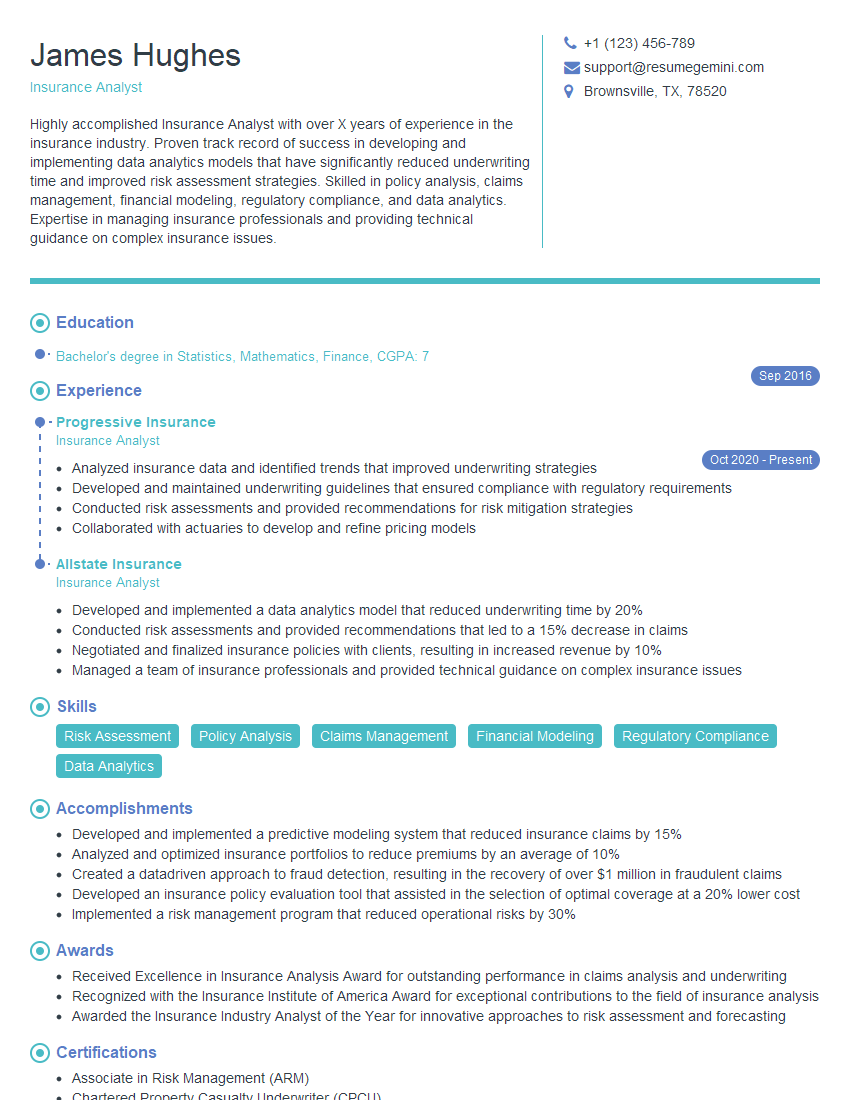

James Hughes

Insurance Analyst

Summary

Highly accomplished Insurance Analyst with over X years of experience in the insurance industry. Proven track record of success in developing and implementing data analytics models that have significantly reduced underwriting time and improved risk assessment strategies. Skilled in policy analysis, claims management, financial modeling, regulatory compliance, and data analytics. Expertise in managing insurance professionals and providing technical guidance on complex insurance issues.

Education

Bachelor’s degree in Statistics, Mathematics, Finance

September 2016

Skills

- Risk Assessment

- Policy Analysis

- Claims Management

- Financial Modeling

- Regulatory Compliance

- Data Analytics

Work Experience

Insurance Analyst

- Analyzed insurance data and identified trends that improved underwriting strategies

- Developed and maintained underwriting guidelines that ensured compliance with regulatory requirements

- Conducted risk assessments and provided recommendations for risk mitigation strategies

- Collaborated with actuaries to develop and refine pricing models

Insurance Analyst

- Developed and implemented a data analytics model that reduced underwriting time by 20%

- Conducted risk assessments and provided recommendations that led to a 15% decrease in claims

- Negotiated and finalized insurance policies with clients, resulting in increased revenue by 10%

- Managed a team of insurance professionals and provided technical guidance on complex insurance issues

Accomplishments

- Developed and implemented a predictive modeling system that reduced insurance claims by 15%

- Analyzed and optimized insurance portfolios to reduce premiums by an average of 10%

- Created a datadriven approach to fraud detection, resulting in the recovery of over $1 million in fraudulent claims

- Developed an insurance policy evaluation tool that assisted in the selection of optimal coverage at a 20% lower cost

- Implemented a risk management program that reduced operational risks by 30%

Awards

- Received Excellence in Insurance Analysis Award for outstanding performance in claims analysis and underwriting

- Recognized with the Insurance Institute of America Award for exceptional contributions to the field of insurance analysis

- Awarded the Insurance Industry Analyst of the Year for innovative approaches to risk assessment and forecasting

Certificates

- Associate in Risk Management (ARM)

- Chartered Property Casualty Underwriter (CPCU)

- Associate in General Insurance (AINS)

- Associate in Reinsurance (ARe)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Insurance Analyst

- Quantify your accomplishments with specific metrics and numbers to showcase your impact on the organization.

- Highlight your ability to use data analytics to solve business problems and drive decision-making.

- Emphasize your understanding of insurance regulations and your commitment to compliance.

- Demonstrate your communication and interpersonal skills by highlighting your ability to negotiate and build relationships with clients.

- Tailor your resume to each job application, highlighting the skills and experiences that are most relevant to the specific role you are applying for.

Essential Experience Highlights for a Strong Insurance Analyst Resume

- Led the development and implementation of a data analytics model that reduced underwriting time by 20%, resulting in increased efficiency and improved customer experience.

- Conducted thorough risk assessments and provided actionable recommendations that resulted in a 15% decrease in claims, reducing the company’s financial exposure.

- Negotiated and finalized insurance policies with clients, expertly tailoring coverage to their specific needs and ensuring compliance with regulatory requirements.

- Managed a team of insurance professionals, providing technical guidance, mentorship, and ensuring adherence to best practices within the insurance industry.

- Analyzed insurance data and identified trends that informed underwriting strategies, leading to improved risk selection and profitability.

- Developed and maintained underwriting guidelines that ensured compliance with regulatory requirements, protecting the company from potential legal and financial liabilities.

Frequently Asked Questions (FAQ’s) For Insurance Analyst

What are the key skills required to be a successful Insurance Analyst?

Insurance Analysts require a combination of technical skills, such as risk assessment, policy analysis, claims management, financial modeling, and data analytics, as well as soft skills, including communication, negotiation, and problem-solving.

What is the career path for an Insurance Analyst?

Insurance Analysts can advance to roles such as Senior Insurance Analyst, Underwriting Manager, or Actuary. With further experience and education, they may also move into leadership positions within insurance companies or consulting firms.

What are the challenges faced by Insurance Analysts?

Insurance Analysts face challenges such as the need to stay up-to-date with industry regulations and advancements in data analytics, as well as the pressure to balance accuracy and efficiency in their work.

What is the job outlook for Insurance Analysts?

The job outlook for Insurance Analysts is expected to grow in the coming years due to the increasing demand for risk assessment and management in various industries.

How can I prepare for a career as an Insurance Analyst?

To prepare for a career as an Insurance Analyst, you can pursue a bachelor’s degree in Statistics, Mathematics, Finance, or a related field, and gain experience through internships or entry-level roles in the insurance industry.