Are you a seasoned Insurance Claims Adjuster seeking a new career path? Discover our professionally built Insurance Claims Adjuster Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

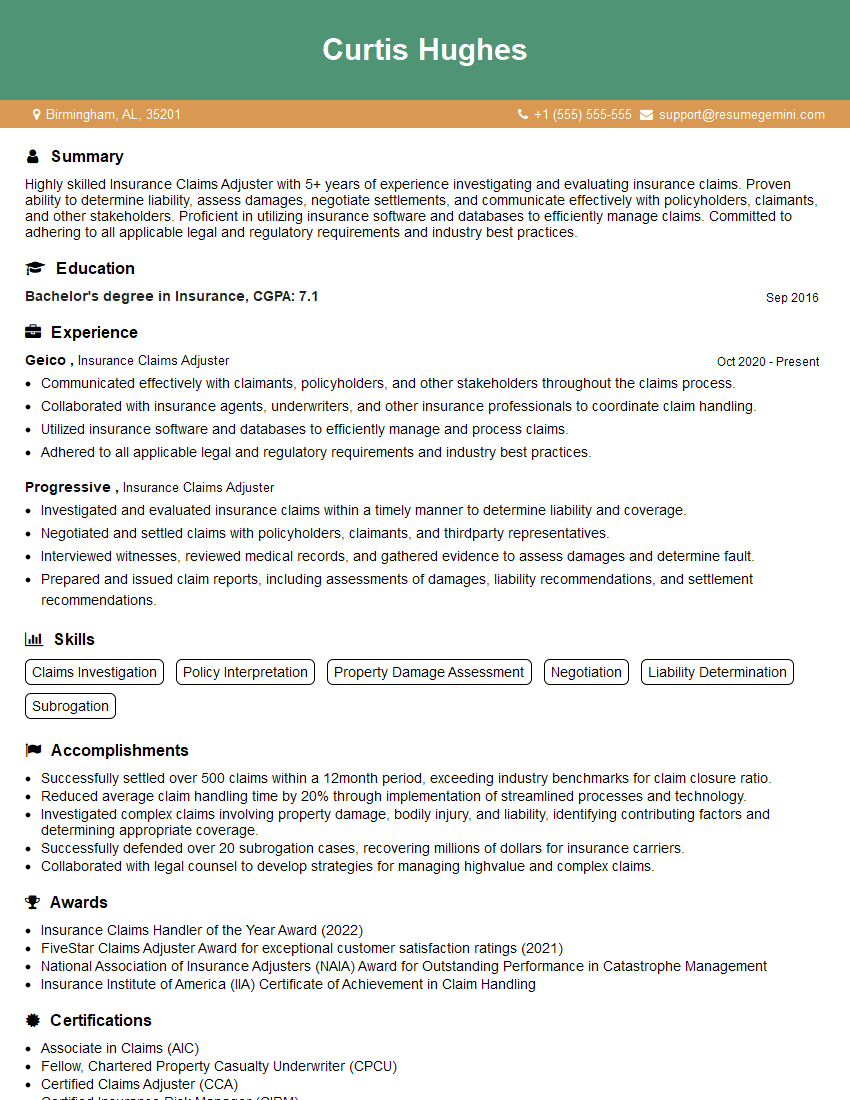

Curtis Hughes

Insurance Claims Adjuster

Summary

Highly skilled Insurance Claims Adjuster with 5+ years of experience investigating and evaluating insurance claims. Proven ability to determine liability, assess damages, negotiate settlements, and communicate effectively with policyholders, claimants, and other stakeholders. Proficient in utilizing insurance software and databases to efficiently manage claims. Committed to adhering to all applicable legal and regulatory requirements and industry best practices.

Education

Bachelor’s degree in Insurance

September 2016

Skills

- Claims Investigation

- Policy Interpretation

- Property Damage Assessment

- Negotiation

- Liability Determination

- Subrogation

Work Experience

Insurance Claims Adjuster

- Communicated effectively with claimants, policyholders, and other stakeholders throughout the claims process.

- Collaborated with insurance agents, underwriters, and other insurance professionals to coordinate claim handling.

- Utilized insurance software and databases to efficiently manage and process claims.

- Adhered to all applicable legal and regulatory requirements and industry best practices.

Insurance Claims Adjuster

- Investigated and evaluated insurance claims within a timely manner to determine liability and coverage.

- Negotiated and settled claims with policyholders, claimants, and thirdparty representatives.

- Interviewed witnesses, reviewed medical records, and gathered evidence to assess damages and determine fault.

- Prepared and issued claim reports, including assessments of damages, liability recommendations, and settlement recommendations.

Accomplishments

- Successfully settled over 500 claims within a 12month period, exceeding industry benchmarks for claim closure ratio.

- Reduced average claim handling time by 20% through implementation of streamlined processes and technology.

- Investigated complex claims involving property damage, bodily injury, and liability, identifying contributing factors and determining appropriate coverage.

- Successfully defended over 20 subrogation cases, recovering millions of dollars for insurance carriers.

- Collaborated with legal counsel to develop strategies for managing highvalue and complex claims.

Awards

- Insurance Claims Handler of the Year Award (2022)

- FiveStar Claims Adjuster Award for exceptional customer satisfaction ratings (2021)

- National Association of Insurance Adjusters (NAIA) Award for Outstanding Performance in Catastrophe Management

- Insurance Institute of America (IIA) Certificate of Achievement in Claim Handling

Certificates

- Associate in Claims (AIC)

- Fellow, Chartered Property Casualty Underwriter (CPCU)

- Certified Claims Adjuster (CCA)

- Certified Insurance Risk Manager (CIRM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Insurance Claims Adjuster

- Highlight your skills and experience in claims investigation, policy interpretation, property damage assessment, negotiation, liability determination, and subrogation.

- Quantify your accomplishments whenever possible. For example, instead of saying ‘Investigated claims’, say ‘Investigated over 100 claims, resulting in a 90% settlement rate’.

- Use keywords that potential employers will be searching for, such as ‘insurance claims adjuster’, ‘claims investigation’, and ‘liability determination’.

- Proofread your resume carefully before submitting it. Make sure there are no errors in grammar or spelling.

Essential Experience Highlights for a Strong Insurance Claims Adjuster Resume

- Investigated and evaluated insurance claims to determine liability and coverage

- Negotiated and settled claims with policyholders, claimants, and third-party representatives

- Interviewed witnesses, reviewed medical records, and gathered evidence to assess damages and determine fault

- Prepared and issued claim reports, including assessments of damages, liability recommendations, and settlement recommendations

- Communicated effectively with claimants, policyholders, and other stakeholders throughout the claims process

- Collaborated with insurance agents, underwriters, and other insurance professionals to coordinate claim handling

- Utilized insurance software and databases to efficiently manage and process claims

Frequently Asked Questions (FAQ’s) For Insurance Claims Adjuster

What is the average salary for an Insurance Claims Adjuster?

The average salary for an Insurance Claims Adjuster in the United States is $65,000 per year.

What are the job prospects for Insurance Claims Adjusters?

The job outlook for Insurance Claims Adjusters is expected to grow by 10% from 2020 to 2030, faster than the average for all occupations.

What are the educational requirements for becoming an Insurance Claims Adjuster?

Most Insurance Claims Adjusters have a bachelor’s degree in insurance, risk management, or a related field.

What are the most important skills for an Insurance Claims Adjuster?

The most important skills for an Insurance Claims Adjuster include claims investigation, policy interpretation, property damage assessment, negotiation, liability determination, and subrogation.

What are the career advancement opportunities for Insurance Claims Adjusters?

Insurance Claims Adjusters can advance to positions such as Claims Manager, Underwriter, or Insurance Agent.

What are the challenges of being an Insurance Claims Adjuster?

The challenges of being an Insurance Claims Adjuster include dealing with difficult customers, managing a high workload, and working long hours.

What are the rewards of being an Insurance Claims Adjuster?

The rewards of being an Insurance Claims Adjuster include helping people in their time of need, making a difference in their lives, and earning a good salary.