Are you a seasoned Insurance Clerk seeking a new career path? Discover our professionally built Insurance Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

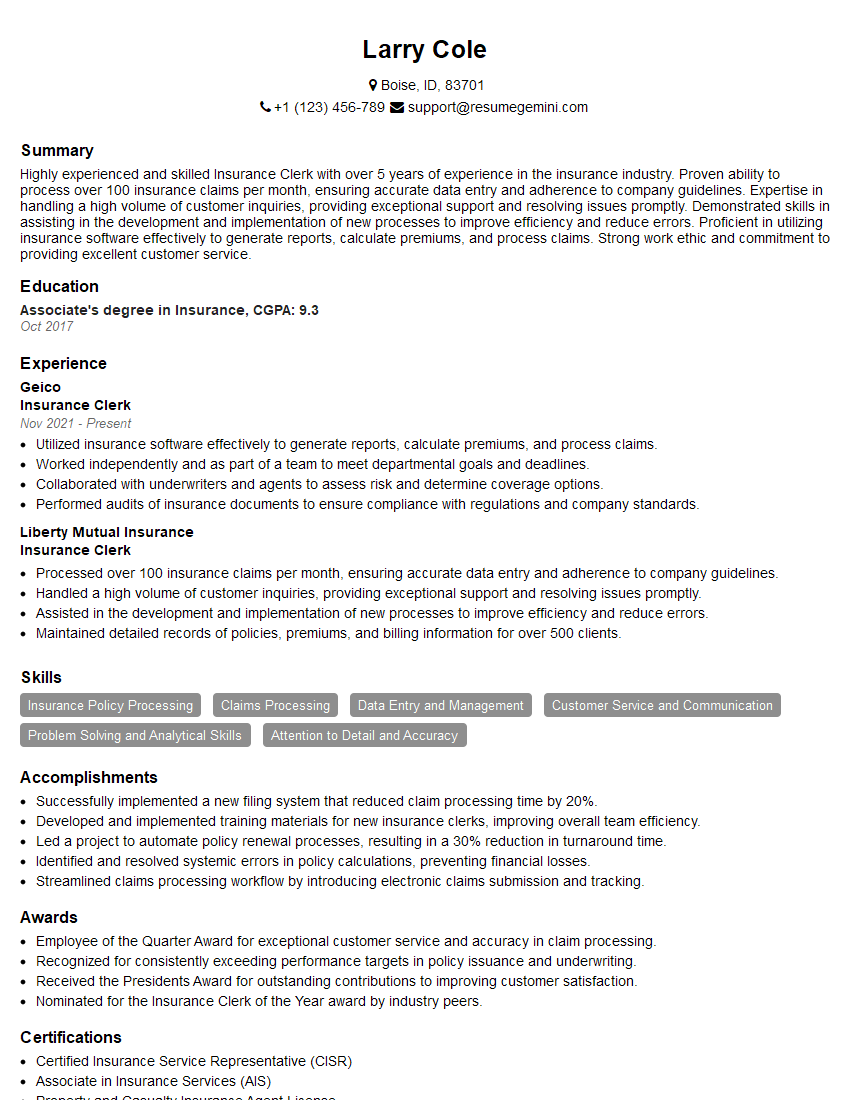

Larry Cole

Insurance Clerk

Summary

Highly experienced and skilled Insurance Clerk with over 5 years of experience in the insurance industry. Proven ability to process over 100 insurance claims per month, ensuring accurate data entry and adherence to company guidelines. Expertise in handling a high volume of customer inquiries, providing exceptional support and resolving issues promptly. Demonstrated skills in assisting in the development and implementation of new processes to improve efficiency and reduce errors. Proficient in utilizing insurance software effectively to generate reports, calculate premiums, and process claims. Strong work ethic and commitment to providing excellent customer service.

Education

Associate’s degree in Insurance

October 2017

Skills

- Insurance Policy Processing

- Claims Processing

- Data Entry and Management

- Customer Service and Communication

- Problem Solving and Analytical Skills

- Attention to Detail and Accuracy

Work Experience

Insurance Clerk

- Utilized insurance software effectively to generate reports, calculate premiums, and process claims.

- Worked independently and as part of a team to meet departmental goals and deadlines.

- Collaborated with underwriters and agents to assess risk and determine coverage options.

- Performed audits of insurance documents to ensure compliance with regulations and company standards.

Insurance Clerk

- Processed over 100 insurance claims per month, ensuring accurate data entry and adherence to company guidelines.

- Handled a high volume of customer inquiries, providing exceptional support and resolving issues promptly.

- Assisted in the development and implementation of new processes to improve efficiency and reduce errors.

- Maintained detailed records of policies, premiums, and billing information for over 500 clients.

Accomplishments

- Successfully implemented a new filing system that reduced claim processing time by 20%.

- Developed and implemented training materials for new insurance clerks, improving overall team efficiency.

- Led a project to automate policy renewal processes, resulting in a 30% reduction in turnaround time.

- Identified and resolved systemic errors in policy calculations, preventing financial losses.

- Streamlined claims processing workflow by introducing electronic claims submission and tracking.

Awards

- Employee of the Quarter Award for exceptional customer service and accuracy in claim processing.

- Recognized for consistently exceeding performance targets in policy issuance and underwriting.

- Received the Presidents Award for outstanding contributions to improving customer satisfaction.

- Nominated for the Insurance Clerk of the Year award by industry peers.

Certificates

- Certified Insurance Service Representative (CISR)

- Associate in Insurance Services (AIS)

- Property and Casualty Insurance Agent License

- Certified Insurance Counselor (CIC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Insurance Clerk

- Highlight your skills in data entry, customer service, and insurance policy processing.

- Quantify your accomplishments whenever possible, using specific numbers and metrics.

- Proofread your resume carefully for any errors.

- Tailor your resume to each job you apply for, highlighting the skills and experience that are most relevant to the position.

Essential Experience Highlights for a Strong Insurance Clerk Resume

- Processed over 100 insurance claims per month, ensuring accurate data entry and adherence to company guidelines.

- Handled a high volume of customer inquiries, providing exceptional support and resolving issues promptly.

- Assisted in the development and implementation of new processes to improve efficiency and reduce errors.

- Maintained detailed records of policies, premiums, and billing information for over 500 clients.

- Utilized insurance software effectively to generate reports, calculate premiums, and process claims.

- Collaborated with underwriters and agents to assess risk and determine coverage options.

- Performed audits of insurance documents to ensure compliance with regulations and company standards.

Frequently Asked Questions (FAQ’s) For Insurance Clerk

What are the key responsibilities of an Insurance Clerk?

The key responsibilities of an Insurance Clerk include processing insurance claims, handling customer inquiries, maintaining insurance records, and assisting in the development and implementation of new processes.

What are the educational requirements for an Insurance Clerk?

Most Insurance Clerks have at least a high school diploma or equivalent, but some employers may prefer candidates with an associate’s degree in insurance or a related field.

What are the soft skills required for an Insurance Clerk?

Insurance Clerks should have strong communication, interpersonal, and problem-solving skills, as well as the ability to work independently and as part of a team.

What are the career prospects for an Insurance Clerk?

Insurance Clerks can advance to positions such as Insurance Underwriter, Insurance Agent, or Insurance Claims Adjuster with experience and additional training.

How can I prepare for an interview for an Insurance Clerk position?

To prepare for an interview for an Insurance Clerk position, you should research the company, practice answering common interview questions, and dress professionally.

What are the common challenges faced by Insurance Clerks?

Insurance Clerks may face challenges such as dealing with difficult customers, processing complex claims, and meeting deadlines.