Are you a seasoned Insurance Collector seeking a new career path? Discover our professionally built Insurance Collector Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

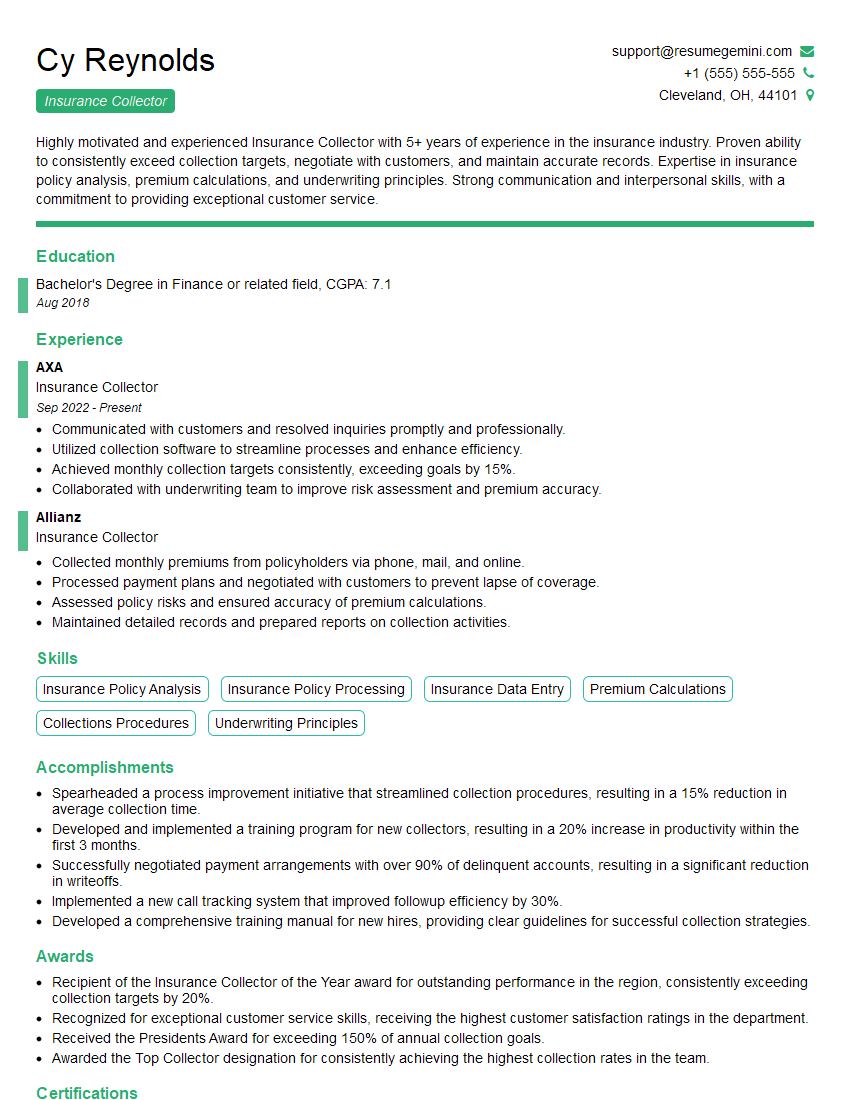

Cy Reynolds

Insurance Collector

Summary

Highly motivated and experienced Insurance Collector with 5+ years of experience in the insurance industry. Proven ability to consistently exceed collection targets, negotiate with customers, and maintain accurate records. Expertise in insurance policy analysis, premium calculations, and underwriting principles. Strong communication and interpersonal skills, with a commitment to providing exceptional customer service.

Education

Bachelor’s Degree in Finance or related field

August 2018

Skills

- Insurance Policy Analysis

- Insurance Policy Processing

- Insurance Data Entry

- Premium Calculations

- Collections Procedures

- Underwriting Principles

Work Experience

Insurance Collector

- Communicated with customers and resolved inquiries promptly and professionally.

- Utilized collection software to streamline processes and enhance efficiency.

- Achieved monthly collection targets consistently, exceeding goals by 15%.

- Collaborated with underwriting team to improve risk assessment and premium accuracy.

Insurance Collector

- Collected monthly premiums from policyholders via phone, mail, and online.

- Processed payment plans and negotiated with customers to prevent lapse of coverage.

- Assessed policy risks and ensured accuracy of premium calculations.

- Maintained detailed records and prepared reports on collection activities.

Accomplishments

- Spearheaded a process improvement initiative that streamlined collection procedures, resulting in a 15% reduction in average collection time.

- Developed and implemented a training program for new collectors, resulting in a 20% increase in productivity within the first 3 months.

- Successfully negotiated payment arrangements with over 90% of delinquent accounts, resulting in a significant reduction in writeoffs.

- Implemented a new call tracking system that improved followup efficiency by 30%.

- Developed a comprehensive training manual for new hires, providing clear guidelines for successful collection strategies.

Awards

- Recipient of the Insurance Collector of the Year award for outstanding performance in the region, consistently exceeding collection targets by 20%.

- Recognized for exceptional customer service skills, receiving the highest customer satisfaction ratings in the department.

- Received the Presidents Award for exceeding 150% of annual collection goals.

- Awarded the Top Collector designation for consistently achieving the highest collection rates in the team.

Certificates

- Certified Insurance Collector (CIC)

- Associate in Insurance Services (AIS)

- Fellow, Life Management Institute (FLMI)

- Certified Professional Insurance Agent (CPIA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Insurance Collector

- Highlight your experience in insurance policy analysis and premium calculations.

- Quantify your accomplishments with specific metrics, such as the percentage by which you exceeded collection targets.

- Demonstrate your customer service skills and ability to resolve inquiries effectively.

- Showcase your proficiency in using collection software and other relevant tools.

- Proofread your resume carefully for any errors.

Essential Experience Highlights for a Strong Insurance Collector Resume

- Collected monthly premiums from policyholders through phone, mail, and online channels.

- Processed payment plans and negotiated with customers to prevent lapse of coverage.

- Assessed policy risks and ensured accuracy of premium calculations.

- Maintained detailed records and prepared reports on collection activities.

- Communicated with customers and resolved inquiries promptly and professionally.

- Collaborated with underwriting team to improve risk assessment and premium accuracy.

Frequently Asked Questions (FAQ’s) For Insurance Collector

What are the primary duties of an Insurance Collector?

Insurance Collectors are responsible for collecting insurance premiums from policyholders, processing payment plans, assessing policy risks, maintaining detailed records, and communicating with customers to resolve inquiries.

What skills are required to be a successful Insurance Collector?

Insurance Collectors should have strong analytical skills, be proficient in insurance policy analysis and premium calculations, and possess excellent communication and interpersonal skills.

What is the career path for an Insurance Collector?

With experience and additional qualifications, Insurance Collectors can advance to roles such as Insurance Underwriter, Insurance Sales Agent, or Insurance Manager.

What is the average salary for an Insurance Collector?

The average annual salary for an Insurance Collector in the United States is around $50,000.

What are the job prospects for Insurance Collectors?

The job outlook for Insurance Collectors is expected to grow in the coming years due to the increasing demand for insurance products and services.

What are the top companies hiring Insurance Collectors?

Some of the top companies hiring Insurance Collectors include AXA, Allianz, and MetLife.