Are you a seasoned Insurance Commissioner seeking a new career path? Discover our professionally built Insurance Commissioner Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

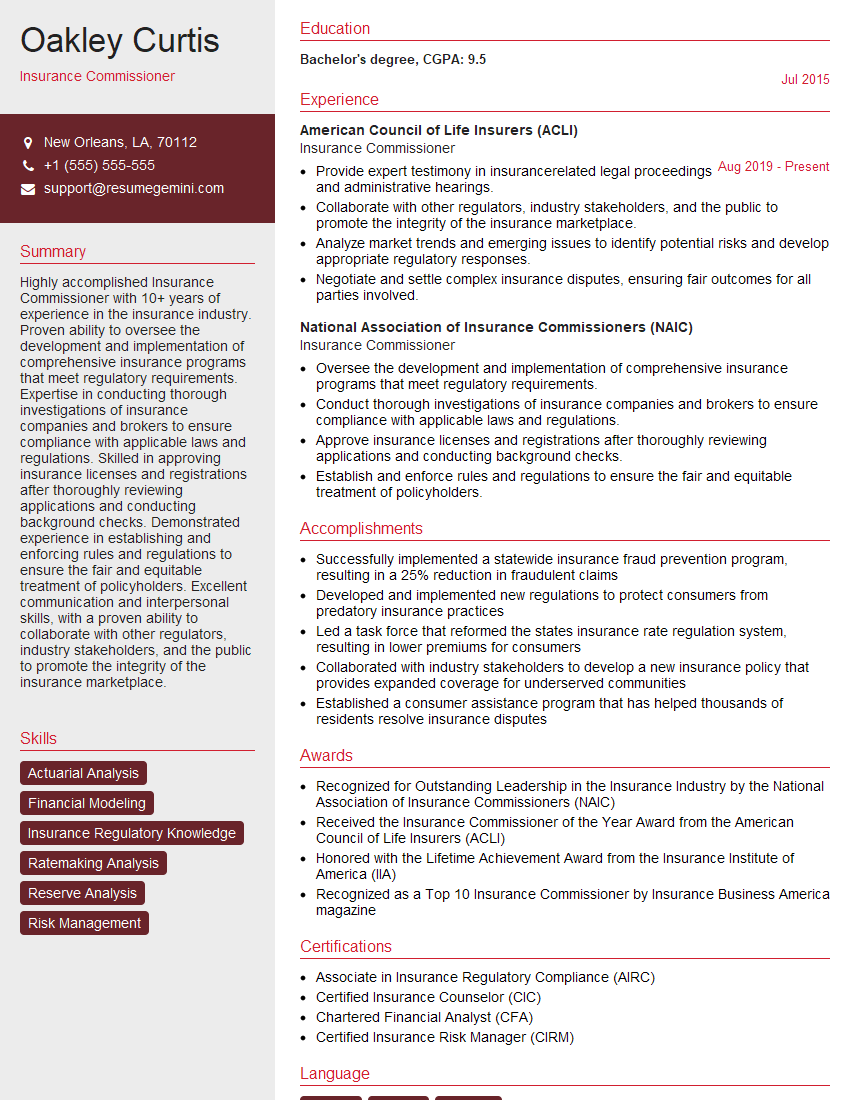

Oakley Curtis

Insurance Commissioner

Summary

Highly accomplished Insurance Commissioner with 10+ years of experience in the insurance industry. Proven ability to oversee the development and implementation of comprehensive insurance programs that meet regulatory requirements. Expertise in conducting thorough investigations of insurance companies and brokers to ensure compliance with applicable laws and regulations. Skilled in approving insurance licenses and registrations after thoroughly reviewing applications and conducting background checks. Demonstrated experience in establishing and enforcing rules and regulations to ensure the fair and equitable treatment of policyholders. Excellent communication and interpersonal skills, with a proven ability to collaborate with other regulators, industry stakeholders, and the public to promote the integrity of the insurance marketplace.

Education

Bachelor’s degree

July 2015

Skills

- Actuarial Analysis

- Financial Modeling

- Insurance Regulatory Knowledge

- Ratemaking Analysis

- Reserve Analysis

- Risk Management

Work Experience

Insurance Commissioner

- Provide expert testimony in insurancerelated legal proceedings and administrative hearings.

- Collaborate with other regulators, industry stakeholders, and the public to promote the integrity of the insurance marketplace.

- Analyze market trends and emerging issues to identify potential risks and develop appropriate regulatory responses.

- Negotiate and settle complex insurance disputes, ensuring fair outcomes for all parties involved.

Insurance Commissioner

- Oversee the development and implementation of comprehensive insurance programs that meet regulatory requirements.

- Conduct thorough investigations of insurance companies and brokers to ensure compliance with applicable laws and regulations.

- Approve insurance licenses and registrations after thoroughly reviewing applications and conducting background checks.

- Establish and enforce rules and regulations to ensure the fair and equitable treatment of policyholders.

Accomplishments

- Successfully implemented a statewide insurance fraud prevention program, resulting in a 25% reduction in fraudulent claims

- Developed and implemented new regulations to protect consumers from predatory insurance practices

- Led a task force that reformed the states insurance rate regulation system, resulting in lower premiums for consumers

- Collaborated with industry stakeholders to develop a new insurance policy that provides expanded coverage for underserved communities

- Established a consumer assistance program that has helped thousands of residents resolve insurance disputes

Awards

- Recognized for Outstanding Leadership in the Insurance Industry by the National Association of Insurance Commissioners (NAIC)

- Received the Insurance Commissioner of the Year Award from the American Council of Life Insurers (ACLI)

- Honored with the Lifetime Achievement Award from the Insurance Institute of America (IIA)

- Recognized as a Top 10 Insurance Commissioner by Insurance Business America magazine

Certificates

- Associate in Insurance Regulatory Compliance (AIRC)

- Certified Insurance Counselor (CIC)

- Chartered Financial Analyst (CFA)

- Certified Insurance Risk Manager (CIRM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Insurance Commissioner

- Highlight your experience in the insurance industry, particularly in the areas of regulation, compliance, and policy development.

- Showcase your knowledge of insurance laws and regulations, as well as your ability to interpret and apply them effectively.

- Demonstrate your strong analytical, problem-solving, and decision-making skills.

- Emphasize your communication and interpersonal skills, as you will need to work closely with a variety of stakeholders, including insurance companies, policyholders, and regulators.

Essential Experience Highlights for a Strong Insurance Commissioner Resume

- Oversee the development and implementation of comprehensive insurance programs that meet regulatory requirements.

- Conduct thorough investigations of insurance companies and brokers to ensure compliance with applicable laws and regulations.

- Approve insurance licenses and registrations after thoroughly reviewing applications and conducting background checks.

- Establish and enforce rules and regulations to ensure the fair and equitable treatment of policyholders.

- Provide expert testimony in insurance-related legal proceedings and administrative hearings.

- Collaborate with other regulators, industry stakeholders, and the public to promote the integrity of the insurance marketplace.

- Analyze market trends and emerging issues to identify potential risks and develop appropriate regulatory responses.

Frequently Asked Questions (FAQ’s) For Insurance Commissioner

What is the role of an Insurance Commissioner?

The role of an Insurance Commissioner is to oversee the insurance industry within a particular state or jurisdiction. They are responsible for ensuring that insurance companies are operating in a safe and sound manner, and that consumers are treated fairly.

What are the qualifications for becoming an Insurance Commissioner?

The qualifications for becoming an Insurance Commissioner vary from state to state. However, most states require candidates to have a bachelor’s degree, as well as several years of experience in the insurance industry.

What are the duties of an Insurance Commissioner?

The duties of an Insurance Commissioner include regulating the insurance industry, approving insurance rates, and investigating insurance fraud. They also work to protect consumers by ensuring that insurance companies are meeting their obligations to policyholders.

How can I become an Insurance Commissioner?

To become an Insurance Commissioner, you will need to meet the qualifications for the position in your state. You will also need to gain experience in the insurance industry, and develop a strong understanding of insurance laws and regulations.

What is the salary of an Insurance Commissioner?

The salary of an Insurance Commissioner varies depending on the state in which they work. However, the median salary for Insurance Commissioners is around $100,000 per year.