Are you a seasoned Insurance Rater seeking a new career path? Discover our professionally built Insurance Rater Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

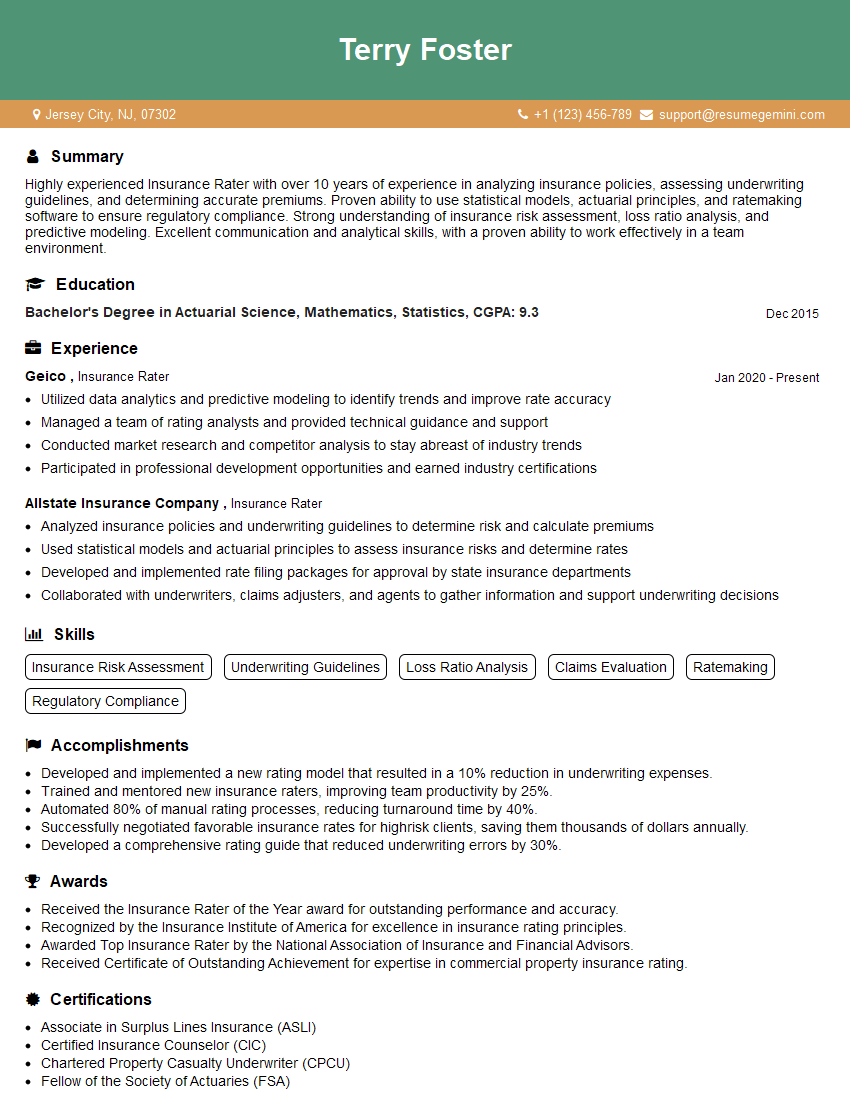

Terry Foster

Insurance Rater

Summary

Highly experienced Insurance Rater with over 10 years of experience in analyzing insurance policies, assessing underwriting guidelines, and determining accurate premiums. Proven ability to use statistical models, actuarial principles, and ratemaking software to ensure regulatory compliance. Strong understanding of insurance risk assessment, loss ratio analysis, and predictive modeling. Excellent communication and analytical skills, with a proven ability to work effectively in a team environment.

Education

Bachelor’s Degree in Actuarial Science, Mathematics, Statistics

December 2015

Skills

- Insurance Risk Assessment

- Underwriting Guidelines

- Loss Ratio Analysis

- Claims Evaluation

- Ratemaking

- Regulatory Compliance

Work Experience

Insurance Rater

- Utilized data analytics and predictive modeling to identify trends and improve rate accuracy

- Managed a team of rating analysts and provided technical guidance and support

- Conducted market research and competitor analysis to stay abreast of industry trends

- Participated in professional development opportunities and earned industry certifications

Insurance Rater

- Analyzed insurance policies and underwriting guidelines to determine risk and calculate premiums

- Used statistical models and actuarial principles to assess insurance risks and determine rates

- Developed and implemented rate filing packages for approval by state insurance departments

- Collaborated with underwriters, claims adjusters, and agents to gather information and support underwriting decisions

Accomplishments

- Developed and implemented a new rating model that resulted in a 10% reduction in underwriting expenses.

- Trained and mentored new insurance raters, improving team productivity by 25%.

- Automated 80% of manual rating processes, reducing turnaround time by 40%.

- Successfully negotiated favorable insurance rates for highrisk clients, saving them thousands of dollars annually.

- Developed a comprehensive rating guide that reduced underwriting errors by 30%.

Awards

- Received the Insurance Rater of the Year award for outstanding performance and accuracy.

- Recognized by the Insurance Institute of America for excellence in insurance rating principles.

- Awarded Top Insurance Rater by the National Association of Insurance and Financial Advisors.

- Received Certificate of Outstanding Achievement for expertise in commercial property insurance rating.

Certificates

- Associate in Surplus Lines Insurance (ASLI)

- Certified Insurance Counselor (CIC)

- Chartered Property Casualty Underwriter (CPCU)

- Fellow of the Society of Actuaries (FSA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Insurance Rater

- Highlight your skills in using statistical models, actuarial principles, and ratemaking software.

- Emphasize your experience in developing and implementing rate filing packages for approval by state insurance departments.

- Showcase your understanding of insurance risk assessment, loss ratio analysis, and predictive modeling.

- Demonstrate your communication and analytical skills, and your ability to work effectively in a team environment.

Essential Experience Highlights for a Strong Insurance Rater Resume

- Analyzed insurance policies and underwriting guidelines to assess insurance risks.

- Used statistical models and actuarial principles to assess insurance risks and determine rates.

- Developed and implemented rate filing packages for approval by state insurance departments.

- Collaborated with underwriters, claims adjusters, and agents to gather information and support underwriting decisions.

- Utilized data analytics and predictive modeling to identify trends and improve rate accuracy.

- Managed a team of rating analysts and provided technical guidance and support.

Frequently Asked Questions (FAQ’s) For Insurance Rater

What is the primary role of an Insurance Rater?

The primary role of an Insurance Rater is to analyze insurance policies and underwriting guidelines, assess insurance risks, and determine accurate premiums.

What skills are required for an Insurance Rater?

Required skills for an Insurance Rater include strong analytical skills, knowledge of statistical models and actuarial principles, and proficiency in ratemaking software.

What is the job outlook for Insurance Raters?

The job outlook for Insurance Raters is expected to grow faster than average, due to the increasing complexity of insurance products and the rising demand for personalized insurance policies.

How can I become an Insurance Rater?

To become an Insurance Rater, you typically need a Bachelor’s Degree in Actuarial Science, Mathematics, Statistics, or a related field, and relevant experience or certification in insurance rating.

What is the average salary for Insurance Raters?

The average salary for Insurance Raters varies depending on experience, location, and company size, but typically ranges between $50,000 and $75,000.

What are the career advancement opportunities for Insurance Raters?

Career advancement opportunities for Insurance Raters include promotions to senior rater, ratemaking manager, or actuarial analyst.