Are you a seasoned Insurance Solicitor seeking a new career path? Discover our professionally built Insurance Solicitor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

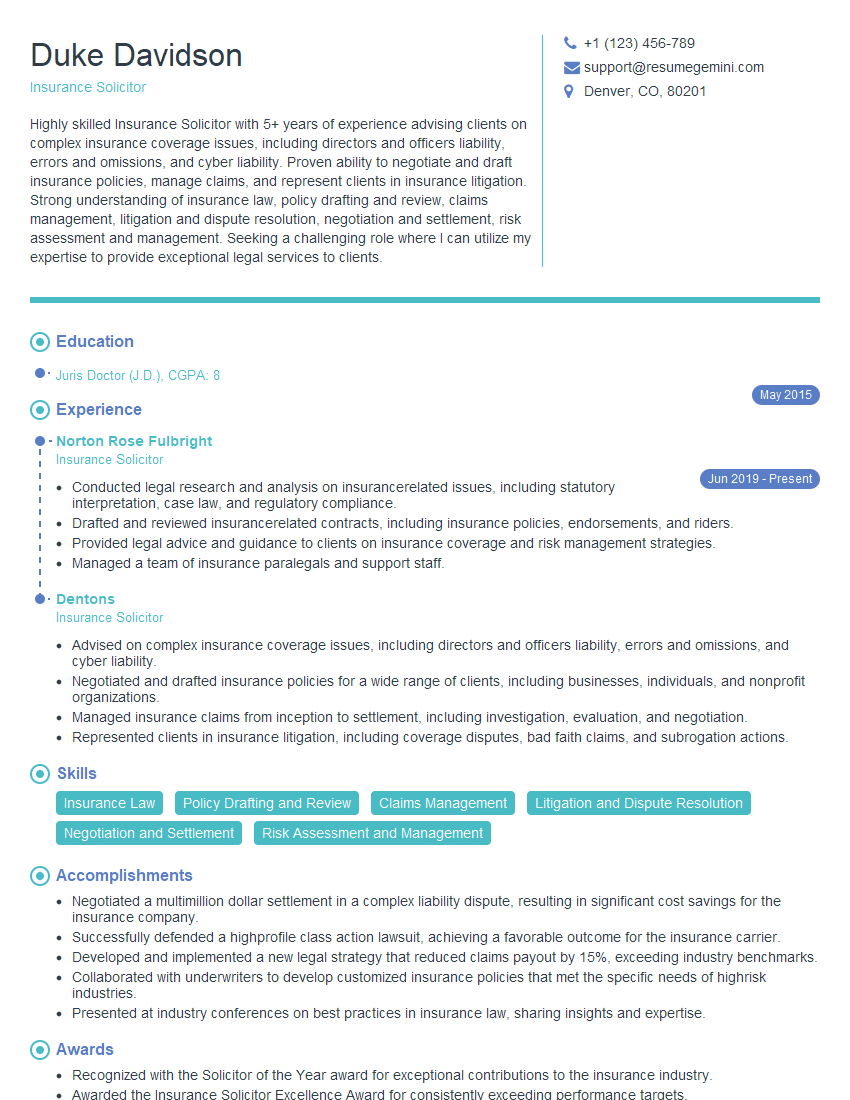

Duke Davidson

Insurance Solicitor

Summary

Highly skilled Insurance Solicitor with 5+ years of experience advising clients on complex insurance coverage issues, including directors and officers liability, errors and omissions, and cyber liability. Proven ability to negotiate and draft insurance policies, manage claims, and represent clients in insurance litigation. Strong understanding of insurance law, policy drafting and review, claims management, litigation and dispute resolution, negotiation and settlement, risk assessment and management. Seeking a challenging role where I can utilize my expertise to provide exceptional legal services to clients.

Education

Juris Doctor (J.D.)

May 2015

Skills

- Insurance Law

- Policy Drafting and Review

- Claims Management

- Litigation and Dispute Resolution

- Negotiation and Settlement

- Risk Assessment and Management

Work Experience

Insurance Solicitor

- Conducted legal research and analysis on insurancerelated issues, including statutory interpretation, case law, and regulatory compliance.

- Drafted and reviewed insurancerelated contracts, including insurance policies, endorsements, and riders.

- Provided legal advice and guidance to clients on insurance coverage and risk management strategies.

- Managed a team of insurance paralegals and support staff.

Insurance Solicitor

- Advised on complex insurance coverage issues, including directors and officers liability, errors and omissions, and cyber liability.

- Negotiated and drafted insurance policies for a wide range of clients, including businesses, individuals, and nonprofit organizations.

- Managed insurance claims from inception to settlement, including investigation, evaluation, and negotiation.

- Represented clients in insurance litigation, including coverage disputes, bad faith claims, and subrogation actions.

Accomplishments

- Negotiated a multimillion dollar settlement in a complex liability dispute, resulting in significant cost savings for the insurance company.

- Successfully defended a highprofile class action lawsuit, achieving a favorable outcome for the insurance carrier.

- Developed and implemented a new legal strategy that reduced claims payout by 15%, exceeding industry benchmarks.

- Collaborated with underwriters to develop customized insurance policies that met the specific needs of highrisk industries.

- Presented at industry conferences on best practices in insurance law, sharing insights and expertise.

Awards

- Recognized with the Solicitor of the Year award for exceptional contributions to the insurance industry.

- Awarded the Insurance Solicitor Excellence Award for consistently exceeding performance targets.

- Received the Outstanding Legal Contribution award for innovative and effective representation in complex insurance cases.

- Honored with the Insurance Law Trailblazer award for pioneering new legal approaches in insurance litigation.

Certificates

- Chartered Property Casualty Underwriter (CPCU)

- Associate in Risk Management (ARM)

- Fellow of the Institute of Chartered Accountants in England and Wales (FCA)

- Certified Insurance Counselor (CIC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Insurance Solicitor

Highlight your expertise in insurance law:

Emphasize your knowledge of insurance statutes, regulations, and case law.Showcase your negotiation and settlement skills:

Provide specific examples of successful negotiations and settlements you have achieved.Demonstrate your litigation experience:

Describe your experience representing clients in insurance litigation, including any notable victories or favorable outcomes.Quantify your results:

Use numbers to demonstrate the impact of your work, such as the number of policies drafted, claims managed, or cases litigated.

Essential Experience Highlights for a Strong Insurance Solicitor Resume

- Advise clients on complex insurance coverage issues, including directors and officers liability, errors and omissions, and cyber liability.

- Negotiate and draft insurance policies for a wide range of clients, including businesses, individuals, and nonprofit organizations.

- Manage insurance claims from inception to settlement, including investigation, evaluation, and negotiation.

- Represent clients in insurance litigation, including coverage disputes, bad faith claims, and subrogation actions.

- Conduct legal research and analysis on insurancerelated issues, including statutory interpretation, case law, and regulatory compliance.

- Draft and review insurancerelated contracts, including insurance policies, endorsements, and riders.

- Provide legal advice and guidance to clients on insurance coverage and risk management strategies.

Frequently Asked Questions (FAQ’s) For Insurance Solicitor

What are the key skills required for an Insurance Solicitor?

Insurance Solicitors require a strong understanding of insurance law, policy drafting and review, claims management, litigation and dispute resolution, negotiation and settlement, risk assessment and management.

What is the average salary for an Insurance Solicitor?

The average salary for an Insurance Solicitor varies depending on experience, location, and firm size, but it typically ranges from $70,000 to $120,000 per year.

What are the career prospects for an Insurance Solicitor?

Insurance Solicitors can advance to senior positions within law firms, insurance companies, or corporations. They may also choose to specialize in a particular area of insurance law, such as directors and officers liability or cyber liability.

What are the challenges faced by Insurance Solicitors?

Insurance Solicitors face challenges such as keeping up with the constantly evolving insurance landscape, negotiating complex insurance policies, and representing clients in adversarial proceedings.

What is the best way to prepare for a career as an Insurance Solicitor?

To prepare for a career as an Insurance Solicitor, it is recommended to obtain a Juris Doctor (J.D.) degree, pass the bar exam, and gain experience in insurance law through internships or clerkships.

What are the ethical considerations for Insurance Solicitors?

Insurance Solicitors must adhere to ethical guidelines, including maintaining client confidentiality, avoiding conflicts of interest, and providing competent and diligent legal services.

How can Insurance Solicitors stay up-to-date on the latest developments in insurance law?

Insurance Solicitors can stay up-to-date on the latest developments in insurance law by attending conferences, reading legal journals, and participating in continuing legal education courses.