Are you a seasoned Insurance Special Agent seeking a new career path? Discover our professionally built Insurance Special Agent Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

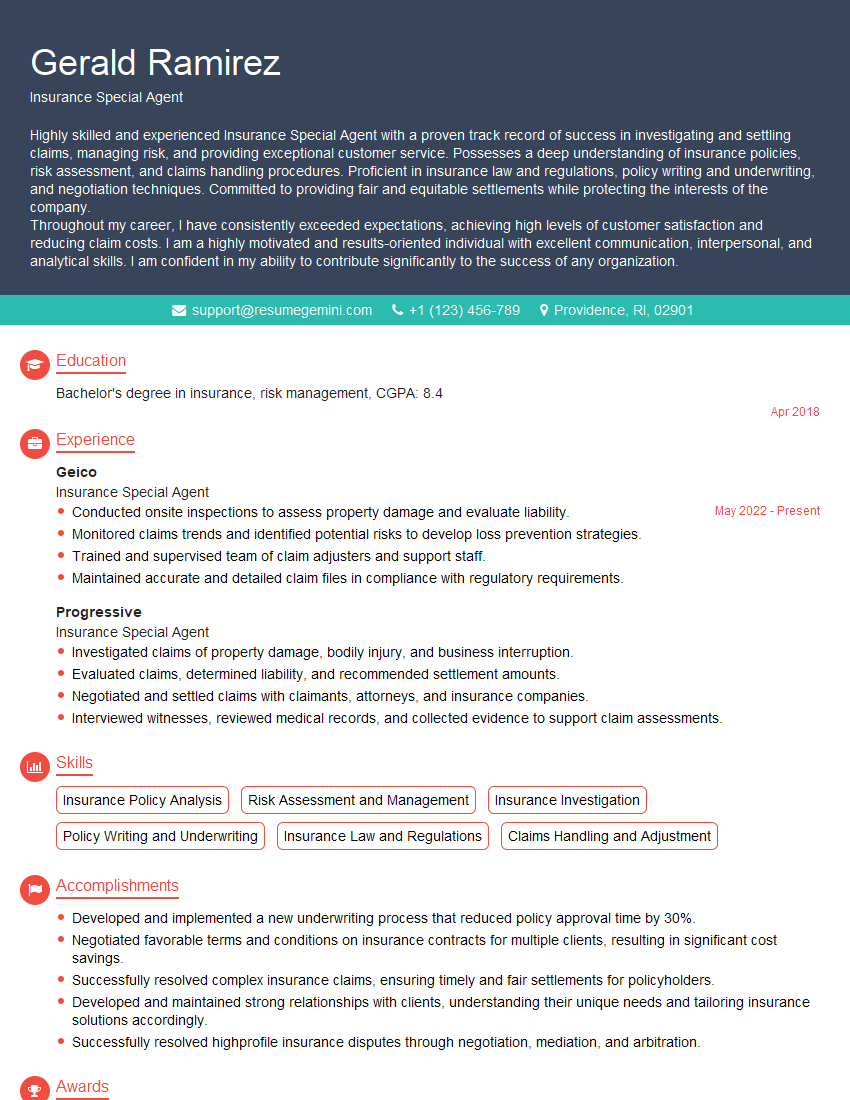

Gerald Ramirez

Insurance Special Agent

Summary

Highly skilled and experienced Insurance Special Agent with a proven track record of success in investigating and settling claims, managing risk, and providing exceptional customer service. Possesses a deep understanding of insurance policies, risk assessment, and claims handling procedures. Proficient in insurance law and regulations, policy writing and underwriting, and negotiation techniques. Committed to providing fair and equitable settlements while protecting the interests of the company.

Throughout my career, I have consistently exceeded expectations, achieving high levels of customer satisfaction and reducing claim costs. I am a highly motivated and results-oriented individual with excellent communication, interpersonal, and analytical skills. I am confident in my ability to contribute significantly to the success of any organization.

Education

Bachelor’s degree in insurance, risk management

April 2018

Skills

- Insurance Policy Analysis

- Risk Assessment and Management

- Insurance Investigation

- Policy Writing and Underwriting

- Insurance Law and Regulations

- Claims Handling and Adjustment

Work Experience

Insurance Special Agent

- Conducted onsite inspections to assess property damage and evaluate liability.

- Monitored claims trends and identified potential risks to develop loss prevention strategies.

- Trained and supervised team of claim adjusters and support staff.

- Maintained accurate and detailed claim files in compliance with regulatory requirements.

Insurance Special Agent

- Investigated claims of property damage, bodily injury, and business interruption.

- Evaluated claims, determined liability, and recommended settlement amounts.

- Negotiated and settled claims with claimants, attorneys, and insurance companies.

- Interviewed witnesses, reviewed medical records, and collected evidence to support claim assessments.

Accomplishments

- Developed and implemented a new underwriting process that reduced policy approval time by 30%.

- Negotiated favorable terms and conditions on insurance contracts for multiple clients, resulting in significant cost savings.

- Successfully resolved complex insurance claims, ensuring timely and fair settlements for policyholders.

- Developed and maintained strong relationships with clients, understanding their unique needs and tailoring insurance solutions accordingly.

- Successfully resolved highprofile insurance disputes through negotiation, mediation, and arbitration.

Awards

- Achieved the Presidents Club Award for consistently exceeding sales targets by 20% or more.

- Recognized as the Top Producer for the agency for three consecutive years.

- Received the Insurance Institute of Americas (IIAA) Certified Insurance Agent (CIC) designation.

- Earned the Chartered Property Casualty Underwriter (CPCU) designation from the Insurance Institute of America.

Certificates

- Chartered Property Casualty Underwriter (CPCU)

- Associate in Claims (AIC)

- Certified Insurance Counselor (CIC)

- Certified Insurance Fraud Investigator (CIFI)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Insurance Special Agent

- Highlight your experience and expertise in insurance claims investigation and settlement.

- Emphasize your knowledge of insurance policies, risk assessment, and claims handling procedures.

- Showcase your negotiation skills and ability to resolve claims fairly and efficiently.

- Quantify your accomplishments and provide specific examples of how you have reduced claim costs or improved customer satisfaction.

Essential Experience Highlights for a Strong Insurance Special Agent Resume

- Investigate and assess insurance claims involving property damage, bodily injury, and business interruption.

- Evaluate liability, determine coverage, and recommend settlement amounts.

- Negotiate and settle claims with claimants, attorneys, and insurance companies.

- Interview witnesses, review medical records, and collect evidence to support claim assessments.

- Conduct onsite inspections to assess property damage and evaluate liability.

- Monitor claims trends and identify potential risks to develop loss prevention strategies.

- Train and supervise team of claim adjusters and support staff.

Frequently Asked Questions (FAQ’s) For Insurance Special Agent

What are the key responsibilities of an Insurance Special Agent?

The key responsibilities of an Insurance Special Agent include investigating and assessing insurance claims, evaluating liability, negotiating and settling claims, interviewing witnesses, conducting onsite inspections, monitoring claims trends, and training and supervising staff.

What is the typical educational background for an Insurance Special Agent?

Insurance Special Agents typically hold a bachelor’s degree in insurance, risk management, or a related field.

What are the key skills and qualities required for an Insurance Special Agent?

Key skills and qualities for an Insurance Special Agent include strong analytical and problem-solving skills, excellent communication and negotiation abilities, a deep understanding of insurance policies and procedures, and a commitment to providing exceptional customer service.

What are the career advancement opportunities for Insurance Special Agents?

Insurance Special Agents with experience and a proven track record of success can advance to management positions, such as Claims Manager or Underwriting Manager.

What is the average salary for an Insurance Special Agent?

The average salary for an Insurance Special Agent varies depending on experience, location, and company. According to Salary.com, the average salary for an Insurance Special Agent in the United States is $75,000 per year.

What are the top companies that hire Insurance Special Agents?

Top companies that hire Insurance Special Agents include Geico, Progressive, State Farm, Allstate, and Liberty Mutual.