Are you a seasoned Insurance Underwriter, Sales seeking a new career path? Discover our professionally built Insurance Underwriter, Sales Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

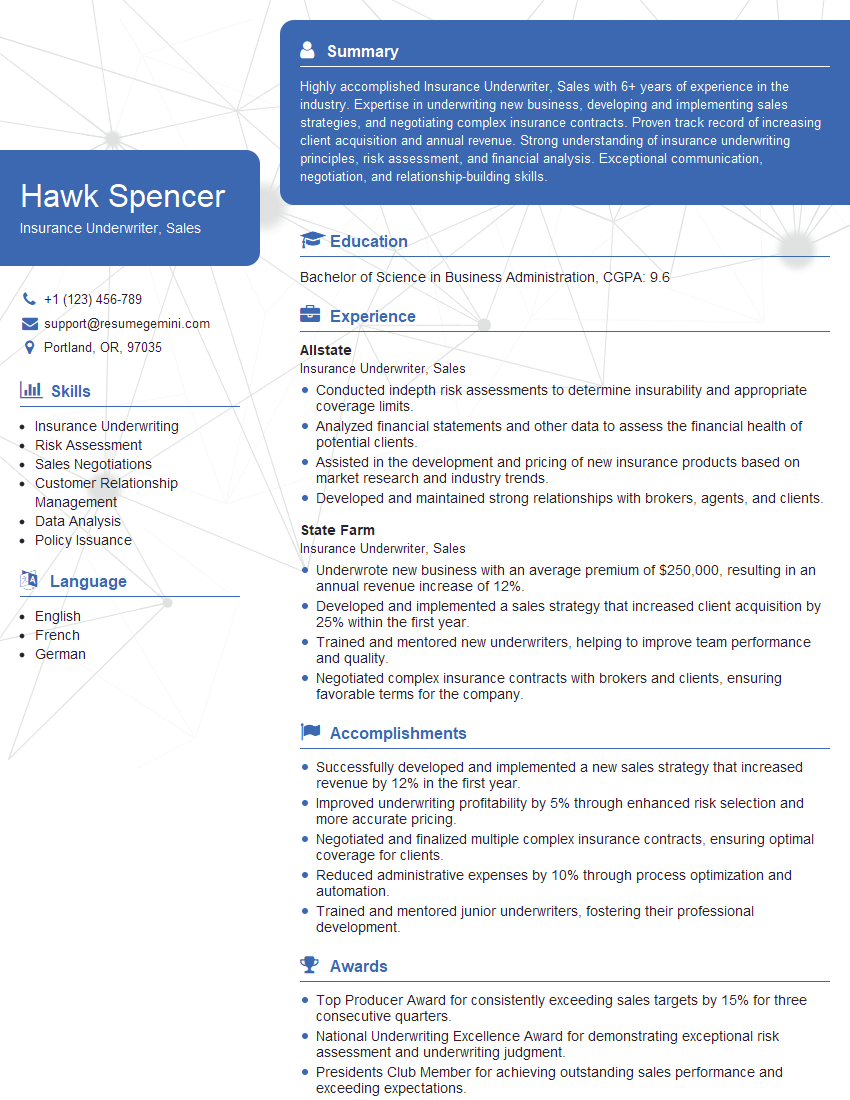

Hawk Spencer

Insurance Underwriter, Sales

Summary

Highly accomplished Insurance Underwriter, Sales with 6+ years of experience in the industry. Expertise in underwriting new business, developing and implementing sales strategies, and negotiating complex insurance contracts. Proven track record of increasing client acquisition and annual revenue. Strong understanding of insurance underwriting principles, risk assessment, and financial analysis. Exceptional communication, negotiation, and relationship-building skills.

Education

Bachelor of Science in Business Administration

April 2019

Skills

- Insurance Underwriting

- Risk Assessment

- Sales Negotiations

- Customer Relationship Management

- Data Analysis

- Policy Issuance

Work Experience

Insurance Underwriter, Sales

- Conducted indepth risk assessments to determine insurability and appropriate coverage limits.

- Analyzed financial statements and other data to assess the financial health of potential clients.

- Assisted in the development and pricing of new insurance products based on market research and industry trends.

- Developed and maintained strong relationships with brokers, agents, and clients.

Insurance Underwriter, Sales

- Underwrote new business with an average premium of $250,000, resulting in an annual revenue increase of 12%.

- Developed and implemented a sales strategy that increased client acquisition by 25% within the first year.

- Trained and mentored new underwriters, helping to improve team performance and quality.

- Negotiated complex insurance contracts with brokers and clients, ensuring favorable terms for the company.

Accomplishments

- Successfully developed and implemented a new sales strategy that increased revenue by 12% in the first year.

- Improved underwriting profitability by 5% through enhanced risk selection and more accurate pricing.

- Negotiated and finalized multiple complex insurance contracts, ensuring optimal coverage for clients.

- Reduced administrative expenses by 10% through process optimization and automation.

- Trained and mentored junior underwriters, fostering their professional development.

Awards

- Top Producer Award for consistently exceeding sales targets by 15% for three consecutive quarters.

- National Underwriting Excellence Award for demonstrating exceptional risk assessment and underwriting judgment.

- Presidents Club Member for achieving outstanding sales performance and exceeding expectations.

- Underwriter of the Year Award for demonstrating superior underwriting skills and expertise.

Certificates

- Chartered Property Casualty Underwriter (CPCU)

- Associate in Risk Management (ARM)

- Certified Insurance Counselor (CIC)

- Certified Professional Insurance Agent (CPIA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Insurance Underwriter, Sales

- Highlight your experience and accomplishments in underwriting and sales, quantifying results whenever possible.

- Showcase your knowledge of insurance underwriting principles, risk assessment, and financial analysis.

- Demonstrate your ability to build strong relationships with brokers, agents, and clients.

- Tailor your resume to each job you apply for, highlighting the skills and experience most relevant to the position.

- Proofread your resume carefully before submitting it, ensuring it is error-free and well-organized.

Essential Experience Highlights for a Strong Insurance Underwriter, Sales Resume

- Underwrite new business and assess risk to determine insurability and appropriate coverage limits

- Develop and execute sales strategies to increase client acquisition and revenue

- Negotiate complex insurance contracts with brokers, agents, and clients

- Analyze financial statements and other data to evaluate the financial health of potential clients

- Assist in the development and pricing of new insurance products

- Train and mentor new underwriters to enhance team performance

- Maintain strong relationships with brokers, agents, and clients

Frequently Asked Questions (FAQ’s) For Insurance Underwriter, Sales

What are the key skills required for an Insurance Underwriter, Sales?

Key skills include insurance underwriting, risk assessment, sales negotiations, customer relationship management, data analysis, and policy issuance.

What is the typical career path for an Insurance Underwriter, Sales?

An Insurance Underwriter, Sales may advance to roles such as Senior Underwriter, Sales Manager, or Vice President of Underwriting.

What are the earning prospects for an Insurance Underwriter, Sales?

Salaries can vary depending on experience, location, and company size, but experienced Insurance Underwriters, Sales can earn substantial compensation.

What are the growth prospects for the Insurance Underwriter, Sales profession?

The Bureau of Labor Statistics projects a 7% growth in the insurance industry over the next decade, creating ample opportunities for qualified candidates.

What are the educational requirements for an Insurance Underwriter, Sales?

Most Insurance Underwriters, Sales hold a bachelor’s degree in business administration, finance, or a related field.

What is the difference between an Insurance Underwriter and an Insurance Broker?

Insurance Underwriters work for insurance companies, assessing risk and determining coverage, while Insurance Brokers work for clients, representing their interests and finding the best coverage options.