Are you a seasoned Insurance Writer seeking a new career path? Discover our professionally built Insurance Writer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

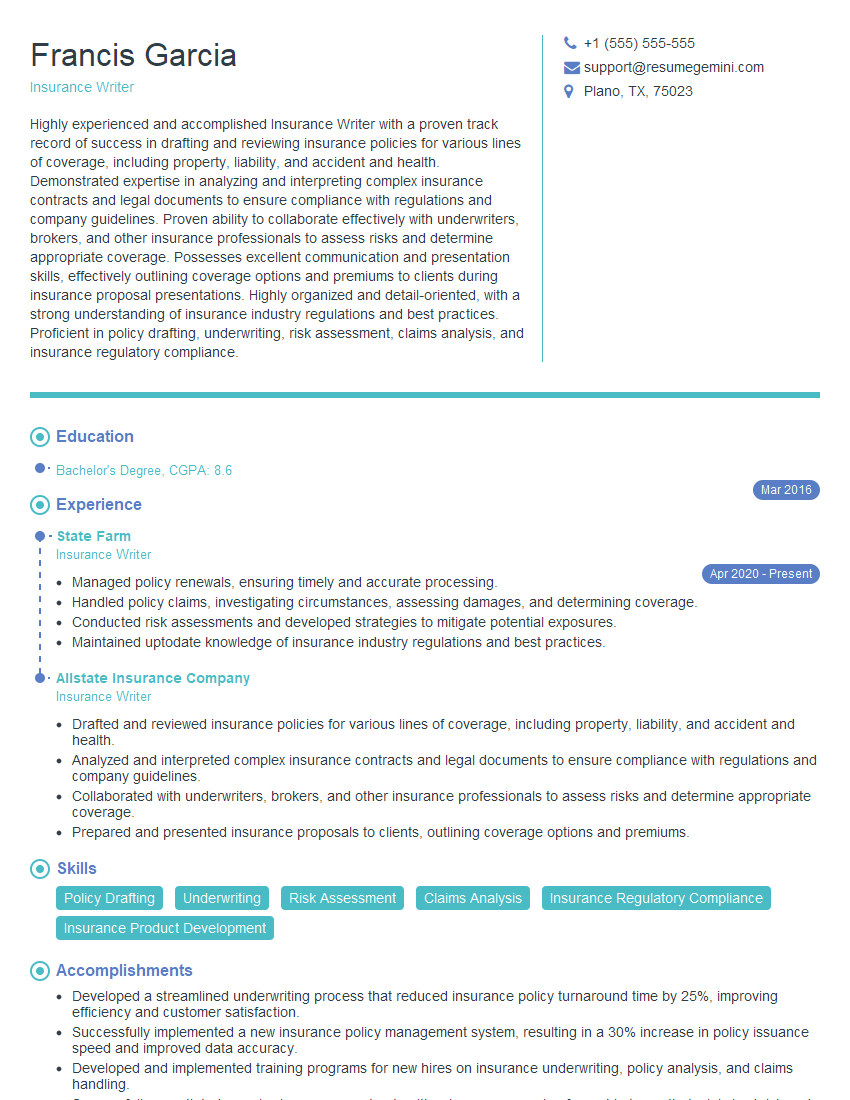

Francis Garcia

Insurance Writer

Summary

Highly experienced and accomplished Insurance Writer with a proven track record of success in drafting and reviewing insurance policies for various lines of coverage, including property, liability, and accident and health. Demonstrated expertise in analyzing and interpreting complex insurance contracts and legal documents to ensure compliance with regulations and company guidelines. Proven ability to collaborate effectively with underwriters, brokers, and other insurance professionals to assess risks and determine appropriate coverage. Possesses excellent communication and presentation skills, effectively outlining coverage options and premiums to clients during insurance proposal presentations. Highly organized and detail-oriented, with a strong understanding of insurance industry regulations and best practices. Proficient in policy drafting, underwriting, risk assessment, claims analysis, and insurance regulatory compliance.

Education

Bachelor’s Degree

March 2016

Skills

- Policy Drafting

- Underwriting

- Risk Assessment

- Claims Analysis

- Insurance Regulatory Compliance

- Insurance Product Development

Work Experience

Insurance Writer

- Managed policy renewals, ensuring timely and accurate processing.

- Handled policy claims, investigating circumstances, assessing damages, and determining coverage.

- Conducted risk assessments and developed strategies to mitigate potential exposures.

- Maintained uptodate knowledge of insurance industry regulations and best practices.

Insurance Writer

- Drafted and reviewed insurance policies for various lines of coverage, including property, liability, and accident and health.

- Analyzed and interpreted complex insurance contracts and legal documents to ensure compliance with regulations and company guidelines.

- Collaborated with underwriters, brokers, and other insurance professionals to assess risks and determine appropriate coverage.

- Prepared and presented insurance proposals to clients, outlining coverage options and premiums.

Accomplishments

- Developed a streamlined underwriting process that reduced insurance policy turnaround time by 25%, improving efficiency and customer satisfaction.

- Successfully implemented a new insurance policy management system, resulting in a 30% increase in policy issuance speed and improved data accuracy.

- Developed and implemented training programs for new hires on insurance underwriting, policy analysis, and claims handling.

- Successfully negotiated complex insurance contracts with reinsurers, securing favorable terms that minimized risk and reduced costs for clients.

- Led a project to implement a data analytics tool that enhanced insurance policy analysis and improved underwriting decisionmaking.

Awards

- Received the Insurance Writer of the Year Award for consistently delivering highquality insurance policies and providing exceptional customer service.

- Won the Team Collaboration Award for effectively collaborating with underwriters, claims adjusters, and brokers to resolve complex insurance claims and ensure seamless service.

- Recognized with the Presidents Club Award for consistently exceeding sales targets and building strong relationships with key insurance clients.

- Received the Innovation Award for creating a novel insurance product that addressed an underserved market need and generated significant revenue.

Certificates

- Chartered Property Casualty Underwriter (CPCU)

- Associate in Insurance Services (AIS)

- Fellow, Society of Actuaries (FSA)

- Certified Insurance Counselor (CIC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Insurance Writer

- Highlight your expertise in policy drafting, risk assessment, and claims analysis.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate your impact.

- Emphasize your communication and interpersonal skills, as they are crucial for building relationships with clients.

- Stay up-to-date with the latest industry trends and regulations to showcase your commitment to professional development.

- Proofread your resume carefully for any errors to ensure a polished and error-free presentation.

Essential Experience Highlights for a Strong Insurance Writer Resume

- Draft and review insurance policies for various lines of coverage, ensuring accuracy and compliance with regulations and company guidelines

- Analyze and interpret complex insurance contracts and legal documents to identify potential risks and coverage gaps

- Collaborate with underwriters, brokers, and other insurance professionals to assess risks and determine appropriate coverage options

- Prepare and present insurance proposals to clients, effectively outlining coverage options and premiums

- Manage policy renewals, ensuring timely and accurate processing to maintain coverage for clients

- Handle policy claims, investigating circumstances, assessing damages, and determining coverage eligibility

- Conduct risk assessments and develop strategies to mitigate potential exposures, reducing financial risks for clients

Frequently Asked Questions (FAQ’s) For Insurance Writer

What is the primary role of an Insurance Writer?

The primary role of an Insurance Writer is to draft, review, and analyze insurance policies to ensure they adhere to regulatory guidelines and company standards, providing clear and accurate coverage to policyholders.

What are the key skills required for success as an Insurance Writer?

To excel as an Insurance Writer, you should possess strong analytical, writing, and communication skills, along with a deep understanding of insurance principles, regulations, and industry best practices.

How can I enhance my qualifications as an Insurance Writer?

Consider obtaining additional certifications, such as the Chartered Property Casualty Underwriter (CPCU) or Associate in Risk Management (ARM), to enhance your knowledge and credibility.

What is the job outlook for Insurance Writers?

The job outlook for Insurance Writers is expected to be favorable due to the increasing demand for insurance coverage across various industries.

Where can I find job opportunities as an Insurance Writer?

You can explore job opportunities through online job boards, company websites, and networking with professionals in the insurance industry.

What is the average salary range for Insurance Writers?

According to the U.S. Bureau of Labor Statistics, the median annual salary for Insurance Writers is around $69,000, with top earners exceeding $120,000.