Are you a seasoned Interchange Agent seeking a new career path? Discover our professionally built Interchange Agent Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

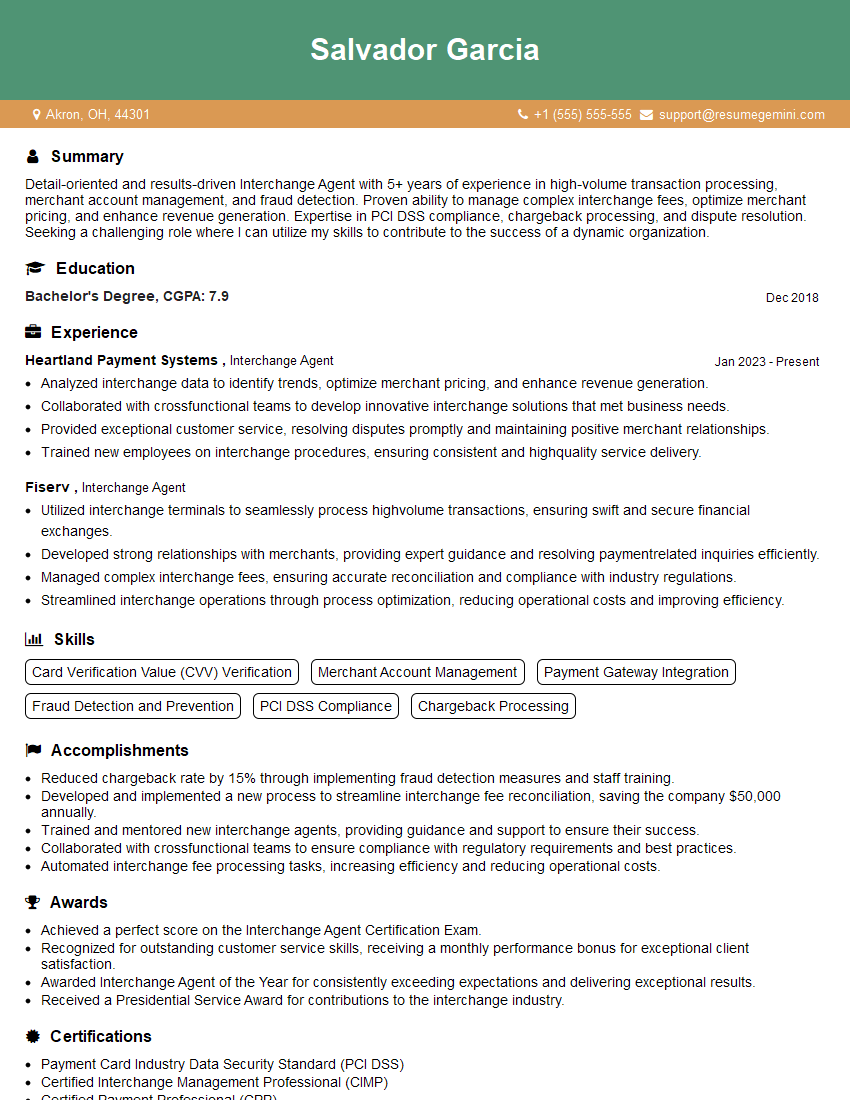

Salvador Garcia

Interchange Agent

Summary

Detail-oriented and results-driven Interchange Agent with 5+ years of experience in high-volume transaction processing, merchant account management, and fraud detection. Proven ability to manage complex interchange fees, optimize merchant pricing, and enhance revenue generation. Expertise in PCI DSS compliance, chargeback processing, and dispute resolution. Seeking a challenging role where I can utilize my skills to contribute to the success of a dynamic organization.

Education

Bachelor’s Degree

December 2018

Skills

- Card Verification Value (CVV) Verification

- Merchant Account Management

- Payment Gateway Integration

- Fraud Detection and Prevention

- PCI DSS Compliance

- Chargeback Processing

Work Experience

Interchange Agent

- Analyzed interchange data to identify trends, optimize merchant pricing, and enhance revenue generation.

- Collaborated with crossfunctional teams to develop innovative interchange solutions that met business needs.

- Provided exceptional customer service, resolving disputes promptly and maintaining positive merchant relationships.

- Trained new employees on interchange procedures, ensuring consistent and highquality service delivery.

Interchange Agent

- Utilized interchange terminals to seamlessly process highvolume transactions, ensuring swift and secure financial exchanges.

- Developed strong relationships with merchants, providing expert guidance and resolving paymentrelated inquiries efficiently.

- Managed complex interchange fees, ensuring accurate reconciliation and compliance with industry regulations.

- Streamlined interchange operations through process optimization, reducing operational costs and improving efficiency.

Accomplishments

- Reduced chargeback rate by 15% through implementing fraud detection measures and staff training.

- Developed and implemented a new process to streamline interchange fee reconciliation, saving the company $50,000 annually.

- Trained and mentored new interchange agents, providing guidance and support to ensure their success.

- Collaborated with crossfunctional teams to ensure compliance with regulatory requirements and best practices.

- Automated interchange fee processing tasks, increasing efficiency and reducing operational costs.

Awards

- Achieved a perfect score on the Interchange Agent Certification Exam.

- Recognized for outstanding customer service skills, receiving a monthly performance bonus for exceptional client satisfaction.

- Awarded Interchange Agent of the Year for consistently exceeding expectations and delivering exceptional results.

- Received a Presidential Service Award for contributions to the interchange industry.

Certificates

- Payment Card Industry Data Security Standard (PCI DSS)

- Certified Interchange Management Professional (CIMP)

- Certified Payment Professional (CPP)

- Certified Fraud Examiner (CFE)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Interchange Agent

- Highlight your expertise in interchange processing, including knowledge of interchange fees, regulations, and best practices.

- Showcase your ability to manage merchant relationships and resolve payment-related inquiries effectively.

- Quantify your accomplishments in optimizing interchange operations and enhancing revenue generation.

- Demonstrate your commitment to compliance and data security by emphasizing your knowledge of PCI DSS and fraud detection techniques.

Essential Experience Highlights for a Strong Interchange Agent Resume

- Processed high-volume transactions seamlessly using interchange terminals, ensuring swift and secure financial exchanges

- Developed strong relationships with merchants, providing expert guidance and resolving payment-related inquiries efficiently

- Managed complex interchange fees, ensuring accurate reconciliation and compliance with industry regulations

- Streamlined interchange operations through process optimization, reducing operational costs and improving efficiency

- Analyzed interchange data to identify trends, optimize merchant pricing, and enhance revenue generation

- Collaborated with cross-functional teams to develop innovative interchange solutions that met business needs

Frequently Asked Questions (FAQ’s) For Interchange Agent

What is the primary role of an Interchange Agent?

An Interchange Agent is responsible for processing high-volume financial transactions using interchange terminals, managing merchant accounts, and ensuring compliance with industry regulations related to interchange fees.

What skills are essential for an Interchange Agent?

Interchange Agents should possess strong analytical and problem-solving abilities, excellent communication and interpersonal skills, and a thorough understanding of interchange processing, merchant account management, and PCI DSS compliance.

What industries typically employ Interchange Agents?

Interchange Agents are employed by various organizations that process high volumes of financial transactions, including banks, payment processors, and retail businesses.

What are the career advancement opportunities for Interchange Agents?

Interchange Agents can advance their careers by taking on leadership roles within their organizations, specializing in specific areas such as fraud detection or merchant account management, or pursuing certifications in the payments industry.

What is the average salary for an Interchange Agent?

The average salary for an Interchange Agent varies depending on experience, location, and industry, but typically ranges from $50,000 to $80,000 per year.

What are the key challenges faced by Interchange Agents?

Interchange Agents face challenges such as managing complex interchange fees, ensuring compliance with industry regulations, resolving merchant disputes, and keeping up with technological advancements in the payments industry.